The World Bank’s misguided attempts to improve its writing show how bad the communication crisis is in economics

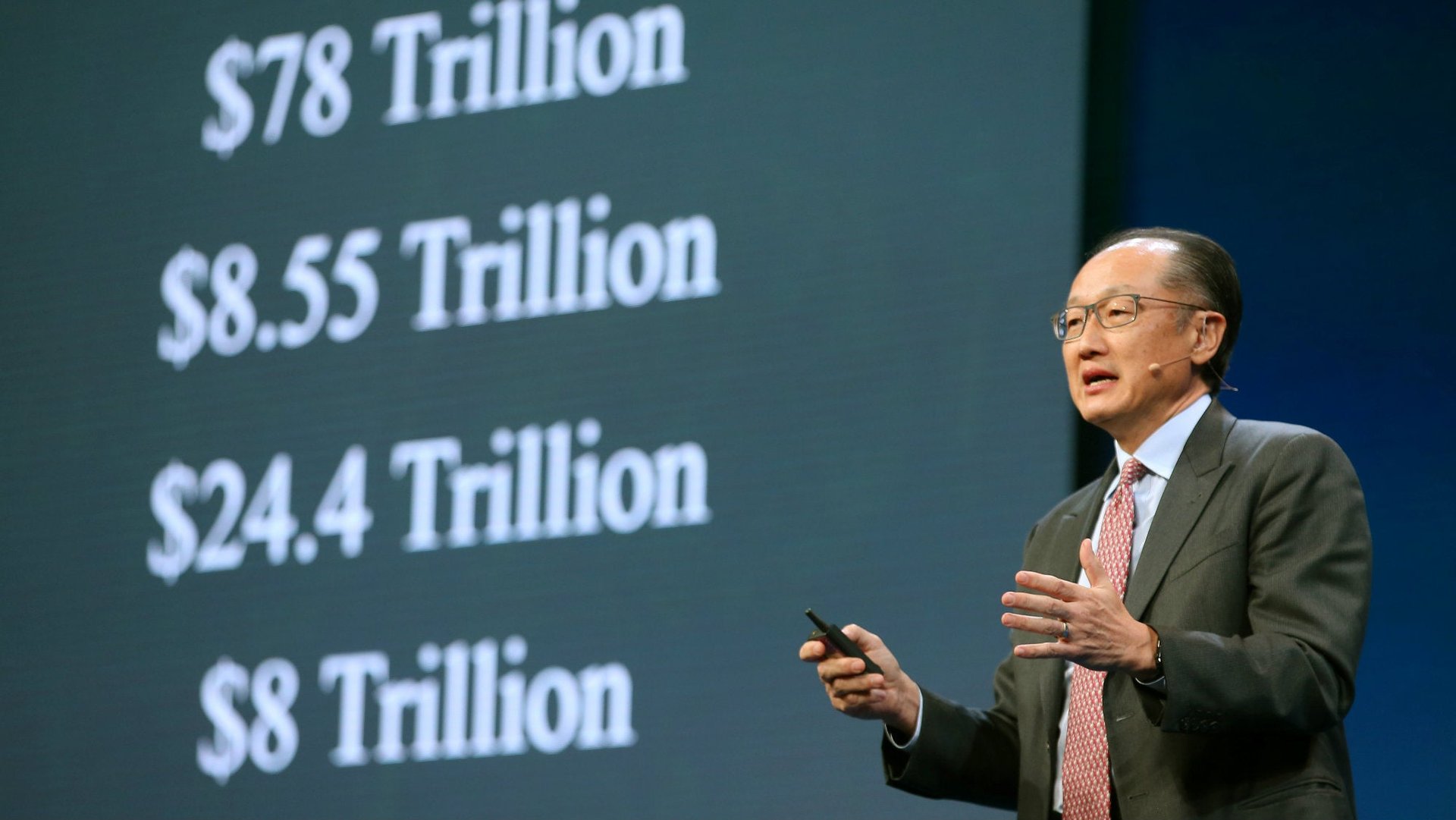

The World Bank’s chief economist Paul Romer lost his managerial duties at the bank’s research arm late last month following a staff revolt against Romer’s efforts to improve the quality of writing in the group’s publications.

