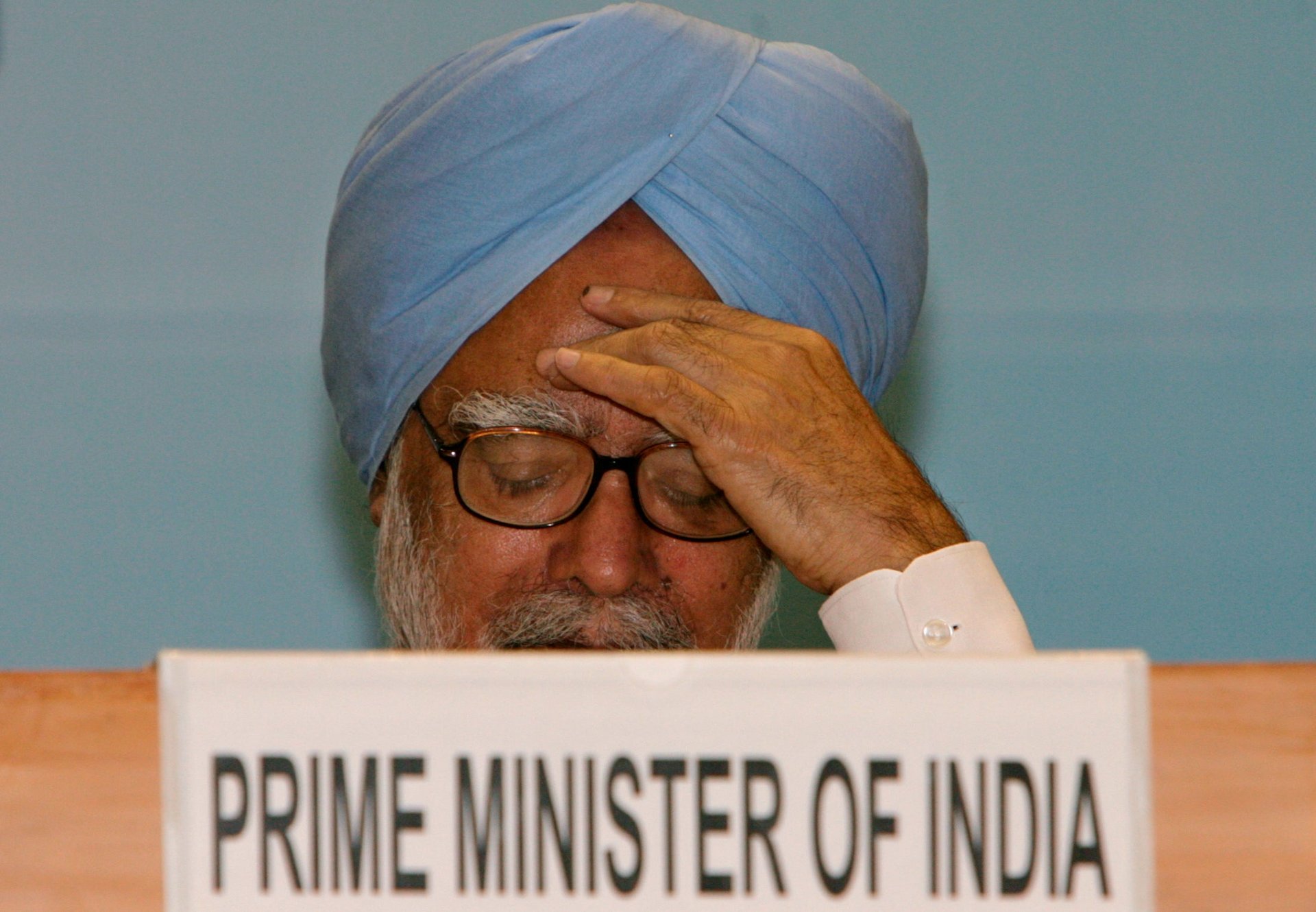

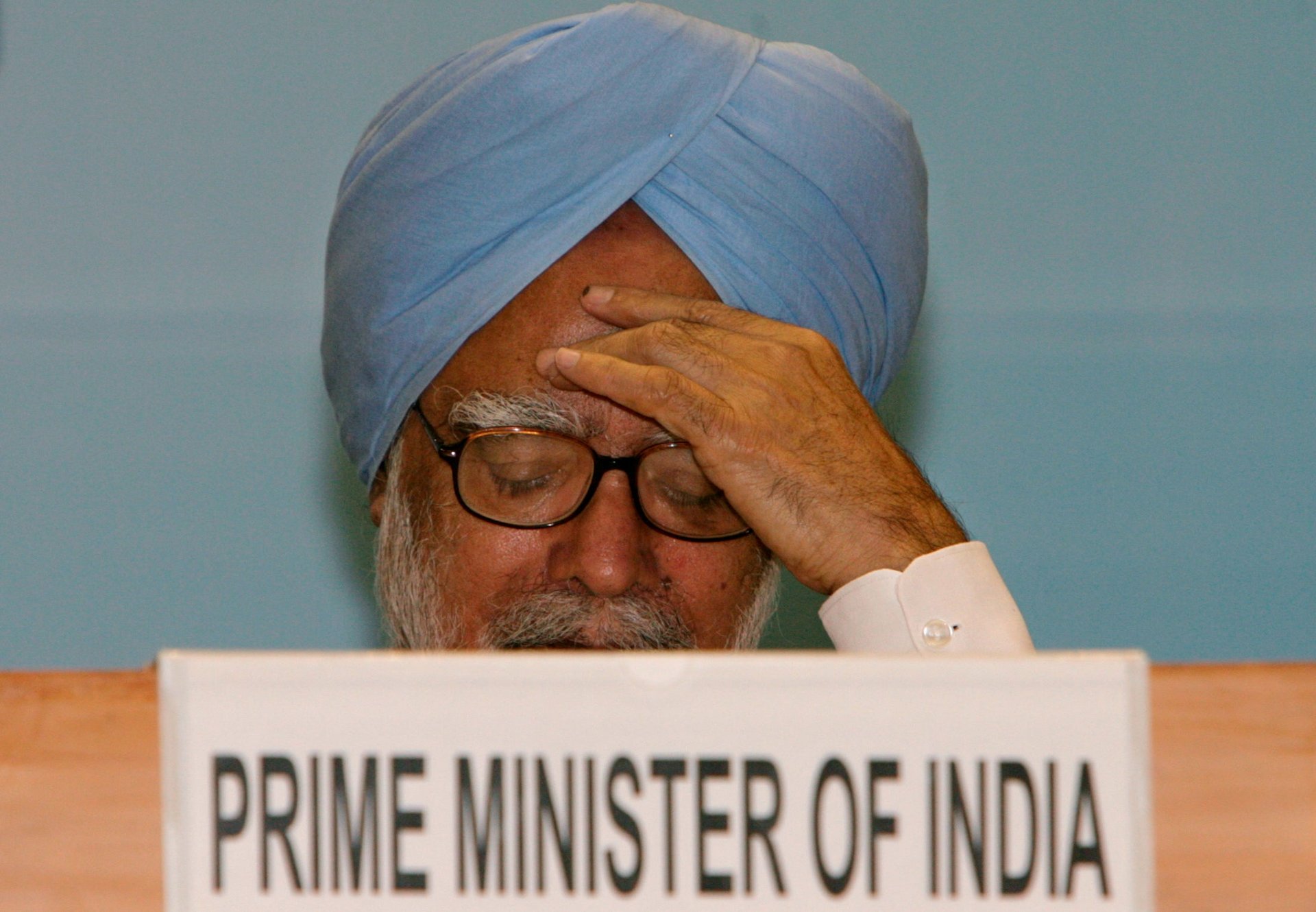

India’s foreign investment reforms are not the answer to its economic woes—with one possible exception

Faced with a slowing economy, a falling currency, and a worrying current account deficit, India’s government has proposed easing foreign investment limits in sectors like telecoms and insurance, and reducing red tape in others like defense, oil refining, and stock and commodity exchanges. However, these measures are unlikely to have a major impact on India’s attractiveness as an investment destination. Here’s why:

Faced with a slowing economy, a falling currency, and a worrying current account deficit, India’s government has proposed easing foreign investment limits in sectors like telecoms and insurance, and reducing red tape in others like defense, oil refining, and stock and commodity exchanges. However, these measures are unlikely to have a major impact on India’s attractiveness as an investment destination. Here’s why:

1. Many of the measures are cosmetic or incremental.

In defense, for example, the FDI limit has been left unchanged at 26%. All that the government has proposed is that higher levels of foreign investments in “state-of-the-art” technology manufacturing will be considered by a cabinet committee on security. Determining what would qualify as ”state-of-the-art” is the defense ministry’s call.

2. The political environment is unfavorable for reforms.

The government wants to hike the foreign investment cap for the insurance sector from 26% to 49%, but the proposal will need to be approved by parliament. And with elections less than a year away, the opposition is in no mood to let the government build its reform credentials. The last session of parliament was marked by disruptions and just two bills were passed. The next session, which starts on August 5, promises to be no different.

3. Liberalizing FDI rules alone won’t bring in investments.

India’s business environment has deteriorated over the last couple of years, and raising FDI caps alone will not open the floodgates for foreign investment. In a note to clients, Eurasia group wrote: “In the absence of bolder and more politically difficult steps to improve India’s overall business environment, the FDI changes proposed today can only help attract limited foreign inflows over a long time horizon, providing little short term economic boost.”

4. Telecoms may be the sole bright spot.

The one sector where the new rules can bring immediate change is telecommunications, where FDI cap has been lifted from 74% to 100%, enabling foreign firms to operated without an Indian partner. UK’s Vodafone and Russia’s Sistema are likely to take advantage of the new rules to buy out their local partners. The increased limits are expected to bring in around 100 billion rupees ($1.68 billion) of investment for the sector.