India’s passion for gold is putting the country’s finances in serious risk.

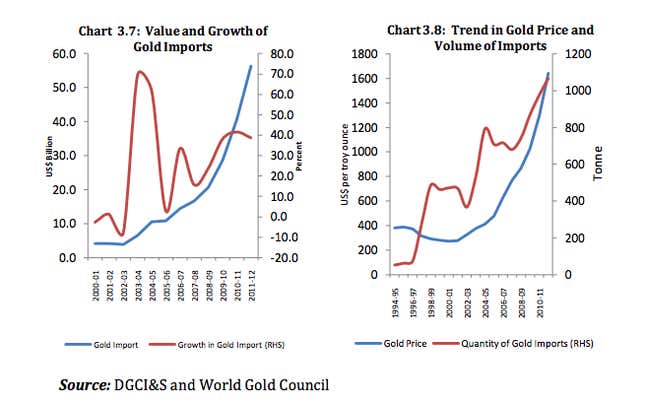

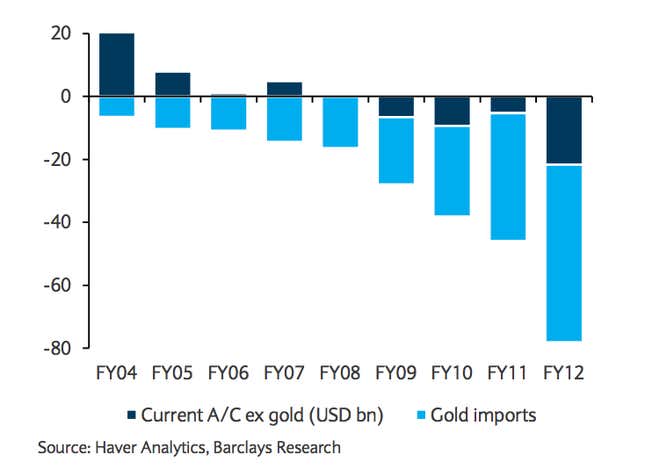

In fiscal years 2011-12, gold accounted for a startling 70% of the country’s current account deficit, the broadest measure of trade that includes not only goods, but also financial flows and payments for services. A country runs a current account deficit when it imports a lot more goods, capital and services than it exports. From a current account perspective, commodities such as gold and oil are a perennial problem for countries like India, which consume much more than they produce. Even so, and explosion of gold imports has driven the current account deficit deeper and deeper into negative territory lately.

What’s going on here? The Economist reported earlier this month:

Over the past decade the mania has spread. By weight consumption has doubled, for several reasons: a surge in money earned on the black market; investors chasing the gold price; and the dismal returns savers get from deposit accounts. Real interest rates are low, reflecting high inflation and a repressed financial system that is geared to helping the state finance itself.

Golden shirts aside, India’s insatiable appetite for the yellow metal is more than a cultural quirk. It could be dangerous. Countries with large current account deficits rely on large inflows of investment to plug the gap. Those investments could take the form of direct investment from foreigners, like say, or investing in physical manufacturing. (Think about a German automaker building a plant in the US, for example.) Or investments could take the form of buying financial assets, something known as “portfolio flows.” (Think about a US investor investing in Brazilian government bonds.)

In general, direct investment by foreigners in physical assets is seen as safer than a flood of foreign cash pouring into bond markets. It’s a lot easier to sell a bond than a paper plant. So, it’s a lot tougher for investors to dump physical assets at once and yank their capital out of the country.

On the other hand, it only takes a couple clicks of a keyboard to withdraw billions of dollars of investment in financial assets. Such so called “sudden stops” of capital can be enormously destructive, resulting in things like currency crises, destabilizing surges in inflation, and debt defaults.

But in order to finance its gold mania, India is trying to encourage more of that kind of risky portfolio investment. The government recently raised its foreign ownership quotas on Indian corporate and government bonds to help fund the current account deficit. That will be something to watch, going forward.

India also raised the duty on gold imports from 4% to 6% to try to quell gold demand. But don’t hold your breath. As you can see from the charts below, the surge in prices for gold in recent years didn’t stop imports from surging, suggesting it will take more than a 6% tax to dissuade Indian consumers from the shiny stuff.