The World Bank’s chief economist Paul Romer lost his managerial duties at the bank’s research arm late last month following a staff revolt against Romer’s efforts to improve the quality of writing in the group’s publications.

It was a noble goal, and a necessary one. World Bank reports are notoriously impenetrable; a 2015 analysis from Stanford University coined the term “Bankspeak” to describe a unique organizational syntax “detached from everyday language.”

But Romer’s advice on writing was nearly as baffling as the writing he criticized. Take this passage from a 2015 post on his personal blog entitled “Clear Writing Produces Clear Thoughts”:

The diagram I wrote above…shows how one person can use a message that contains codified knowledge to communicate with someone else:

H(t)→A(t+1)→H∗(t+2)

The first person, who starts with human capital H(t) in her neurons today, produces a codified message A(t+1) that is available tomorrow. The day after, the second person reads that text, and this changes what he has stored in his neurons. You can bind the first arrow to the verb “write” and the second to the verb “read.” To have different symbols for different verbs, you could put the letter W above the first arrow the letter R above the second arrow. Now the diagram looks like this:

H(t)→WA(t+1)→RH∗(t+2)

Treat this as a creative process.

In normal-person terms, that translates roughly to: “Writing transmits information from one person to another. Have fun with it.”

It got worse. He made scatter-plots of noun-to-verb ratios and in one email to staff, announced that he would no longer approve any publication in which the word “and” constituted more than 2.6% of the total word count. It’s a head-scratching metric of quality writing. George Orwell’s 1946 essay “Politics and the English Language,” a classic and elegantly written testament to the power of good writing, is 2.7% “and.” (We counted.)

Romer has been honest about his difficulties with written language. He has dyslexia and was insecure about writing at the start of his career, reassuring himself with the mantra “if Neil Young can make a living as a singer, I can make a living as a writer.”

Yet his challenges at the World Bank highlight a greater problem facing financial institutions: It is deeply difficult for many economists to communicate their ideas like regular people, and that difficulty widens a dangerous gap between the public and the systems that serve it.

