This item has been corrected.

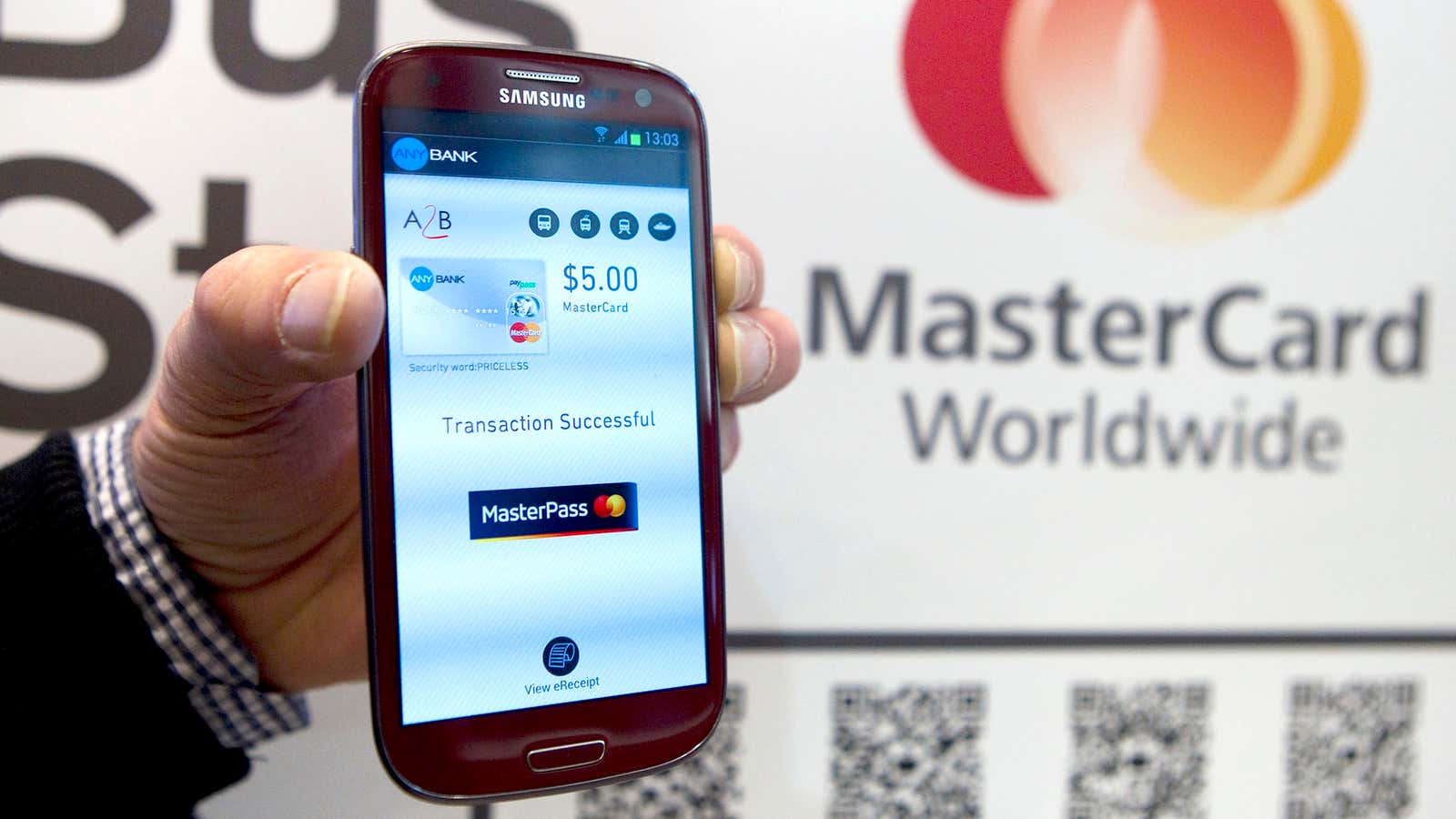

We’ve reported on how people in emerging markets residents are opening bank accounts and paying for things with their mobile phones, transforming business in those countries. But the US Federal Reserve would like you to know (pdf) that the changes aren’t all in other parts of the world. Poor people in the US are some of the most avid users of mobile banking and mobile payment systems.

In fact, they’re likely to be the first adopters. And when you look at why, it turns out to be for similar reasons to why people in emerging markets have embraced mobile banking and payments: mobile banking cuts down the costs of having a bank account.

Clearly the situation in the US is a little different than it is in, say, Kenya. Of Americans 18 and over, 87% owned or had regular access to a mobile phone in 2012. And only 9.5% of people said they were completely “unbanked,” meaning they didn’t have a savings, checking, or money market account. Another 10% are ”underbanked”—which the Fed defines as “people with bank accounts but who use check cashers, payday lenders, or payroll cards.”

Compare that to 70% of Kenyans who simply don’t have access to a bank account, and about 70% who have mobile phones.

But despite being among the poorest, most of these US residents—59% of the unbanked, and 90% of the underbanked—have mobile phones, and around half of them are smartphones. They’re also far more likely to bank online and make mobile payments:

- Of underbanked consumers with phones, 49% use mobile banking, versus just 28% of all people in the US with mobile phones.

- 30% of underbanked residents have used mobile payments in the last 12 months, compared to 15% of the total population of mobile phone users.

Also intriguing is that the percentage of the population without a bank account is slowly declining, from 10.8% in 2011 to 9.5% in 2012. The Fed doesn’t make any firm conclusions about why that is.

Although US residents are more likely to be able to walk in the front door of a bank than Kenyans, it costs less time to bank online. It shouldn’t be surprising, then, that poor people with access to cell phones—in the US or abroad—are most likely to take advantage of the cheapest option to manage their finances.

Correction: An earlier version of this post said that poor Americans were more likely to use mobile banking because they lacked access to a bank account, rather than because the costs of mobile banking were lower.