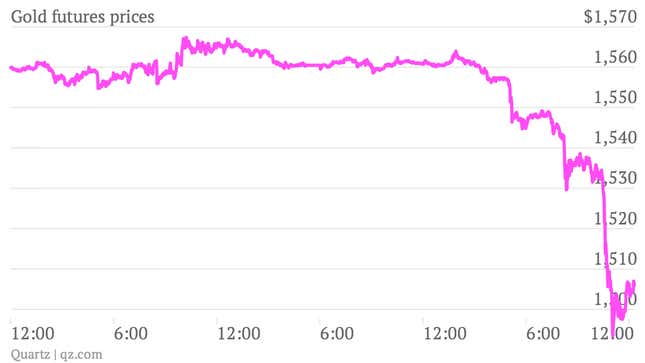

Gold was already the worst investment of the year. But it’s even worse after today’s terrific tumble sent the price below $1,500 dollars a troy ounce today for the first time since 2011. What’s set off the recent spate of selling? Was it Goldman’s suggestion to sell? Have the doomsday gold hoarders finally gotten tired of waiting for the perpetually looming hyperinflation that never seems to materialize? Who knows! Markets go up and down and there’s far less logic to them than we like to pretend in the financial press. But one thing that you can’t deny is that the recent ride lower for gold has been painful. Here’s a look at the last couple of days, which include the sharp tumble around noon ET.

And with Gold prices fluttering around $1,500 an ounce, that’s almost dead-on bear market territory, traditionally defined as 20% below a peak. Gold topped out just shy of $1,900 an ounce back in August 2011, right around the time of the US flirtation with default as part of the debt ceiling debate got investors nervous. Here’s a chart of gold prices over the last few years. (Today’s sharp fall is that last bit on the right.)

At last glance, the yellow metal is now down more than 10% since the start of 2013. But it’s important to keep in mind, investors who got on board the gold train early might still be hanging onto some solid gains. Over the last five years gold is still up 62.9%.