Distressed real estate shark is cleaning up on European assets

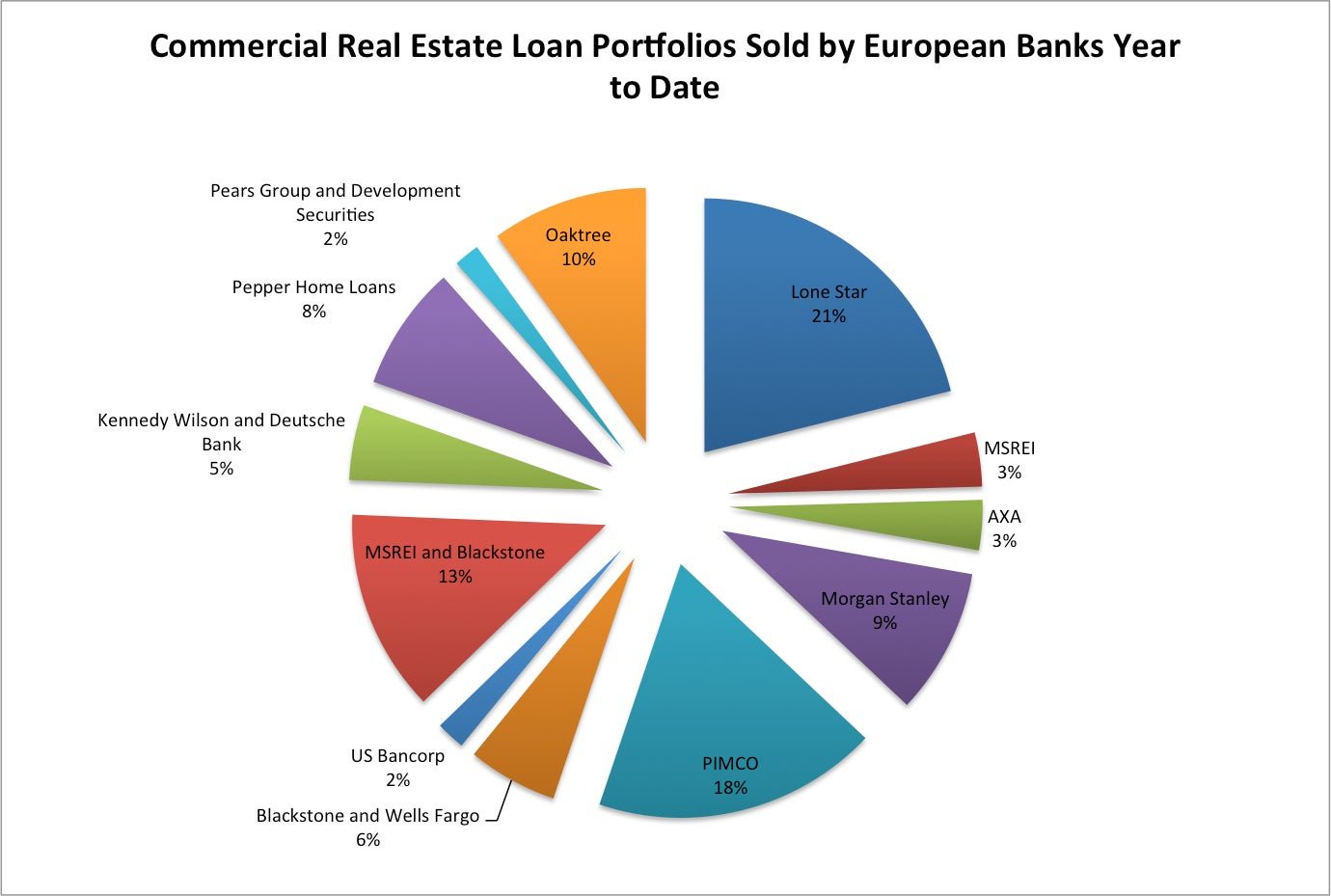

Seven years ago, Lone Star Funds made a name for itself gobbling up the lion’s share of distressed real estate assets that German banks had been forced to put on the market. Now, the fund is back at it again, this time elsewhere in Europe. Data released from the CBRE Group last week showed that the private equity group had purchased €1.6 billion ($2.0 billion) in commercial real estate loan portfolios from European banks so far this year. Lone Star’s purchases accounted for 21% of the €7.5 billion in such real estate transactions that have taken place this year.

Seven years ago, Lone Star Funds made a name for itself gobbling up the lion’s share of distressed real estate assets that German banks had been forced to put on the market. Now, the fund is back at it again, this time elsewhere in Europe. Data released from the CBRE Group last week showed that the private equity group had purchased €1.6 billion ($2.0 billion) in commercial real estate loan portfolios from European banks so far this year. Lone Star’s purchases accounted for 21% of the €7.5 billion in such real estate transactions that have taken place this year.

Just seven years ago. Lone Star was in a similar position. Capitalizing on German talent, the firm purchased about two-thirds of the $13-$16 billion in assets offloaded by German banks attempting to rejuvenate themselves after a few years of stagnation.

It is unclear if that mentality has shifted to pan-European debt today. However, the firm’s recent purchases, all in distressed debt, suggest this may be the case. With $33 billion under management, Lone Star’s purchases far outstrip those of the $1.8 trillion PIMCO, the second-largest buyer of commercial European real estate portfolios year-to-date. PIMCO purchased €1.4 billion in debts once held by Lehman brothers back in April. Here’s a quick chart I made from the CBRE data:

CBRE estimates that European banks are looking to get rid of another €11 billion in real estate assets before the year is out. With economic downturn continuing to trouble the euro area, it seems likely that this trend will continue, creating more opportunities for firms like Lone Star.