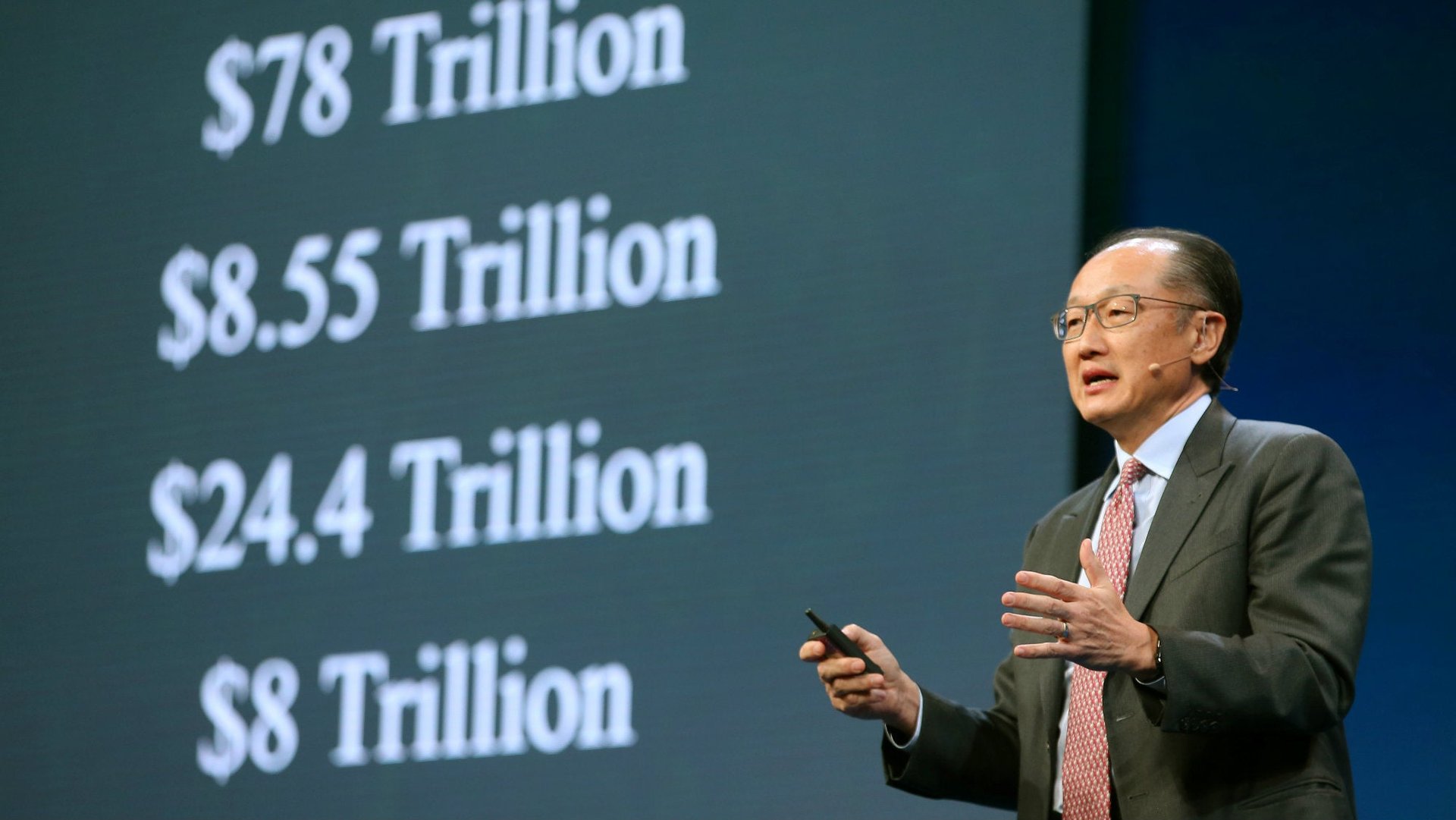

Orwell’s essay condemns cliches and tortured rhetoric as screens to hide the ugly realities of politics. Likewise, the Stanford report criticized the World Bank for relying on language so abstract that it was no longer clear what the bank was actually doing with its money, nor who was responsible for the consequences of its policies. “‘Pollution, soil erosion, land degradation, deforestation, and deterioration of the urban environment,’ mourns another recent Report; and the absence of social actors is striking,” the authors wrote. “All these threatening trends—and no one is responsible?”

From the public’s perspective, there’s little difference between an organization hiding behind maddeningly opaque jargon and just plain hiding. Indirect language leads to distrust.

“It’s the same when you hear money people talk about the effect of QE2 on M3, or the supply-side impact of some policy or other,” writes John Lanchester, author of the book How to Speak Money: What the Money People Say—And What It Really Means. “You are left wondering whether somebody is trying to con you, or to obfuscate and blather so that you can’t tell what’s being talked about.”

Economists lapse into jargon when talking about their work for the same reason people in other fields do. Acronyms and insider terms are useful shorthand when talking to peers. But when it comes time to communicate that work to a broader audience, failure to translate jargon into accessible language becomes a failure of transparency. If people don’t really understand what their financial institutions are doing, they can’t have a meaningful say in the policies that govern them.

It doesn’t have to be this way. Nemat Shafik, former governor of the Bank of England, told an audience late last month (paywall) that after an internal review found that roughly 80% of the UK population lacked the literacy skills to understand a typical bank publication, the bank’s staff reviewed books by the children’s author Dr. Seuss as examples of effective but simple language.

“Dr. Seuss was a genius at simple language,” Shafik said. “It’s not about dumbing down. It’s actually about, as we often see in life, the people who really know their stuff can explain things clearly and simply in accessible language, and I think many experts have to rise to that challenge.”

Difficult though it may be, economists have a duty to strive for clarity and accessibility in communications to the public. And those of us daunted by financial language have a duty to more closely examine passages that on first glance resemble an impenetrable pile of jargon. Important stuff is buried within.

Many people feel “put off or defeated by anything having to do with money and economics. It’s almost as if they didn’t have permission to understand it,” Lanchester writes.

“The language of money is a powerful tool, and it is also a tool of power. Incomprehension is a form of consent. If we allow ourselves not to understand this language, we are signing off on the way the world works today.” In other words, we have permission to understand what financial institutions are saying, and the right to demand better.