Online travel bookings expected to hit all time high this summer: $54 billion

Online bookings for online travel agents, airlines, hotel, and car rental services have reached an all-time high, setting up this summer to be a record-breaking travel season. This latest Adobe Digital Index report, which looked at 51.5 billion visits, reveals overall trends that illustrate the movement toward booking travel online and provides insight into the seasonality of online reservations.

Online bookings for online travel agents, airlines, hotel, and car rental services have reached an all-time high, setting up this summer to be a record-breaking travel season. This latest Adobe Digital Index report, which looked at 51.5 billion visits, reveals overall trends that illustrate the movement toward booking travel online and provides insight into the seasonality of online reservations.

It’s going to be a hot summer for online travel

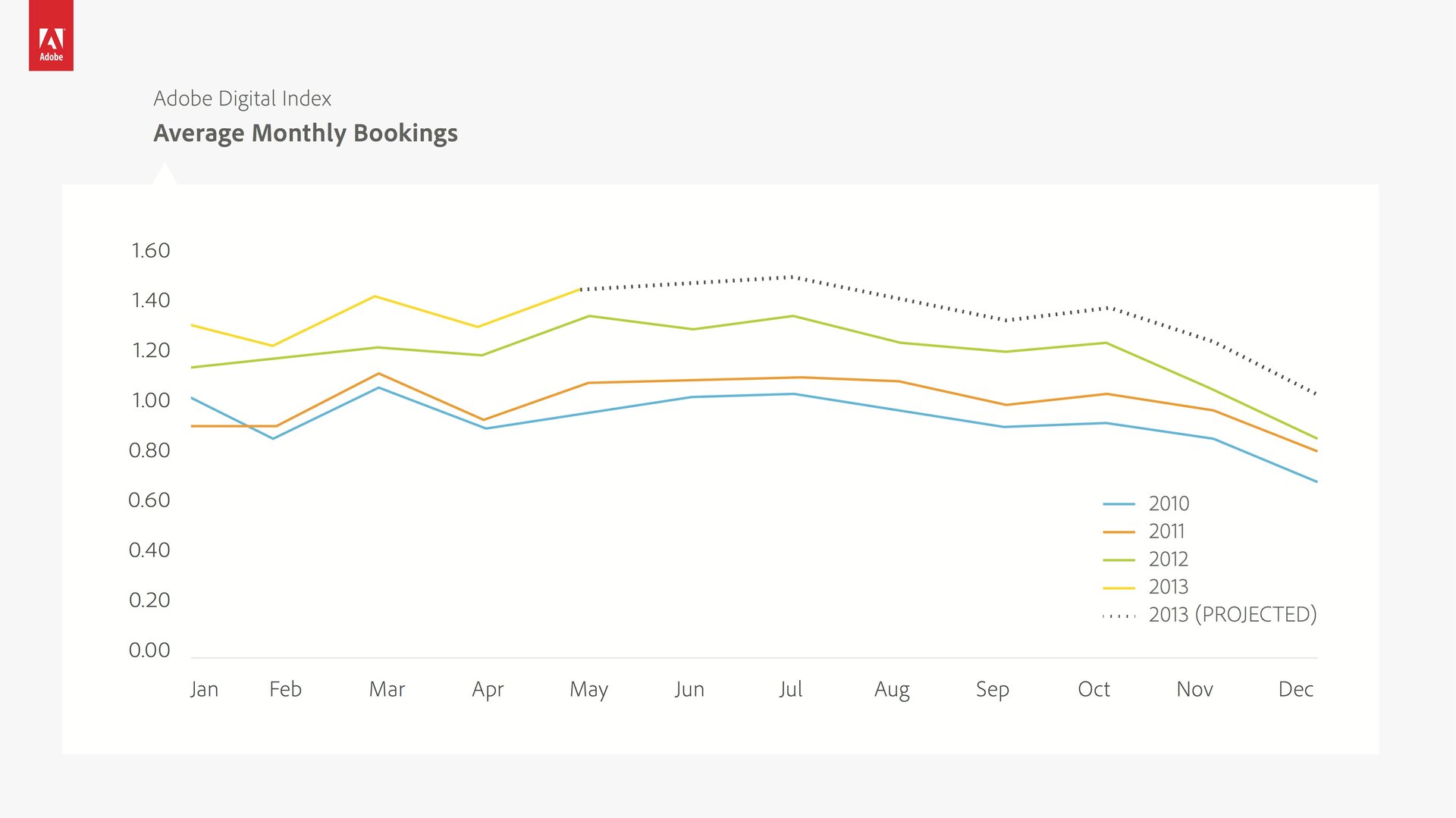

Based on an analysis of more than 150 mobile and global travel (airline, hotel, travel agency, car rental, cruise line, and casino) websites from January of 2009 to April of 2013, online bookings to these travel sites typically peak in mid-July with the U.S.-based companies expected to hit $54 billion in Q3, a 10.7% increase over last year. Q4, which typically sees a decline in bookings, is expected to also maintain an 8–10% YoY growth rate. The Q4 fall-off comes from the hotel and car rental segments; however, airline bookings peak in October as road warriors return home and holiday plans are booked further in advance.

