Hedge funds may be coming to a billboard near you

The US Securities and Exchange Commission (SEC) has voted to allow hedge funds to advertise to the general public, easing 80-year-old restrictions on how investment funds can raise money in the United States.

The US Securities and Exchange Commission (SEC) has voted to allow hedge funds to advertise to the general public, easing 80-year-old restrictions on how investment funds can raise money in the United States.

The rule change stems from the Jumpstart Our Business Startups Act (JOBS Act), a 2012 law meant to spur investment in small businesses by relaxing rules on how companies and funds can raise money. And in fact, private equity funds and other startup companies that were once barred from “general solicitation” will—once the rule goes into effect—be able to publicly ask for money and discuss investment opportunities.

The bill still limits would-be investors in the funds to people with assets in excess of $1,000,000, or those who have had an income of $200,000 or more per year for the last two years. That ends up including about 7.8% of the population. Critics have argued that relaxing these restrictions increases the likelihood of fraud.

But does a probable increase in fraud because of the new rule outweigh the benefits of allowing more investors to participate in funding new businesses, or in funding firms that fund new businesses?

Although the US economy appears to be recovering, credit standards have remained high, and loans to companies are still tight. What’s more, new financial regulations are starting to kick in, which encourage US banks to take fewer risks, and new business ventures are risky.

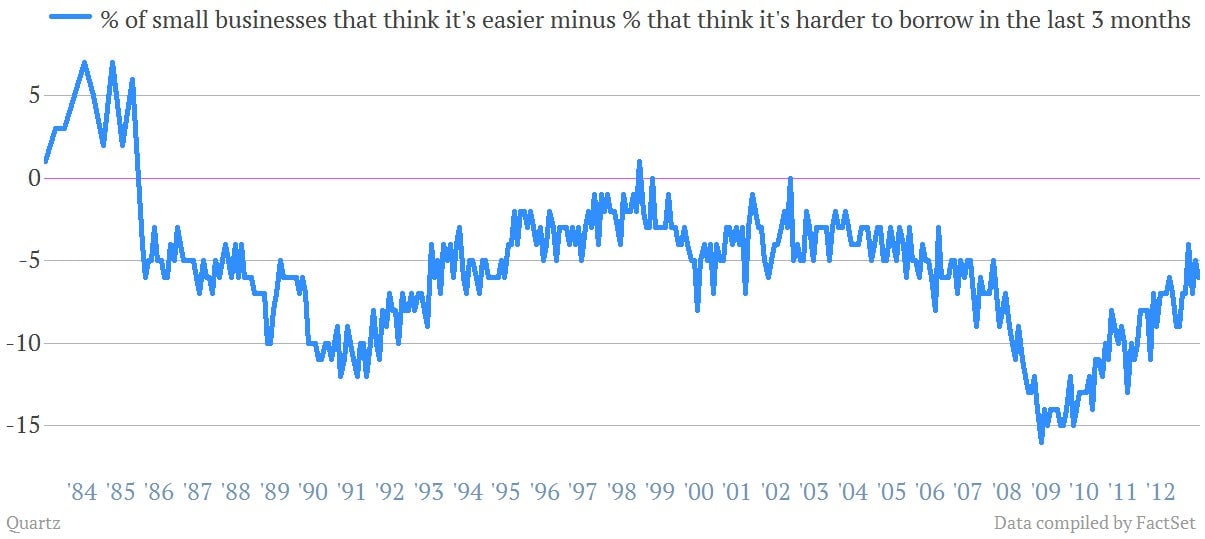

The graph below, from the National Federation of Independent Business’s small business survey, shows the percentage of small business owners who think it’s become easier to borrow in the last three months, minus the percentage who think it’s harder. As it shows, although the gap has been closing steadily since 2009, small businesses are still recovering from the worst funding conditions in 30 years, and more still think funding conditions are worsening rather than getting better.