An “America First” policy on trade with Canada is going to hit Harvey victims hardest

Earlier this year, the US government charged Canada with giving its logging industry an unfair leg up and slapped steep tariffs on Canadian timber. This is bad news for Canada since, like most of its exports, around three-quarters of its softwood lumber goes to the US.

Earlier this year, the US government charged Canada with giving its logging industry an unfair leg up and slapped steep tariffs on Canadian timber. This is bad news for Canada since, like most of its exports, around three-quarters of its softwood lumber goes to the US.

However, it’s also bad news for America homeowners and prospective homebuyers—particularly in the wake of Harvey. In fact, this trade kerfuffle illustrates how easily protectionism can backfire, hurting an economy more than it helps.

First, some fast facts on the great North American log trade saga. And “saga” isn’t huge hyperbole here: the US and Canada have been tussling over timber trading for the better part of four decades. The current trade actions aren’t new; US officials passed similar tariffs on Canadian softwood in 1991 and 2001. Even the current investigation was instigated by US lumber companies in December 2016—meaning, it predates Donald Trump’s White House tenure.

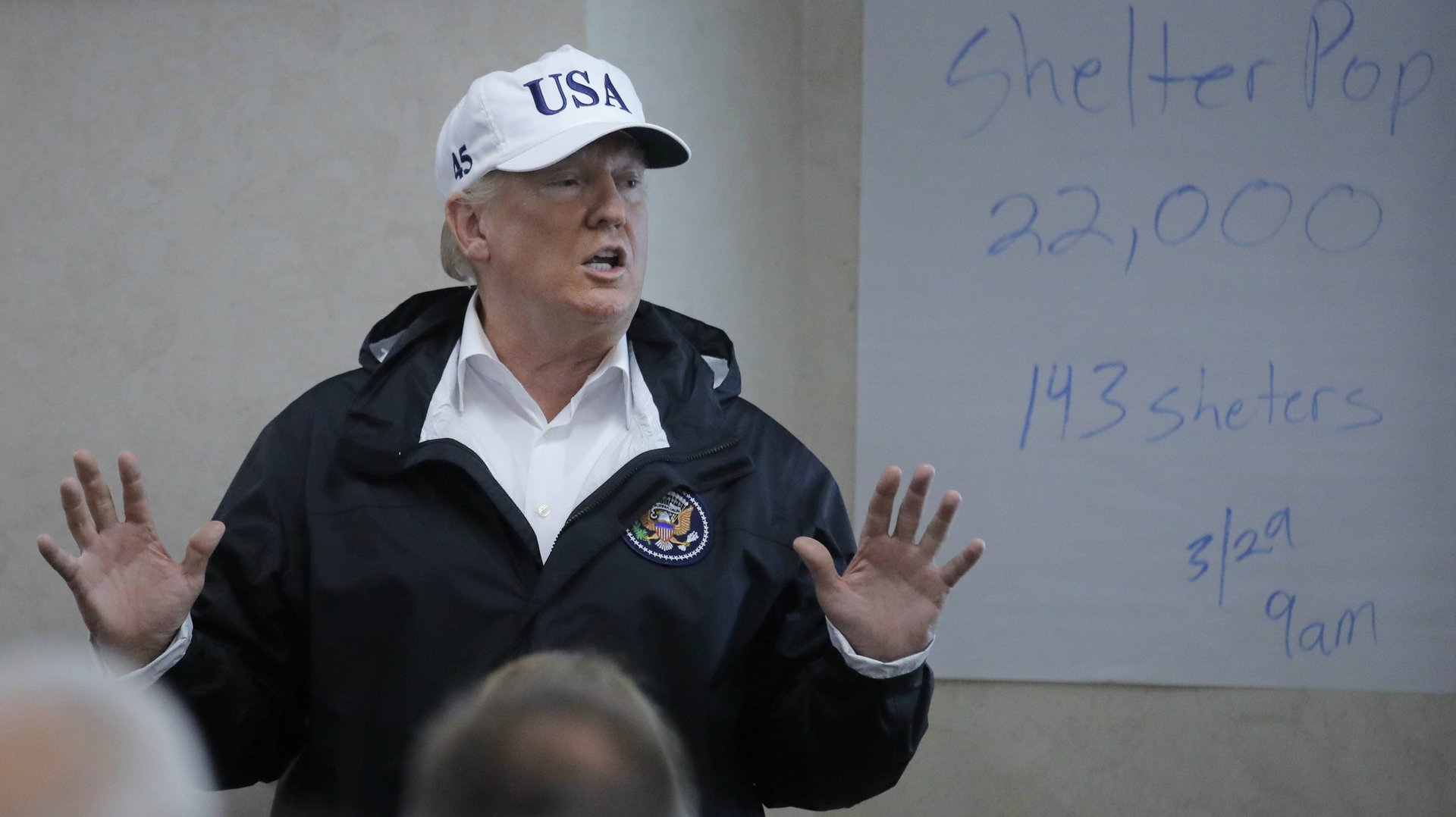

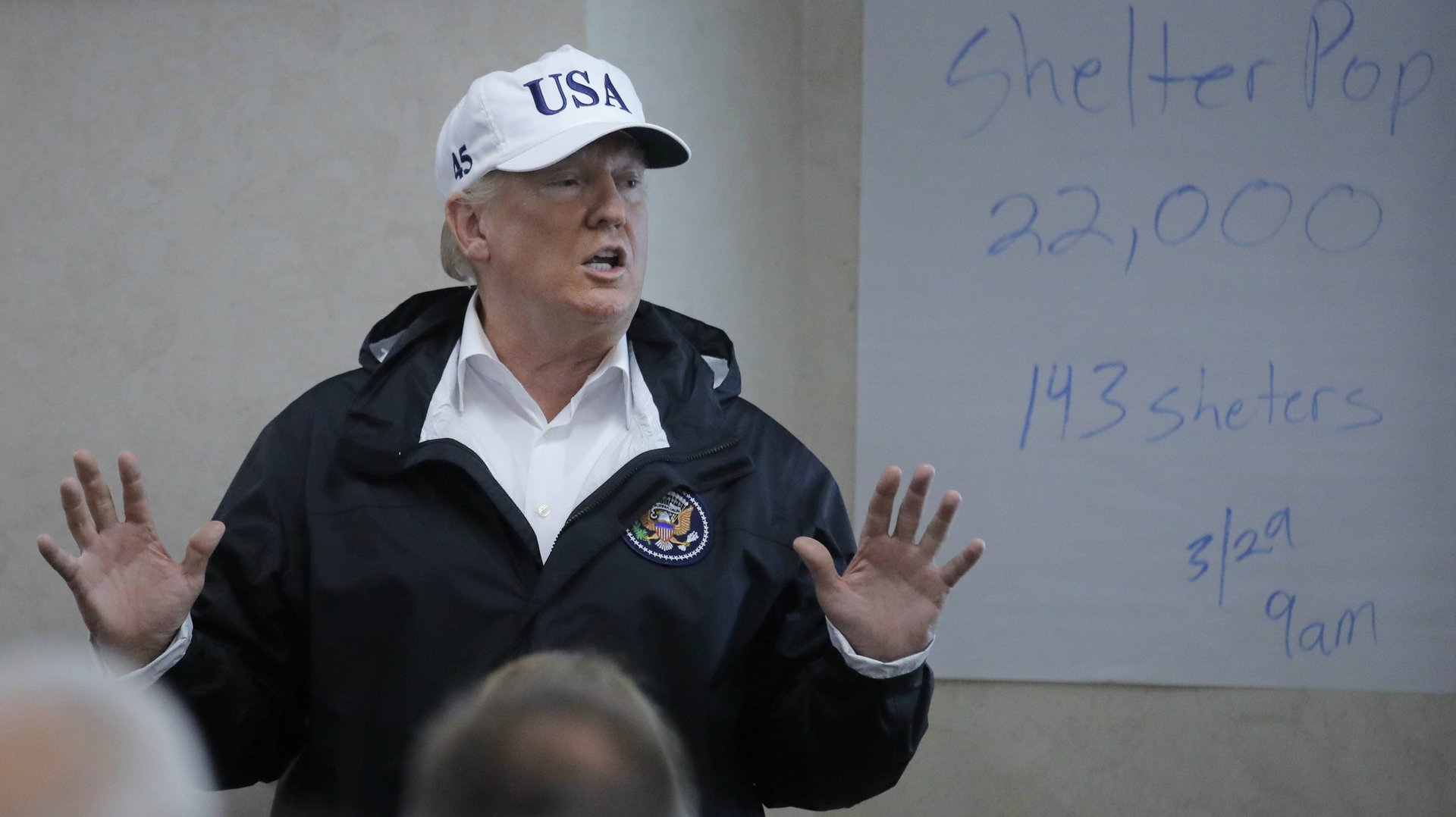

That said, the timber tiff is still getting the “America First” treatment. Trump’s attention to the dispute has taken a routine technocratic issue—one that likely would have occurred regardless of who won the White House last November—and “escalated it politically” (pdf, p.8), says Chad Bown of Peterson Institute