Car rental sites are leading the pack. Travelers are becoming more loyal.

Current trends indicate that car rental websites will see the largest year-over-year growth at nearly 20%. All categories will see growth rates in the double digits except for the airline category, which is already the leader in overall online bookings. The trends indicate that money is moving from offline booking methods to online, but not all of the new bookings are going to online travel agents.

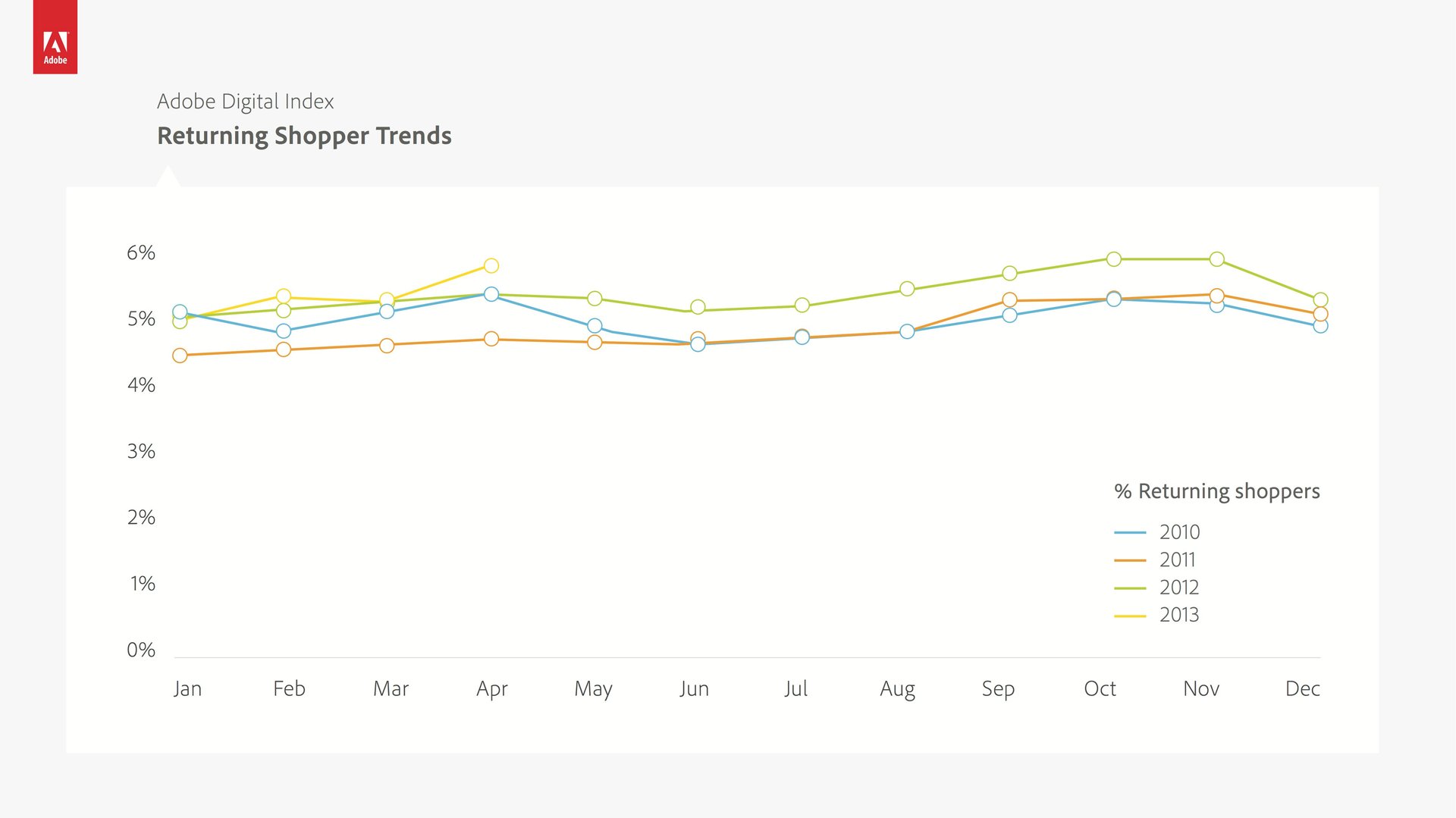

Online travel sites are expected to receive an influx of new customers and gain momentum in loyalty.

Improvements to the site’s proportion of return visitors also reduce marketing acquisition costs. As more travel sites adopt new digital marketing technologies, which can specifically target content and marketing to existing customers, the trends indicate that they are making good progress in bringing back more return shoppers.

