The US has the largest monthly budget surplus since the financial crisis

Today, the US Treasury reported a $117 billion budget surplus in June, the largest since 2008. The June surplus gives credence to estimates that this year the US will post its smallest yearly deficit since 2008.

Today, the US Treasury reported a $117 billion budget surplus in June, the largest since 2008. The June surplus gives credence to estimates that this year the US will post its smallest yearly deficit since 2008.

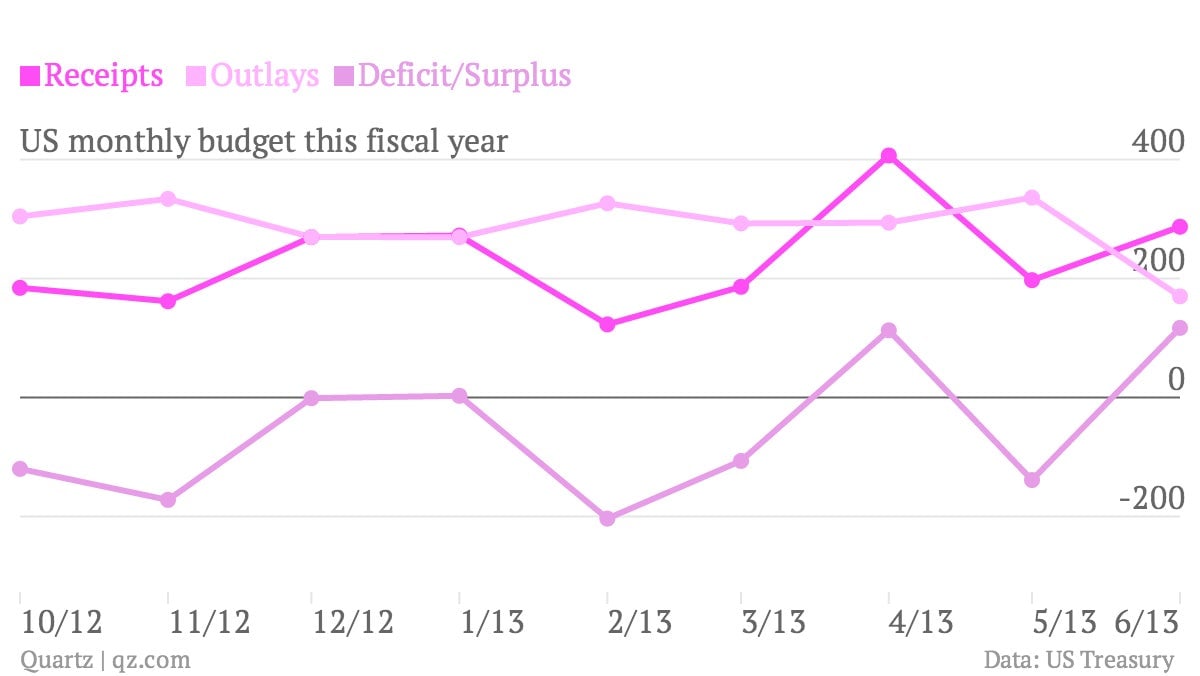

Of course, this is just a monthly total, and if you look at the chart above, you can see that since the fiscal year began in October, we’ve had mostly deficits and the US has borrowed some $500 billion. If the White House’s latest estimates are right, the US will end up borrowing some $760 billion this year, which is some $214 billion less than they thought just a few months ago.

Today’s surprising result—analysts expected a $40 billion surplus— is partly due to a $66 billion dividends payment from housing financiers Fannie Mae and Freddie Mac. The bailed-out institutions have become so lucrative since the housing recovery began that suddenly everyone wants a piece of the action.

But the housing market’s resurgence only accounts for half the surplus. June is also a time when businesses pay quarterly taxes, which also boosted receipts. Government spending was reduced by budget sequestration, the across-the-board cuts implemented after last year’s contentious budget deal flopped.

The economic recovery has also helped the budget. With more people working and more economic activity underway, spending on safety net programs is going down as revenues rise. That makes the decision by US policymakers to delay post-crisis austerity measures look wise.

If the plunge in borrowing continues, the need to raise the US debt ceiling will be pushed further away, and legislators might avoid a repeat of last year’s gridlock. It would also weaken the case of fiscal hawks rallying for immediate spending reductions.