for International Economics. Though the two sides have been trying to agree on a marketshare cap for Canadian lumber, negotiations haven’t gone anywhere. The countervailing duties of around 20% that the White House slapped on softwood in April expired last week, though the 7% anti-dumping duty remains in place. The Trump administration will decide in mid-November whether to keep both levies in place.

The thing is, by angling to protect US timber jobs from northern competition, Trump is hurting American consumers. Canada supplies about 30% of the wood used to make the floors and outer walls of American homes. The current tariffs make imported softwood about 30% pricier, on average, allowing US lumber companies to charge more at home, too. And of course, someone has to pay those extra costs. In this case, more expensive building materials means more expensive houses.

Normally, Trump’s protectionism would also hit construction by tamping down on potential housing demand. But thanks to what can only be called a perfect storm of factors, the real problem for the American economy will be supply. Obviously, there’s Hurricane Harvey, which leveled some 40,000 homes in Houston alone. While rapidly approaching Irma is likely to wipe out homes along the US southeast as well, it also is set to hit parlously close to major sources of homebuilding wood in Georgia and South Carolina. Meanwhile, forest fires that have raged in British Columbia for several months have already driven up lumber prices. Rebuilding in these storms’ wake will push timber prices even higher.

Even before all this, it was unclear whether US lumber companies could produce enough wood to meet housing construction demand on their own.