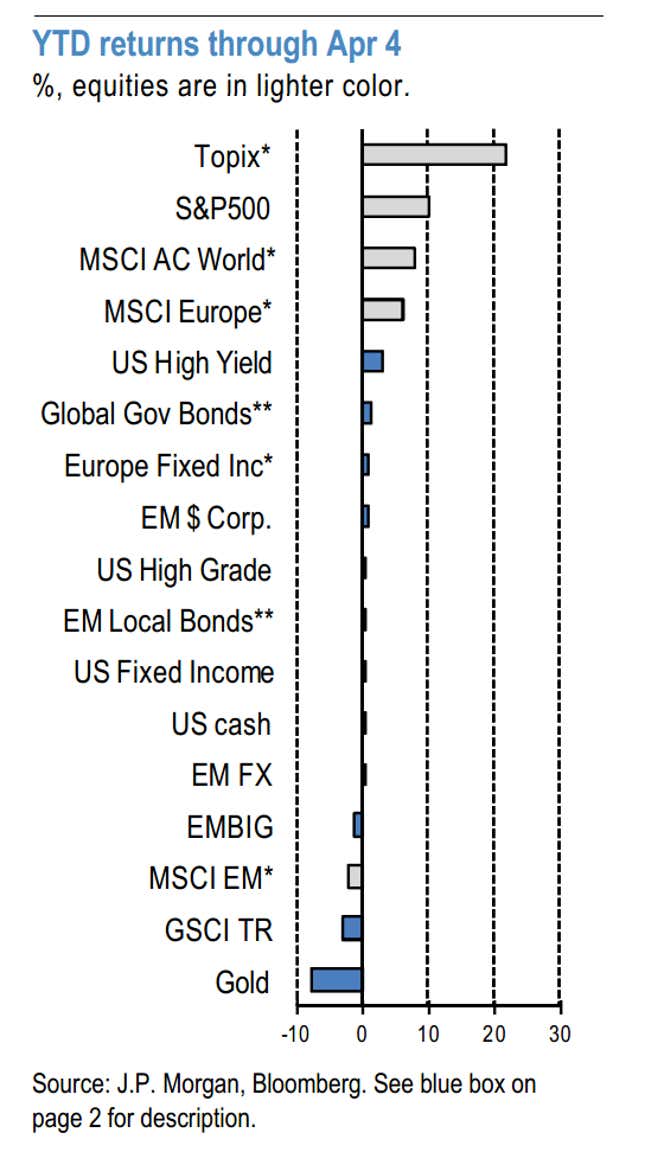

We’ve told you several times that gold has been the dog of global markets this year. Here’s a look through the end of last week, with Japan’s Topix stock index leading the pack and gold bringing up the rear:

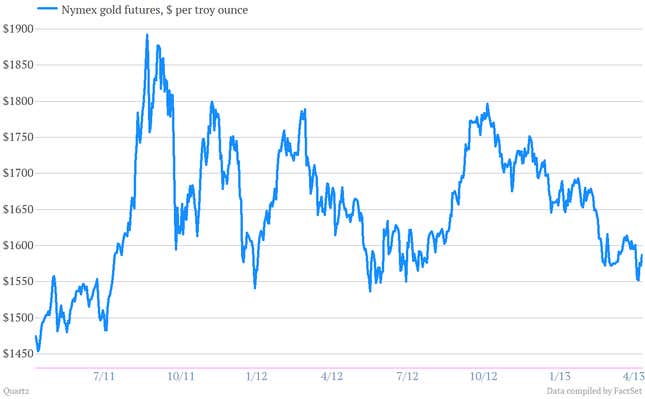

Despite some wild swings, gold prices have gone largely nowhere since peaking back in August of 2011, amid the US debt ceiling debacle.

Now Goldman Sachs commodities analysts suggest the selloff in the yellow metal could be about to gain momentum. In a research note Wednesday they write not even the stress over Cyprus could generate much of a rally in gold prices. And they come to the conclusion that “long” enthusiasm over gold prices is ebbing fast:

Despite resurgence in Euro area risk aversion and disappointing US economic data, gold prices are unchanged over the past month, highlighting how conviction in holding gold is quickly waning. With our economists expecting few ramifications from Cyprus and that the recent US slowdown will not derail the faster recovery they forecast in 2H13, we believe a sharp rebound in gold prices is unlikely.

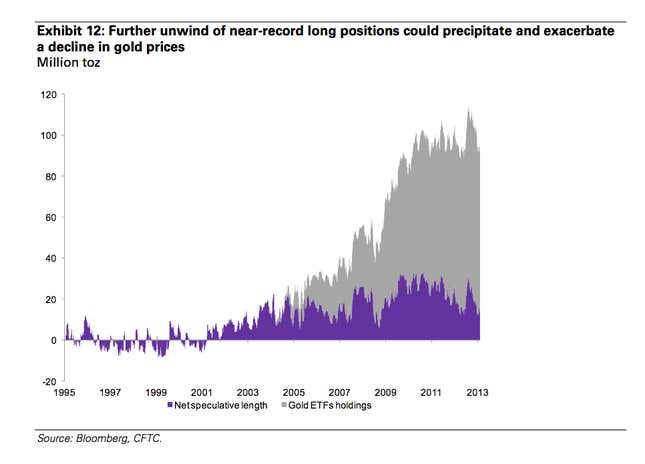

Goldman analysts say gold could fall to $1,450 per troy ounce, which is about 9% lower than where gold was trading yesterday. But they also suggest that gold prices could drop even faster than they expect, due to the fact that many investors have been betting big on higher prices for a while. As these investors become increasingly dismayed by falling prices, they may decide to cut their losses and abandon their positions, adding momentum to the sell-off. Here’s Goldman’s chart on the topic:

And that’s why Goldman is now recommending that investors take a “short” position on the metal—in other words, bet on declining prices.