The business risks of business school: Your blue-chip MBA program could sell itself

The Thunderbird School of Management, one of the world’s top business schools, has a daunting management problem to deal with: How to maintain its academic prestige and mollify 40,000 angry alumni after selling its campus to a for-profit college company—a situation it was forced into by a severe downturn in demand for MBA degrees.

The Thunderbird School of Management, one of the world’s top business schools, has a daunting management problem to deal with: How to maintain its academic prestige and mollify 40,000 angry alumni after selling its campus to a for-profit college company—a situation it was forced into by a severe downturn in demand for MBA degrees.

As Quartz has reported, modern-day MBA programs were once a golden ticket to the executive suite at a large corporation but now often result in hefty debt and a dismal placement rate for graduates. That trend has been most severe at lower-tier schools, but Thunderbird—ranked the No. 1 international business program by both US News & World Report and Bloomberg Businessweek—is an exception, or perhaps an ominous harbinger for higher education.

The deal revealed on Monday resembles a marriage between a destitute blue-blood spinster and a no-name nouveau riche suitor. Thunderbird, based on a former Air Force Base in Glendale, Arizona, has a dwindling enrollment and endowment: Applications for its two-year MBA have dropped 75% in the past 15 years, and it had only $26.6 million in the bank at the beginning of the year. Private equity-owned Laureate, formerly known as Sylvan Learning Systems, has about 780,000 students in 29 countries; revenues were about $4 billion in 2012. Thunderbird will be the only non-profit institution in Laureate’s US network alongside schools like the online-only Walden University, which spent $1,574 on teaching and $2,230 in marketing per student in 2009-2010, resulting in a tidy profit of $101 million.

Under terms of Thunderbird’s deal with the for-profit Laureate Education, its campus will be sold in a leaseback deal for $52 million, and the two will form a joint venture to host Thunderbird programs at some of Laureate’s 71 worldwide campuses, and to expand its online and undergraduate programs. The deal could be quite lucrative for Thunderbird. In a letter to alumni obtained by the Wall Street Journal, the school said it expects to garner more than $100 million over the next decade. But many of the school’s far-flung alumni, which include top bankers and Fortune 500 CEOs, are irate that the value of their degrees will be diminished by the association with Laureate.

