Tired of old-fangled investments? Had it up to here with Bernanke-induced market panics? Just want to pile on the risk already? We have a solution: Invest in disaster!

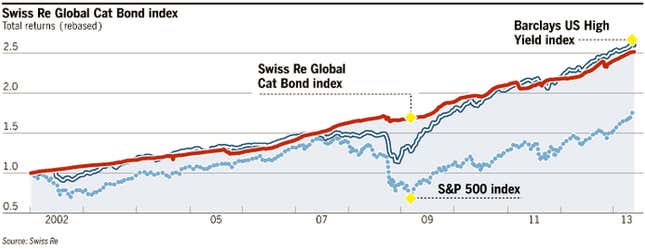

More and more investors are piling into so-called catastrophe bonds, also known as the rather more cuddly-sounding “cat bonds.” Insurance companies issue them for investors to buy as a bet that companies won’t have to pay out insurance claims in the next 3-5 years (pdf). Insurers expect insurance claims to swallow up only about 1% of the money they get from these investors, so most of the time the investors get all their money back, plus interest. The only time they would lose money, in fact, is when reinsurance companies have to meet claims after a major natural disaster, like a 1-in-100-year event. Many bonds are now structured so that default would require multiple catastrophes.

Pension funds are flooding into cat bonds, which offer them protection from the fickleness and low yields of capital markets. According to Swiss Re, pension funds have gone from virtually zero in 2007 to owning a direct share in about 14% of cat bonds on the market. There were 4.75 times as many buyers as there were notes available when Nationwide issued a cat bond in March, according a note from Credit Suisse analyst Michael Zaremski.

And if investors want it, then insurance companies are happy to give it to them, because cat bonds are effectively a cheaper alternative to reinsurance. Zaremski wrote that the Nationwide bond priced “at a cost we estimate to be at least 15% below what a comparable traditional reinsurer would seek to charge for an excess-of-loss (XoL) policy.” As a result, 2013 is likely to be a record year for the nearly $16 billion market. So far $4.17 billion in cat bond debt has been issued, up from $3.87 billion at the same point last year.

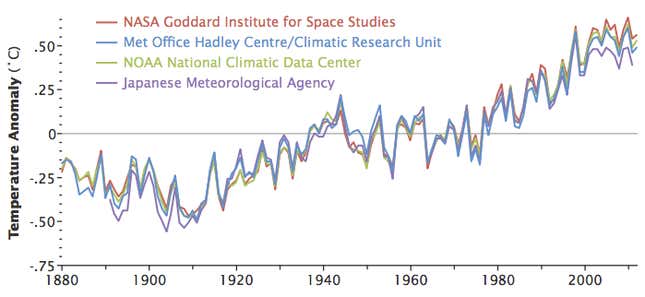

It’s a sign of how fed up investors must be with low yields and the vagaries of US, European, and Japanese policy that they are willing to bet on the improbability of 100-year storms or earthquakes even as louder warnings are sounding about the effects of climate change. Numerous research reports suggest that warmer weather, melting ice caps, and rising seas are likely to breed bigger and badder storms. A study conducted led by Aslak Grinsted of the University of Copenhagen in Denmark found that temperatures were likely to rise by 2.0 to 5.2 degrees Fahrenheit (1.1-2.9 °C) over the next century. An increase of just 0.7 degrees would mean double the number of extreme storm surges, like the one witnessed during Hurricane Katrina, which hit the US in 2005: as much as 28 feet (8.5 meters) in parts of Mississippi.

So what was considered a 1-in-100-year event a few years ago might end up being a 1-in-50-year or 1-in-25-year catastrophe. And cat bonds are already considered pretty risky—that Nationwide bond we mentioned was rated BB-, well below “investment grade”. The deal certainly makes sense for insurance companies, however. In an uncertain world, it’s always nice to spread around the risk.