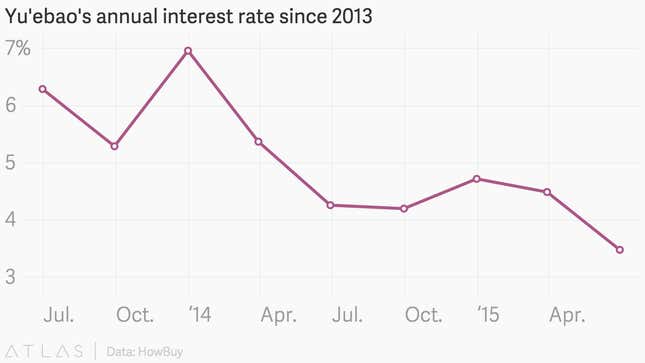

When Chinese internet giants including Alibaba, WeChat, and Baidu rolled out online money market funds in late 2013, many predicted they would shake up China’s sleepy banking industry, forcing state-run companies to compete for customers, and possibly disrupt the entire financial system. Using their smartphones, Chinese consumers stashed billions in funds like the Alibaba-affiliated Yu’ebao, which were pledging return rates as high as 8%.

But those returns have fallen sharply.

Annual interest rates for China’s money market funds are the lowest they’ve ever been. Yu’ebao, the industry standard bearer, is currently issuing annual returns of 3.33%, nearly half the return rate two years ago.

Other competing money market funds are facing plummeting interest rates as well. According to Chinese media outlet Today Morning Express, Licaitong, the money market fund that’s a part of WeChat, China’s massively popular answer to WhatsApp, is offering interest rates of 3.8% (link in Chinese). When it launched in January 2014, its rates were at 7.34%. Offerings by search giant Baidu and web portal Netease have also dropped to over 3%.

These money market funds are serious competitors to traditional savings accounts offered by China’s state owned banks. In February 2014, Chinese International Capital Corp. estimated that online money-market funds could soak up 8% of total consumer deposits in three years. The leader is Yu’ebao, which has over $98 billion in assets and 200 million users to date.

The plummeting rates are partially tied to trends in China’s monetary policy. Yu’ebao cash is parked in a combination of interbank deposits and government and corporate bonds. Both types of assets are subject to the whims of China’s central bank. Recently, China cut the deposit ranks for banks to 2%, and lowered the one year lending rate for the seventh time in one year, to 4.85%.

Yu’ebao’s return rate is still better, at over 3%. But they’ll likely continue to dip, and won’t return back to their sky-high rates. “If recent trends are an indication, future return rates should be more based on interest rates, resulting in greater correlation between the two,” says Michael Zhu, partner at Gobi Partners.

Rates on smartphone money market funds have also tumbled due to competition. When it launched in June 2013, Yu’ebao was the first and loudest player in the market, and Alibaba used the fund’s early popularity to negotiate high return rates from small banks, in exchange for parking its cash there. That bargaining power is disappearing, as other identical entrants flood enter the scene.

“With more competitors on the market… [Yu’ebao] no longer has as much room to negotiate the rates of these reinvestments as competitors are approaching these vehicles and may be willing to accept lower rates, bringing overall returns down for the industry as a whole,” says Zhu.

China’s online money market boom has entered a period of diminishing returns, literally and figuratively.