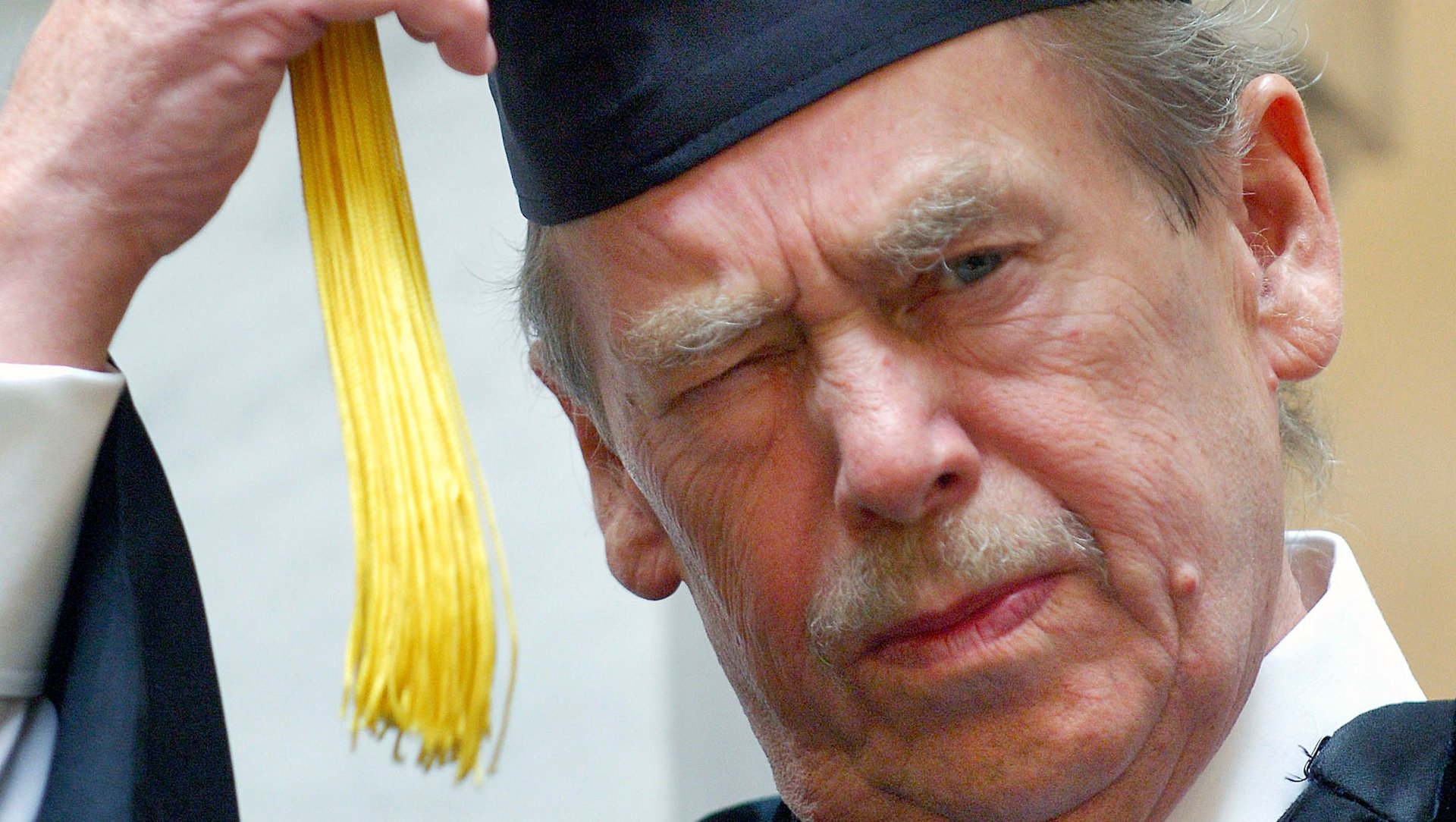

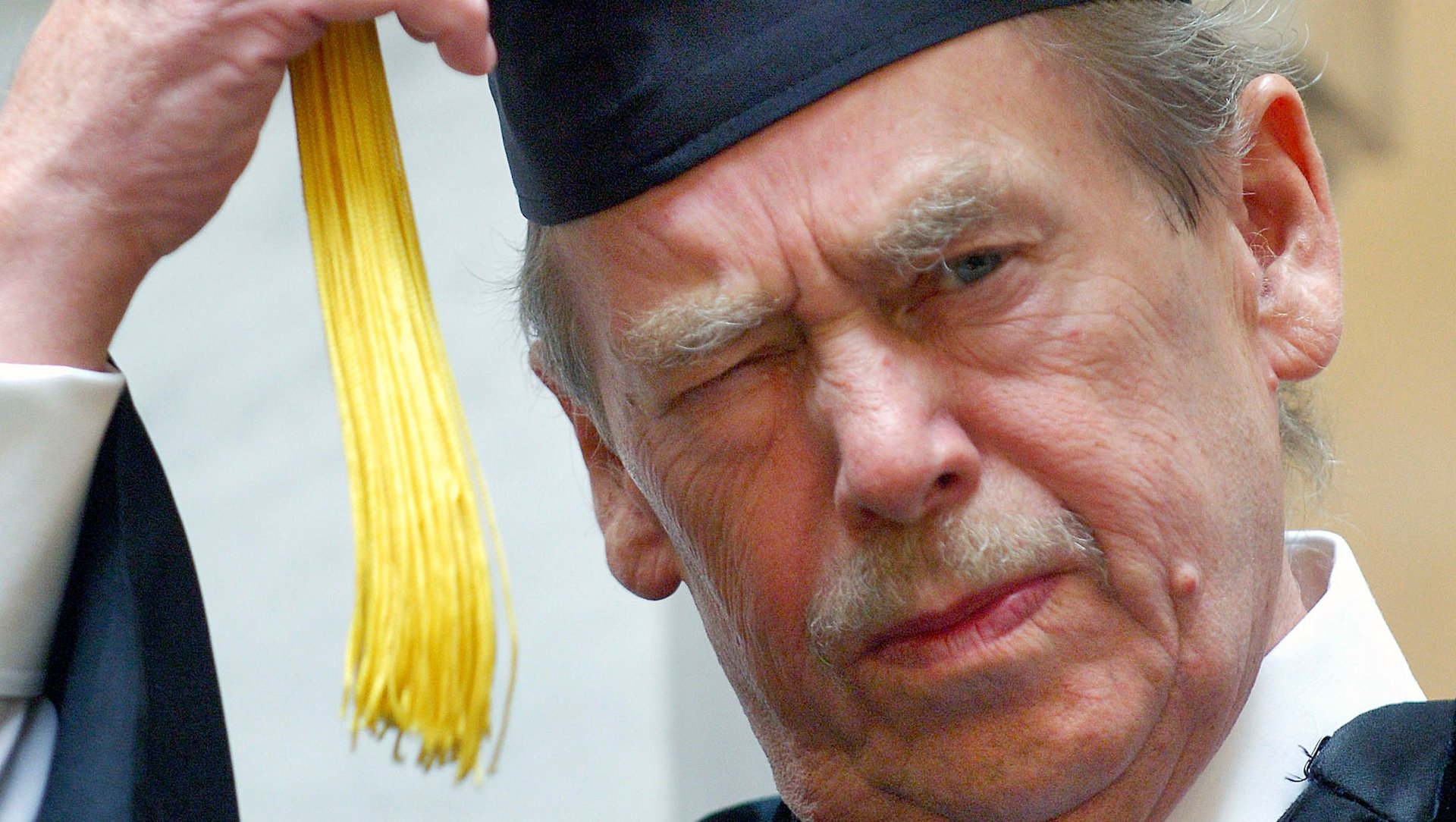

“This is the end of Thunderbird as we have known it,” Merle Hinrich, one of two Thunderbird board members to resign in protest, wrote in an email to his former colleagues. “My personal belief is that the Laureate transaction is a tragedy for Thunderbird and a total windfall for Laureate.”

The return on investment for business school degrees has never been in more doubt, especially for low- and mid-tier schools, as Quartz contributor Jay Bhatti (Wharton, 2002) wrote earlier this year. Thunderbird alumni now face the prospect of their degrees being devalued even more. Perhaps prospective business school students could profit by learning a business lesson from their predicament.