America’s vast swaths of retail space have become a burden in the age of e-commerce

For all the talk of the “retail apocalypse” taking place in the US, the reality is that retail overall isn’t dying. E-commerce and Amazon, after all, are part of retail, too, and they’re doing alright.

For all the talk of the “retail apocalypse” taking place in the US, the reality is that retail overall isn’t dying. E-commerce and Amazon, after all, are part of retail, too, and they’re doing alright.

The suffering is mostly concentrated in brick-and-mortar retailers, particularly malls and department stores. One of the underlying causes is the amount of physical retail space in the US, which grew excessively even as more shopping began taking place online. American retail is in serious need of a diet, and 2017 is forcing it on one.

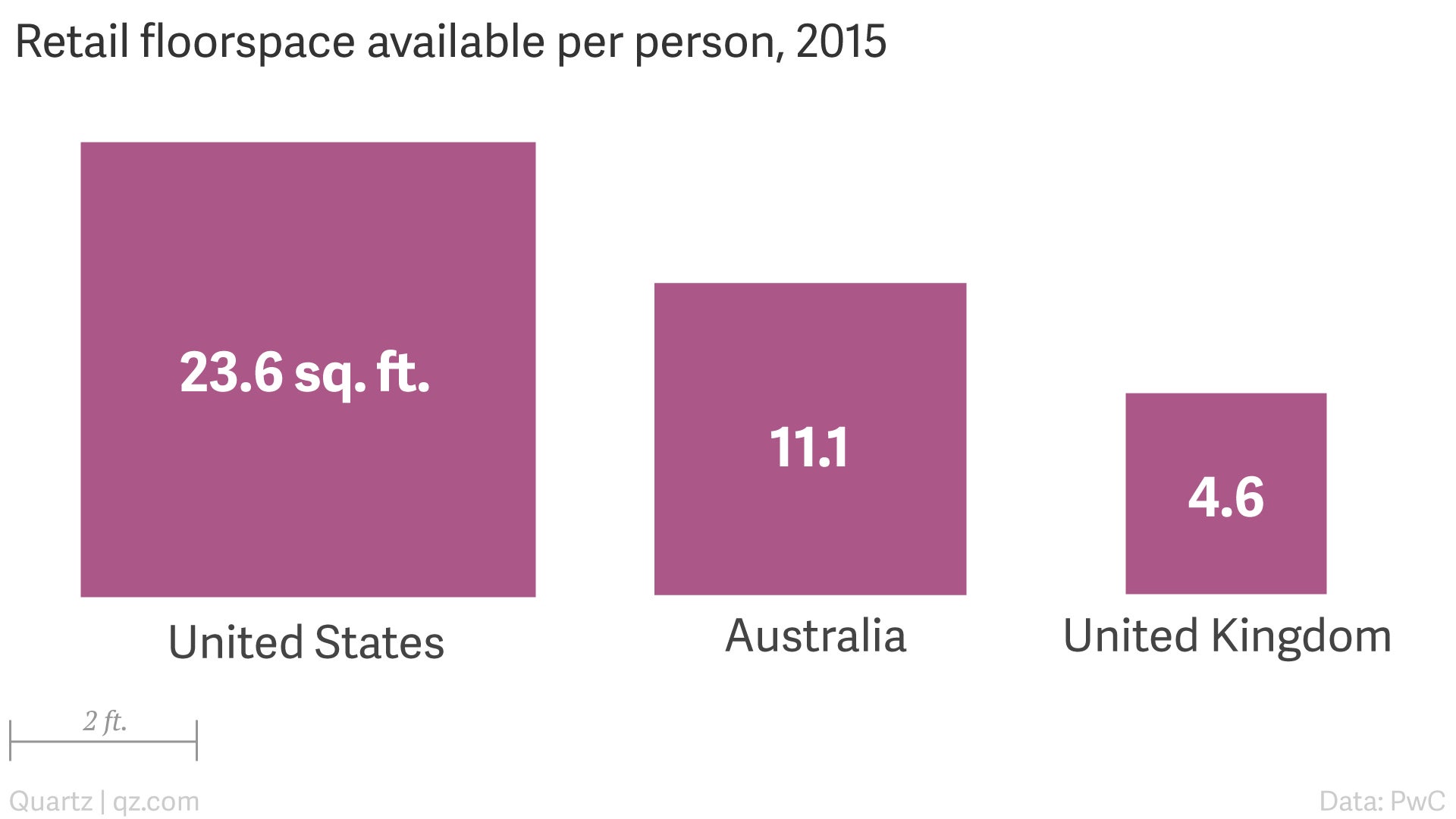

The size of the issue becomes clear when comparing the square footage of retail space available for lease, both used and unused, per person in the US to other countries. In 2015—the most recent year with comparable data available—the US had about 23.6 sq ft of retail space per person available, according to estimates from PwC. As the Financial Times reported (paywall), that’s more than twice the amount in Australia, and roughly five times that of the UK and other European countries.

The retail environment is different in the US, where consumer spending is higher than most countries, but the numbers still point to bloating in the country’s physical retail space. ”It’s unlikely that the square footage of retailing floorspace per person in the US will shrink to the Australian levels, mainly due to the fact that US consumers are more consumptive than other mature regions,” says Byron Carlock Jr., who heads up PwC’s US real estate practice. “However, I do believe the existing square footage per capita will shrink and eventually space will be repurposed.”

A slimming down is already underway. Earlier this year, analysts at Credit Suisse estimated that more stores could shutter this year than during the Great Recession in 2008. Hedge funds, as noted by the Financial Times and others (paywall), think the next big short opportunity is likely to come from retail.

Urban Outfitters CEO Richard Haynes summed up the situation during an earnings call with analysts in March:

Retail square feet per capita in the United States is more than six times that of Europe or Japan. And this doesn’t count digital commerce. Our industry, not unlike the housing industry, saw too much square footage capacity added in the 1990s and early 2000s.

Thousands of new doors opened and rents soared. This created a bubble, and like housing, that bubble has now burst. We are seeing the results, doors shuttering and rents retreating. This trend will continue for the foreseeable future, and may even accelerate.

Physical stores are still where the great majority of purchases happen. But the retail landscape of years ago has changed, and now it’s filling up with empty storefronts.