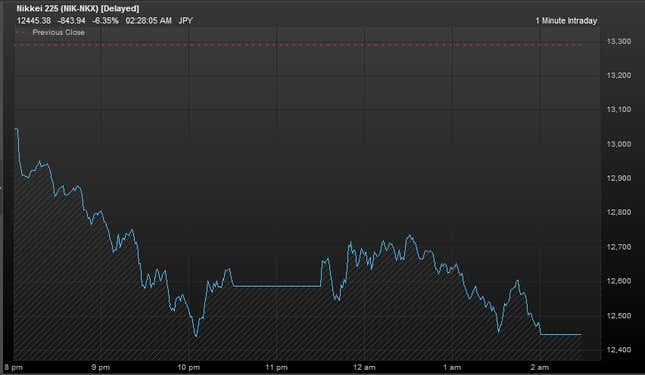

Panicked trading shaved 6.35% off the Nikkei-225 today, dragging the index down more than 21% since its May 22 peak. In other words, the Nikkei has wandered into bear country, folks. Here’s a look at the day’s carnage, via FactSet:

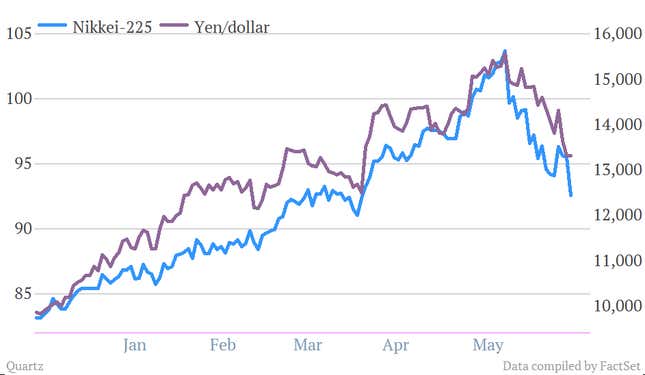

The yen and the Nikkei have largely shared their fortunes, and surely enough, the yen strengthened 1.73% against the dollar today, bringing it to rest at ¥94.36. That’s down from ¥103.21 on May 17.

Does this mean Abenomics is on its deathbed?

Unclear. Abenomics, you’ll recall, is a strategy to jumpstart the economy with a mix of monetary and fiscal stimulus and structural reform. The fear behind the Nikkei nosedive may be that investors believe Abenomics has run out of steam—in other words, that economic fundamentals are still lacking. That’s particularly damning after strong first-quarter growth. However, it’s hard to tell how much this sell-off will affect the underlying economy and inflation expectations.

Plus, a convincing case can be made that the problem isn’t one of economics, but of poor public relations. Haruhiko Kuroda, the Bank of Japan’s governor, has done little to discourage the freakout about leaping nominal bond yields. He might have mentioned that they were absolutely part of the plan, given that interest rates rise with inflation—which is the whole point of Abenomics, recall. But, no.

Nor has Kuroda doused fears that the BoJ is a house divided, after BoJ minutes revealed signs of dissent. There was more of that today when, lamenting the consumption tax planned for next spring (paywall), a BoJ board member worried that the 2% inflation target couldn’t be reached. (She wasn’t exactly wrong. A parting gift from outgoing prime minister Yoshihiko Noda, the consumption tax is royally wrongheaded for a country grappling with deflation and low growth. Still, the timing of this hand-wringing could have been better, particularly considering that prime minister Shinzo Abe and company will review the tax in October.)

Both anxieties are related to a bigger doubt about the BoJ’s commitment to its inflation target. This is silly. It should be very clear to markets that Kuroda’s gunning for that 2%, come hell, high water and/or rising bond yields. But given the mammoth proportions of the Japanese government’s debt-servicing obligations—its debt-to-GDP ratio is pushing 240%—investors can be forgiven for needing a little more hand-holding through this process.

But in any case, all eyes are about to turn from Kuroda to the Japanese cabinet. Tomorrow it will most likely approve Abe’s “third arrow,” the structural reform program designed to reinvigorate the Japanese economy. It will do this, hopes Abe, by slashing taxes to encourage investment, opening special economic trade zones, and getting more women into the labor force.

Though many found this reform package uninspiring, that disappointment has already been priced into the market. More worrisome is signs of disgruntlement with the program, even from Abe’s own health minister. So far the success of Abenomics has depended in large part on the government’s unity. If that starts to look shaky, we’re probably looking at a really big bear.