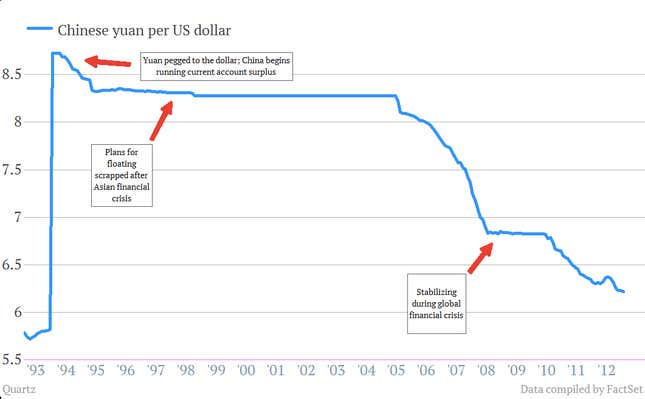

The Chinese government obviously used to manipulate its currency. Its currency policies have been abundantly documented and plenty debated. Here’s basically how this has shaken out over the last few decades:

We’ve written before that there are good reasons to think the yuan is closing in on its “correct” value against the dollar, but there is now a more concrete reason to think China’s yuan manipulation has stopped.

Why did China want to manipulate its currency in the first place? To keep its exports cheap, so that it could fuel an export-led economic boom.

How do you manipulate a currency, anyway? You buy it (or rather, your central bank does). Simply setting an official exchange rate for the dollar wouldn’t work too well; forced to exchange yuan for dollars at an artificial rate, Chinese banks would have to eat massive losses. Instead, the People’s Bank of China (PBoC), the central bank, offered to exchange yuan for dollars at the repressed rate. Essentially, the Chinese government paid exporters more than it should have for their dollars—a kind of subsidy.

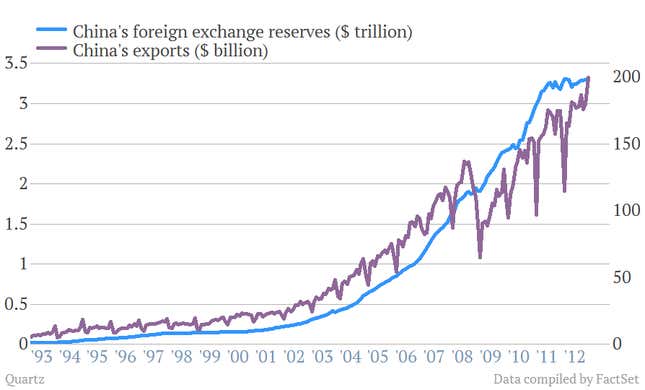

How can you tell that the government is buying the currency, though? Its foreign reserves. After the Chinese government buys dollars from exporters, they end up in its reserves, either in the form of cash or invested in foreign government bonds. The government’s stash of foreign currency has mushroomed since it began exporting aggressively:

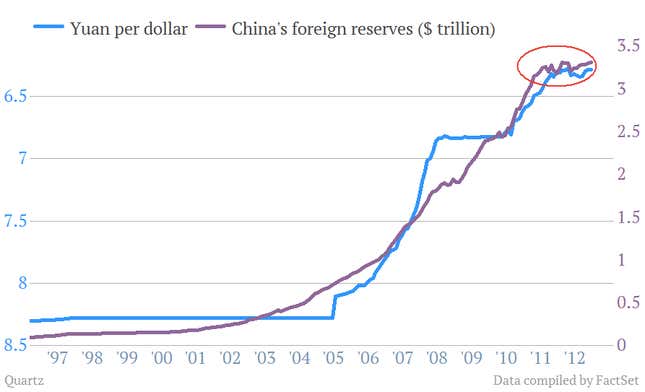

So are the foreign reserves still growing? Barely. The People’s Bank of China has pretty much stopped buying up dollars. In 2012, it added only $96.5 billion (link in Chinese) to its $3.33-trillion forex reserve. That sounds like a lot, but it’s the smallest amount since 2004. Here’s that in context:

So if the government has stopped amassing foreign exchange, the yuan should now be appreciating, right? In the past it would have done. But right now, as the chart above shows, it’s not moving much. It may have room to appreciate a little more; we can’t be sure because the Chinese government does still control the range the yuan trades in, in what it calls a “managed float.” But the point here is that the central bank is no longer having to buy up dollars to weaken it. Economics blogger Scott Grannis sums this up:

After more than 15 years of steady gains, China’s foreign exchange reserves have been effectively unchanged at about $3.3 trillion for the past 18 months. Moreover, for the past two years, China’s holdings of Treasuries have also been effectively unchanged at about $1.2 trillion. China is no longer accumulating foreign exchange reserves because it no longer needs to keep its currency from appreciating.

So… why isn’t the yuan appreciating? There are two types of people in China who need to swap yuan for dollars on a regular basis: importers, and investors who need dollars to spend overseas. Both them are buying more dollars than before. As Grannis points out in the same post, Chinese imports of US goods have risen at a 13% annualized rate since mid-2010. At the same time, capital flight has picked up considerably, and Chinese investors and businesses continue to snap up foreign companies, natural resources, real estate and undoubtedly lots of other assets. The central bank is now lending its forex reserves to businesses making overseas acquisitions.

In short, the outflow in spending from Chinese importers and investors is now balancing out the inflow from Chinese exporters and foreign investors. The yuan is finally close to being at an exchange-rate equilibrium with the dollar. And no manipulation is needed to keep it there.