Taking control of risk: the path to investing success

Investors often ask which of the two main bond market risks they should focus on—interest rate or credit. The answer? Both—and the way they interact with each other.

Investors often ask which of the two main bond market risks they should focus on—interest rate or credit. The answer? Both—and the way they interact with each other.

Investors typically view interest-rate-sensitive bonds (global government bonds, inflation-linked bonds) and growth-sensitive credit assets (high-yield corporate bonds, bank loans, emerging-market debt) as two separate groups. And they use different managers for each.

In theory, the divide-and-conquer approach works like this: if the assets in the credit-oriented portfolio get too expensive to justify the risk, a manager might sell some of them and shift those assets into the rate-sensitive portfolio.

But there’s a problem with this approach. Managing these pools of assets separately can cause investors to miss income-generating opportunities and take on too much exposure to the risk of losses.

THE PROBLEM WITH DIVIDE AND CONQUER

It’s not easy to shift money quickly from one portfolio to another, due to the difficulty of forecasting interest-rate changes or credit events. Anyone can get lucky once or twice. But even the most seasoned investors struggle to get it right consistently.

Some investors may try to address this hurdle by putting their bonds on autopilot—and taking active managers out of the equation. But that’s not much of a solution. Strategies that passively track a market index can’t pick and choose their exposures at all—they’re locked into exposures just because those issuers are part of the index. Additionally, investors who manage interest-rate and credit risk separately may overlook the crucial interplay between the two.

In other words, investors today must pay constant attention to interest-rate and credit risk. That means having a manager who understands how the two interact and has the flexibility to tilt toward one or the other, depending on rapidly changing conditions.

Doing this effectively calls for a “combine-and-conquer” approach: pairing the two groups of assets in a single strategy known as a credit barbell and letting managers adjust the balance as conditions and valuations change. When managed effectively, this strategy may minimize large drawdowns while still providing a strong and steady stream of income. For investors, that can mean more efficient income.

THE SWEET SPOT ON THE SEESAW

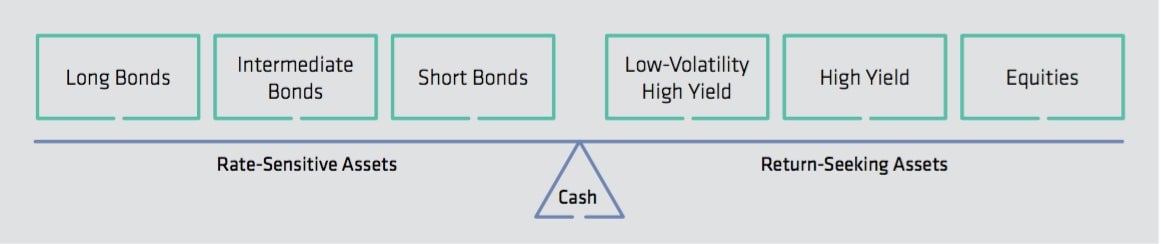

When building a portfolio, it helps to visualize your investment options as an asset-allocation seesaw, with cash in the middle, government bonds on the left and return-seeking assets such as high-yield bonds or equities on the right.

The assets on each side of the seesaw tend to react differently to most macroeconomic factors, particularly their dominant risk premiums. Interest-rate-sensitive assets such as US Treasuries or German Bunds have two main risk premiums. The real-interest-rate risk premium is the portion of the coupon that compensates investors for lending money to the government, while the inflation-protection risk premium protects the purchasing power of a bond’s principal.

Corporate bond yields consist of the yield on comparable-maturity government bonds plus a credit spread, which can be broken down into further risk premiums. Corporate bonds also carry a credit, or default, risk premium, the portion of the spread that compensates for the possibility that the issuer will suffer a credit downgrade, become unable to make coupon payments or go bankrupt.

Moving away from cash in either direction on the seesaw increases return. There’s a catch, though: yields on bonds with different maturities don’t move in lockstep. When they rise, they rise on a curve, not a straight line. The further out one moves, the smaller the yield increase. That means it’s almost never efficient to tilt all the way left or all the way right.

By mixing interest-rate-sensitive assets with higher-yielding credit securities in one portfolio, investors may increase their chances of earning extra income without taking on unacceptable levels of risk.

Investing, like most things in life, is better with balance. A carefully constructed strategy can create that balance in investors’ fixed-income portfolios by reducing risk without sacrificing much return. The key to long-term success isn’t avoiding volatility. It’s generating a consistently high level of income and avoiding large drawdowns. Do that, and you’re likely to win over time.

To learn more about responsible investing, visit AB (AllianceBernstein) or read the whitepaper.

This article was produced by AB and not by the Quartz editorial staff.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.