Booking via tablets rising quickly

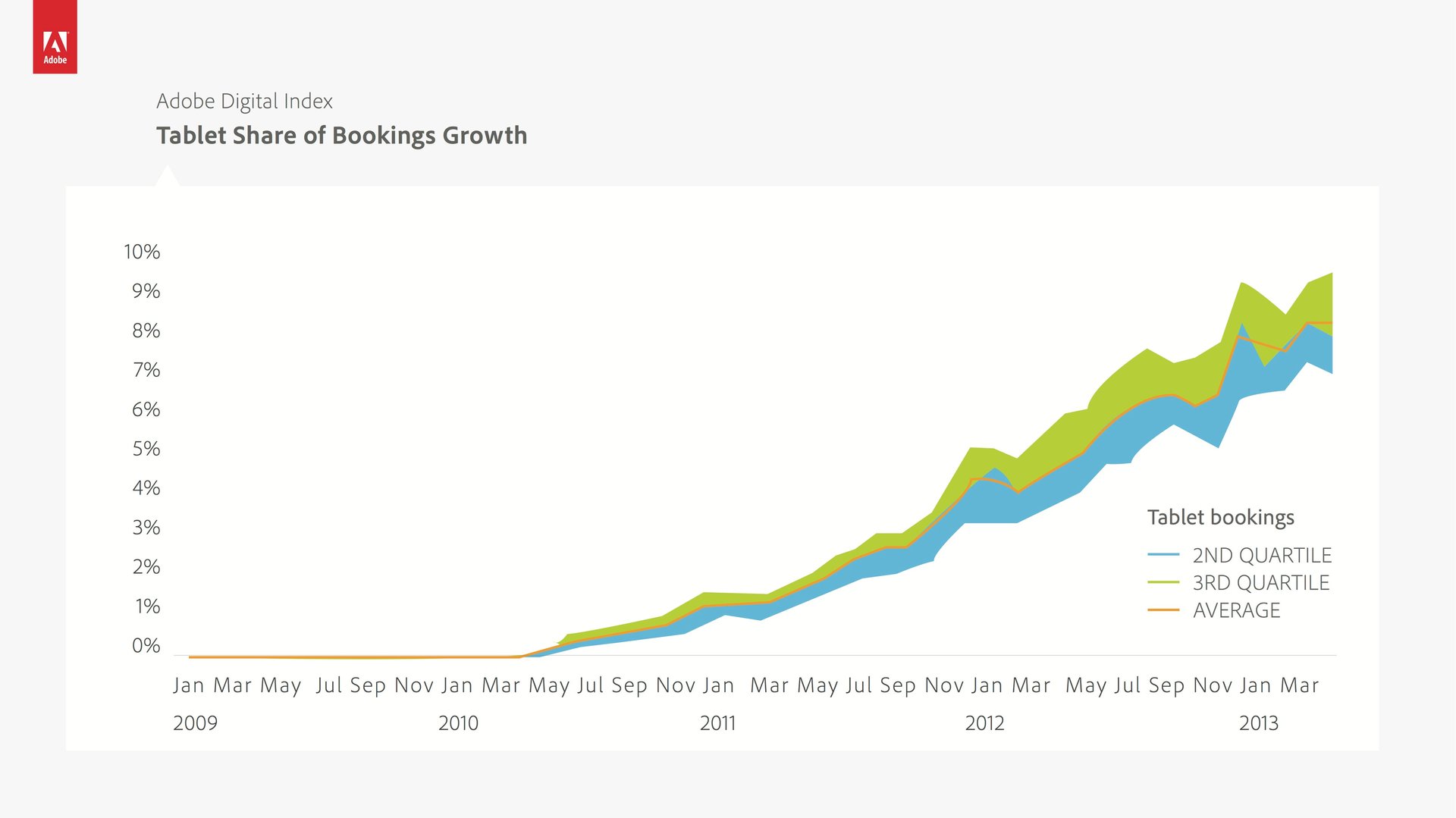

Tablets drive 7.5% of all bookings and have become a major factor for this industry, but not all sites have become good at servicing them. An analysis of the distribution of tablet bookings across all sites, indicated by the width of the shaded areas, demonstrates a widening gap between the sites that have optimized for tablet versus those that have not.

As usage climbs, so does the amount of money spent per booking. Average booking value from tablets has increased nearly 10% since last year to $636 per booking on average.

Onward and upward

Increasing demand and the continued shift from offline to online travel bookings continue to drive a surprising amount of new opportunity since the current shift represents a fraction of $600 billion industry. Additionally, new online business models and an improved economy may shift transaction volume toward direct channels in the coming years. There is always more work to do, especially around the increasingly complex array of mobile interaction points. Many companies haven’t begun to deal with smartphones or tablets and are now faced with game consoles, Internet-enabled eReader devices, and SmartTVs. The industry will be in constant evolution and will continue to surprise and delight personal and business travelers alike as they take advantage of innovative new approaches to selling and servicing our travel needs.

Follow me on Twitter @tamarag for further insights into the digital marketing business.

This article is written by Adobe and not by the Quartz editorial staff.