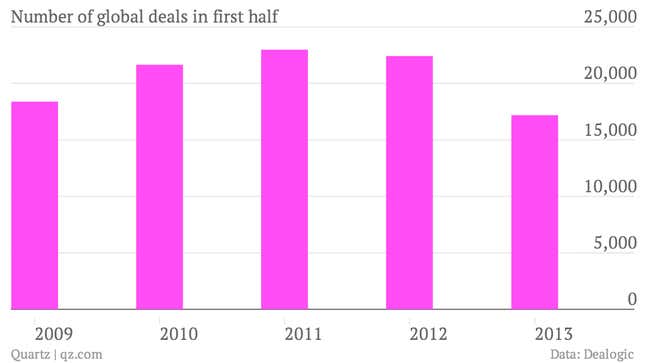

Despite record cash on the balance sheets of corporations, global mergers and acquisitions fell by 24% in the first half of this year compared to the same period last year, according to Dealogic data. There were about 17,100 deals in the first six months of this year, the lowest level in five years.

The number of deals in the first half of this year was even lower than that same period in 2009, when the world was still reeling from the financial crisis. Continuing worries about the global economy make corporations less than confident in making deal moves, especially for takeovers that would be game changers for their firms. Dealmakers say company executives and boards are reluctant to take risks and in many cases, they want to pull the trigger on a deal only if it’s an absolutely perfect fit.

The good news is that the total value of global deals was more in line with past activity. Takeovers totaled about $1.25 trillion for the first half of the year, compared to about $1.24 trillion in the same period last year, according to Dealogic. But there hasn’t been a steady pace of the deals worth $1 billion to $3 billion that usually keep M&A humming. The market has been choppy, with big deals announced one week, followed by a drought the next several weeks.

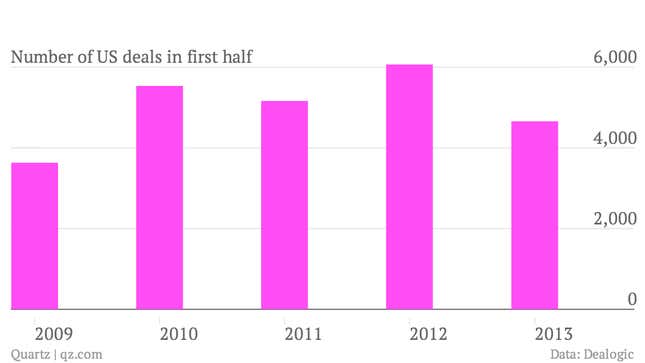

With the American economy recovering more quickly than other countries, dealmakers have looked to the US as a bright spot for M&A. But even there the number of deals fell to its lowest level since 2010. Recent market volatility and worries about the US Federal Reserve tapering its bond buying program could mean a slow M&A environment for the second half of this year.