S&P: So, yeah, Italy’s still a mess…

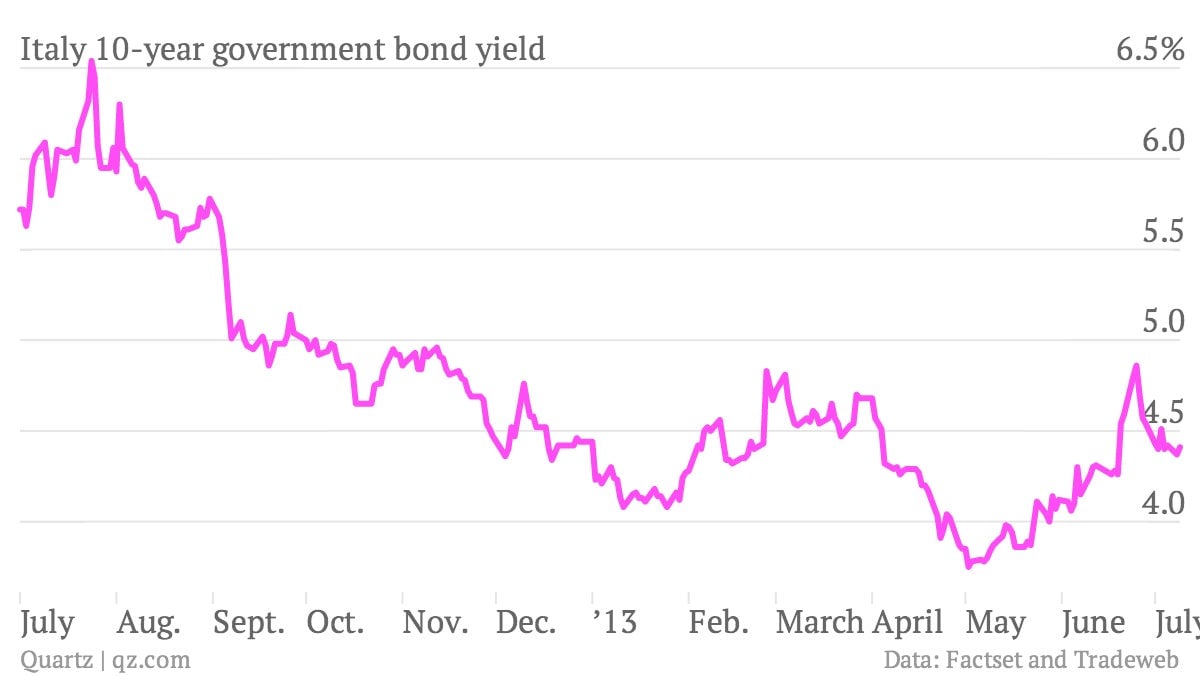

Standard & Poor’s today cut Italy’s credit rating from BBB+ to BBB, despite signs of stabilization across the European periphery. Last year, markets might have gone crazy over this news; today, a downgrade seems far less important.

Standard & Poor’s today cut Italy’s credit rating from BBB+ to BBB, despite signs of stabilization across the European periphery. Last year, markets might have gone crazy over this news; today, a downgrade seems far less important.

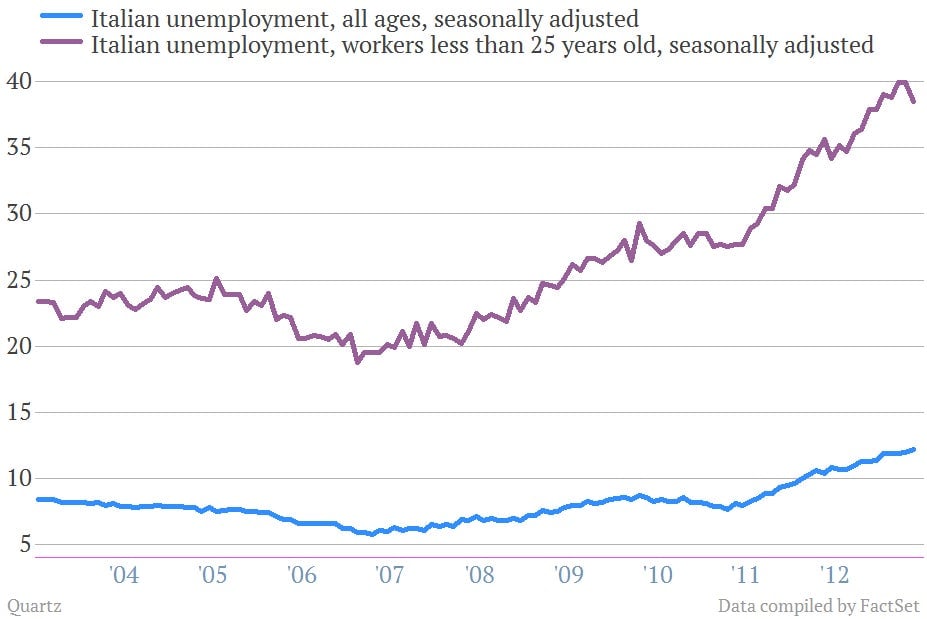

That said, Italy’s economic problems aren’t anything to scoff at. Unemployment remains high, particularly among the youth; 38.5% of young people were unemployed in May on a seasonally adjusted basis. Italy’s statistical agency predicts the country’s economy will contract by 1.4% in 2013; S&P pegs the contraction at 1.9%.

The ratings agency says its outlook remains “negative,” meaning there’s at least a one-in-three chance of another downgrade by the end of next year. Italy’s political parties weren’t able to form a coalition on their own after elections earlier this year, and despite the pragmatism of current PM Enrico Letta, power struggles threaten to slow down any progress on economic reforms.