High hopes ride on the European Central Bank, which is set to make its latest monetary policy announcement on Thursday. Despite the fact that poor economic data continues to flow out of the euro zone, investors seem convinced that the euro area is a fleeting concern, and certain that the ECB will cut rates from their current level of 0.75% in order to relax credit.

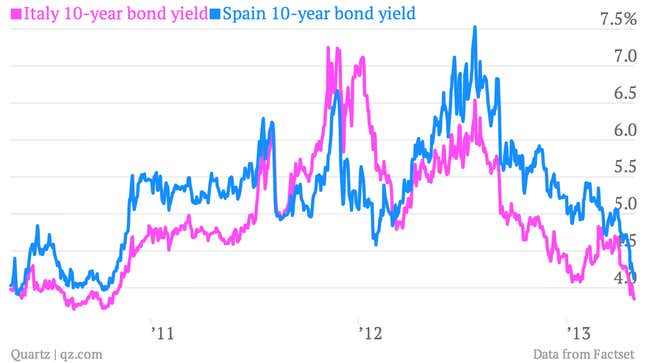

Recently, yields on Spanish and Italian bonds—which rise with doubts that those countries can pay back their government debt—hit multi-year lows.

But there are a handful of reasons to believe that all is not as it seems. Despite the likelihood of a rate cut, the euro zone is still mired in a sovereign debt and banking crisis, with a recession that isn’t likely to go away so fast. We’ve already argued that even if the ECB slashes its target interest rate, the effect is unlikely to trickle down into the real economy, and particularly to small- and medium-sized enterprises (SMEs).

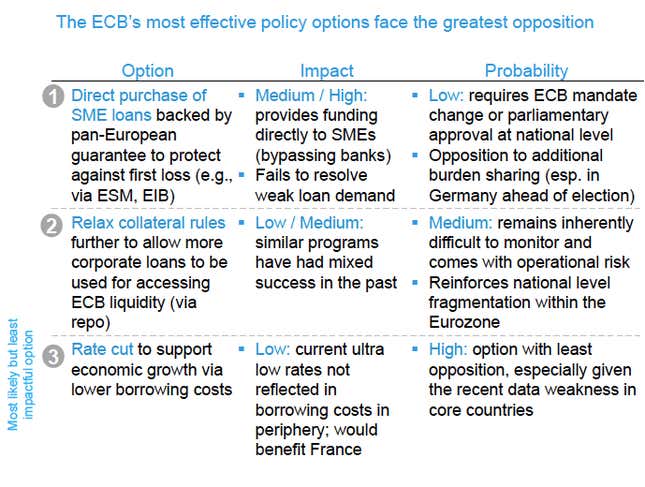

The options

Deutsche Bank wraps up all the options it thinks the ECB has (and the likelihood of each happening) in this handy chart:

Importantly, banks are still scared to lend to one another, so they’re paying a premium to fund themselves. While interest rates have fallen across the board because of earlier ECB actions, borrowing rates for SMEs and individuals have not fallen much in the last year.

Outsized expectations

A rate cut of at least 25 basis points seems like a no-brainer at this point “given the strong language used at the last press conference, a significant easing in inflation pressures and the marked deterioration in the data,” writes Morgan Stanley Europe analyst Olivier Bizimana.

The problem is that the ECB doesn’t have a great track record in caring how bad the euro zone economy gets. In April, ECB president Mario Draghi told reporters, “We cannot replace capital that is lacking in the banking system…we cannot compensate for lack of action by governments.” (Morgan Stanley does note the small possibility that the ECB could push off a cut until June.)

Investors may be fooling themselves or are, at the very least, overzealous. Steven Englander, Citi’s global head of G10 FX strategy, wrote in a note yesterday:

The Bloomberg consensus has about 65% chance of a cut priced in, but market discussion suggests that the conviction is even stronger, so we think that the cut is pretty much priced in…In addition, there is persistent discussion of a plan to get credit to the private sector. We think that the heavier market weight is on the view that they will deliver something much bigger as a stimulus plan and that investors will be disappointed if the outcome is just a refi cut. The EUR support right now is less from monetary tightness than from a sense that political risk is waning.

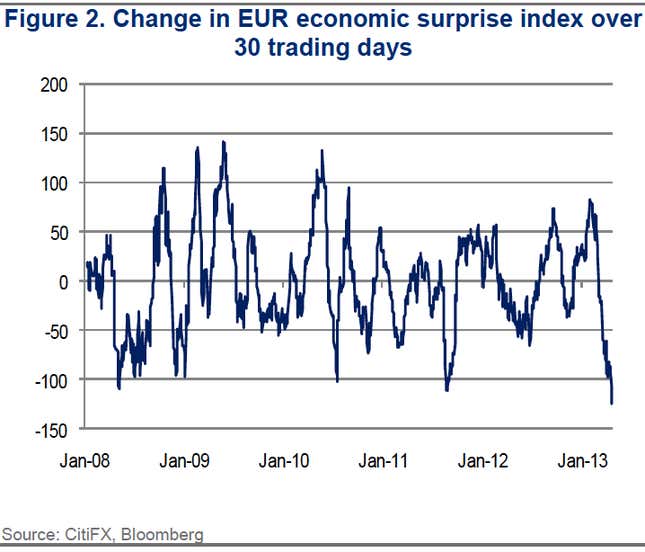

Too much enthusiasm

Markets apparently have not yet adjusted to all the bad data we’ve been seeing lately. Citi’s economic surprise index—which falls below zero when the data is worse than expected and rises above zero when it is better than expected— showed the steepest thirty-day trading drop in April since the 2008 stock market crash. “This divergence between outcomes and asset market enthusiasm reinforces our view that if the ECB disappoints on the stimulus, market enthusiasm for the EUR will wane quickly,” writes Englander.

And despite falling yields on Italian and Spanish bonds, German bonds are actually moving in a direction that does not fit the trend. Investors generally see a decline in the demand for German 10-year bonds (called bunds) as a sign that investors are fleeing to safe assets. At Tuesday’s close, yields were 1.22%.

Suffice it to say that investors could be in for a rude awakening, if all their hopes are placed on central bank action. It all depends on how willing they believe Draghi is to “do whatever it takes” to protect the euro, a promise he made—and hasn’t had to prove—more than nine months ago.