As China’s steepest market drop in decades continues, almost half (link in Chinese) of all listed companies in China voluntarily suspended trading of their shares on July 8, and over 800 others had their stocks automatically halted after reaching their daily drop limit. The benchmark Shanghai Composite Index closed down 5.9%. The CSI 300 was also down, by 6.8%.

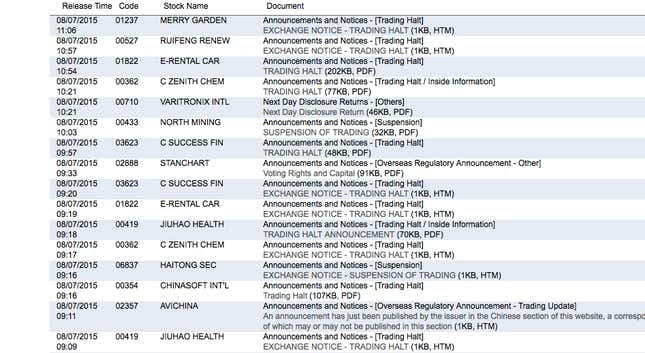

That left only a handful—just 22%, according to our calculations, of all listed stocks on the Chinese stock market trading on Wednesday. Dozens of stocks in Hong Kong also voluntarily suspended trading, as the spill-over from China’s market dragged down Hong Kong’s Hang Seng Index, which tumbled as much as 8.6%, its biggest intraday fall since the financial crisis, to close 5.8% lower.

Companies listed in China and Hong Kong can apply to stop trading ahead of the release of market-moving news—most of the companies that applied for a suspension said they had an “important project in preparation” and would make an announcement over the next five days. Most analysts believe companies are just hoping to ride out the market slump.

Investors wondering when these stocks might start trading again can take a look at Hanergy Thin Film Power, which stopped traded in Hong Kong in May after its stock started falling—and has not yet restarted.

“Greed and fear,” Michael Every, head of financial markets research at Rabobank Group told Bloomberg. “If you hadn’t been greedy you have nothing to fear now. We are heading to 2,500,” he said, referring to the Shanghai Composite Index, which was at 3507 at its close on July 8.

Chinese regulators and the central bank, which have already numerous measures to try to prop up the markets, are rolling out more. The China Securities Regulatory Commission (CSRC) said today it would increase purchases of shares in small and medium cap stocks, after criticism that it was only supporting large state-owned companies.

Those measures aren’t likely to stem the bleeding. After reaching a seven-year peak and the longest running bull market since the market opened in 1990, Chinese stocks have been on a nosedive and, thanks to a huge amount of borrowing to buy stocks in the run-up, may still fall further. About $3.4 trillion in value of listed companies has disappeared over the past few weeks.