The slow and steady Goldman Sachs smokes expectations

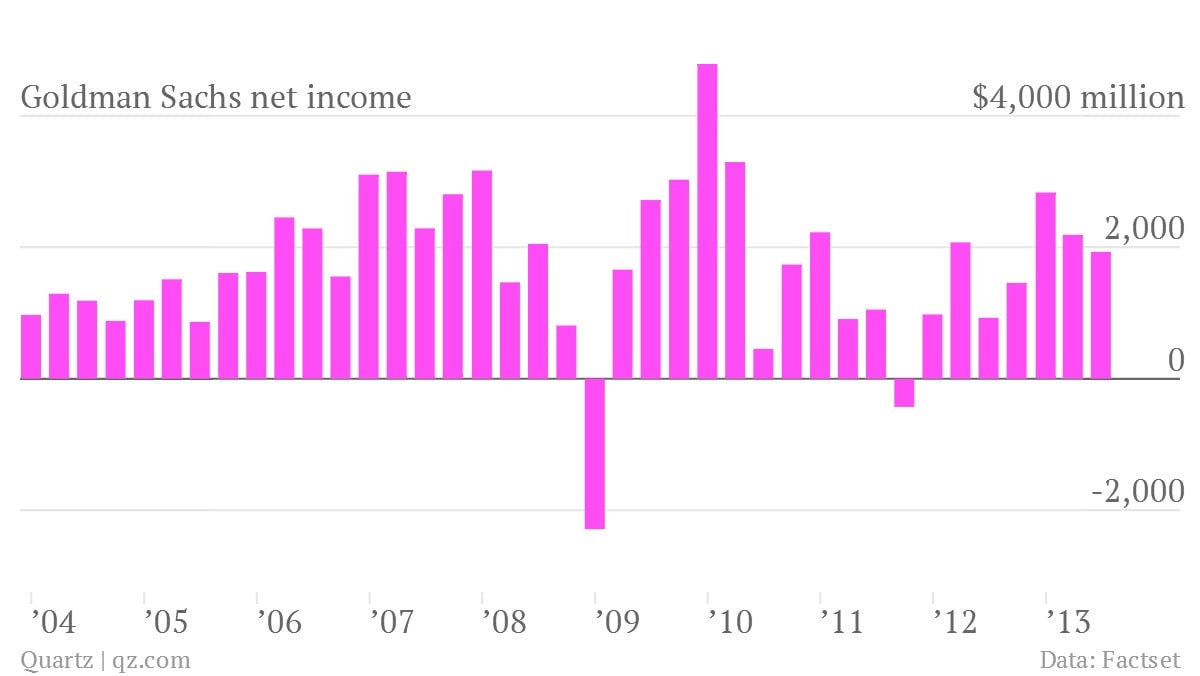

The numbers: Goldman Sachs whooshed past analyst expectations, with earnings of $3.70 per share—trumping analyst predictions of $2.83—and revenues of $8.61 billion. The firm’s profits fell slightly from last quarter to $1.93 billion.

The numbers: Goldman Sachs whooshed past analyst expectations, with earnings of $3.70 per share—trumping analyst predictions of $2.83—and revenues of $8.61 billion. The firm’s profits fell slightly from last quarter to $1.93 billion.

The takeaway: The bank continues to sell itself in specialties many other firms have decided to rethink: investment banking and trading. Even so, the quarter was challenging for Goldman Sachs; although revenues in investment banking and what’s known as FICC (fixed income, currency and commodity client execution) were up 29% and 12%, respectively, from a year ago, they were down 1% and 23% from the first quarter of 2013. Nonetheless, it’s hard to scoff at respectable returns in a challenging market, and shares were up 0.7% in pre-market trading.

What’s interesting: The bank talks a lot about the capital and liquidity requirements it continues to meet for Basel 1 standards of banking regulation, but it fails to talk about how well it is preparing to satisfy future requirements. Other US banks have given more detail about capital and liquidity levels under rules that haven’t yet gone into effect, but Goldman Sachs seems to be hanging back.