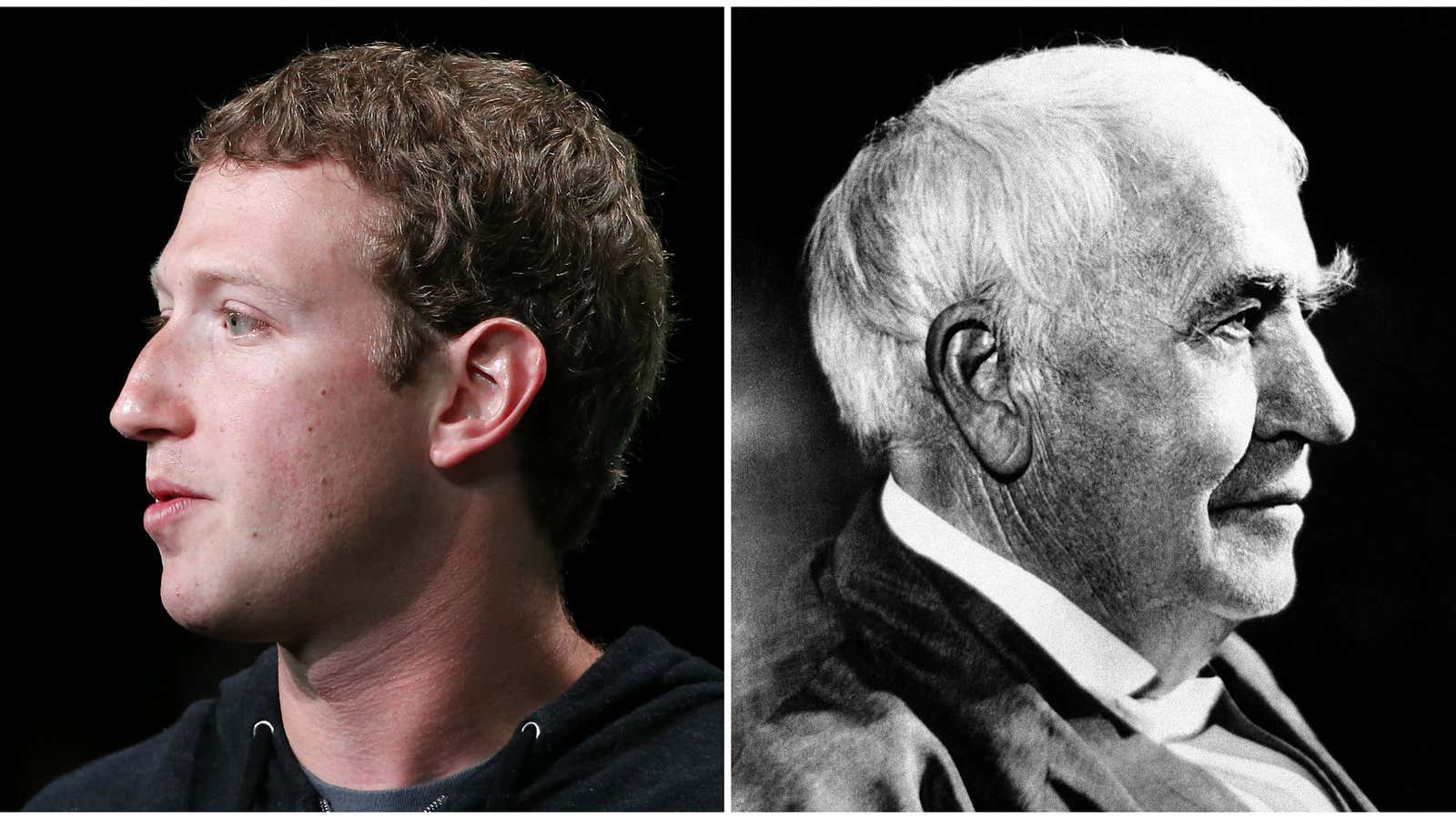

There’s a new wizard of Menlo Park.

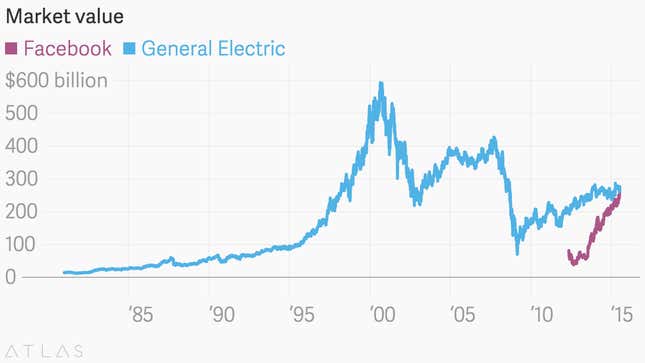

If you were wondering what that purplish blur zipping past General Electric’s market value was, it was Facebook.

The market value of Menlo Park, Calif., based Facebook soared today (July 20). The stock jumped 3.3%, pushing the market value of the company to more than $275 billion. That’s slightly ahead of the $273 billion market value of General Electric, an American industrial titan since it was formed in 1892.

Of course, the man largely responsible for GE is inventor Thomas Edison, the original “wizard of Menlo Park” who—among myriad other developments—gave humanity commercially viable inventions including the incandescent lightbulb and the phonograph.

Of course, the market valuation for Facebook reflects a perhaps unhealthy about of optimism about that company’s prospects.

Right now, Facebook packs nowhere near the economic punch of GE. GE racked up $149 billion in sales last year and employed more than 300,000 people. Facebook reported $12.5 billion in sales and employed roughly 9,200.

Even so, Facebook’s market value has overtaken some of the biggest names in corporate America—including Wal-Mart—over the last year thanks to a more than 40% rise in its share price. And the company has definitely elbowed its way into the top tier of American industry—at least in the estimation of investors.

Whether it can stay there is another question altogether.

General Electric, on the other hand, has been there for more than a century.