If China slows down, will the rest of the world slow with it? It is frequently argued that a Chinese “hard landing” would be bad for the global economy, and that China’s economy is ”the world’s most important source of economic growth.” That’s because China powers an ever-larger portion of global GDP growth, which implies that China must also be fueling growth in other countries.

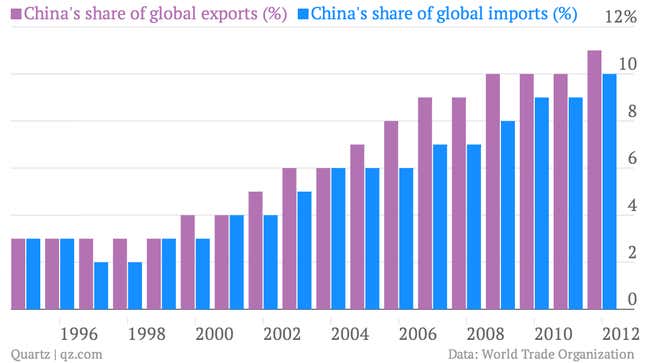

But it isn’t. There’s a big difference between contributing to global GDP and contributing to global demand. Global GDP doesn’t tell us much about how growth is distributed, but trade accounting does. A country’s share of global trade reflects its contributions to global supply (exports) and contributing demand (imports). As you can see, China consistently supplies more to the global economy than it demands. That hurts other countries that need to boost their share of global exports to grow their economy.

This trade dynamic isn’t the result of China’s businesses being more industrious or its people thriftier. It’s because of carefully planned Chinese government policy, which has deliberately suppressed demand to boost supply, most notably by lowering the value of its currency (though as we’ve discussed before, it’s probably not that far off from equilibrium right now).

But China also does this by setting an artificially low deposit rate at banks. In effect, that means households are subsidizing the credit that banks lend to businesses. As a result, the vast majority of Chinese households don’t feel wealthy enough to spend freely. China’s household consumption still contributes only around 35% of China’s GDP—which is very low considering its rapidly rising wages and radical improvements in quality of life. In this way, Chinese households subsidize its export industry, which contributes to the country’s excess share of global supply.

Slowing China’s export engine wouldn’t likely destroy the global economy. If annual GDP growth slowed to 3-4%, it might hurt a tiny handful of countries like South Korea that run a trade surplus with China, and some commodity prices would drop. But companies that compete with China overseas would suddenly be more competitive. And for many countries, that’s a good thing.