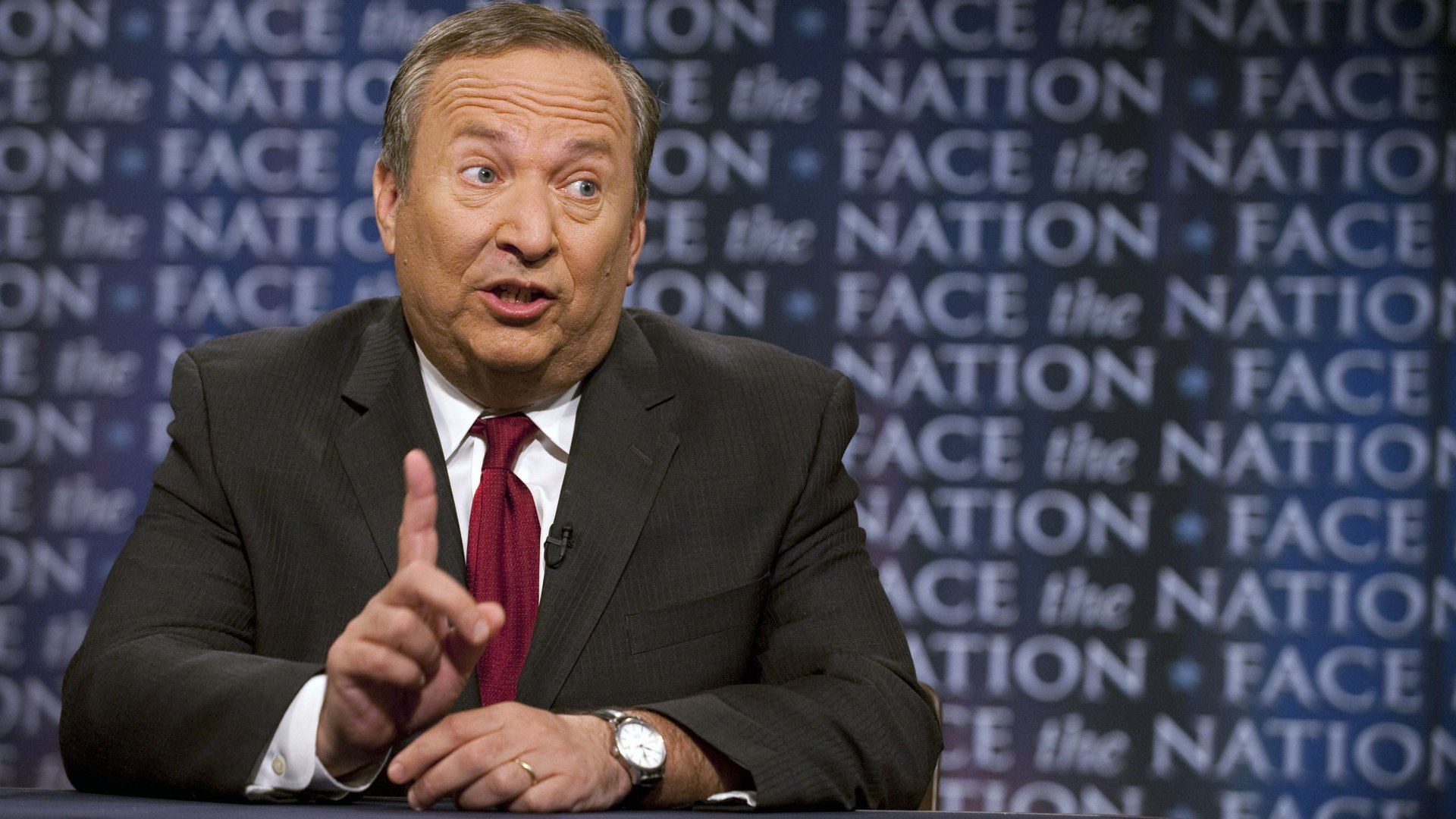

Why it’s so difficult to figure out what Larry Summers is thinking

Trying to figure out what Larry Summers thinks can be like measuring the location of an electron. As soon as you observe it, the opinion scurries away to another spot. The man can’t easily be pinned down.

Trying to figure out what Larry Summers thinks can be like measuring the location of an electron. As soon as you observe it, the opinion scurries away to another spot. The man can’t easily be pinned down.

Call it the Summers Uncertainty Principle. His inscrutability is complicating the task of journalists and investors trying to discern Summers’s view on monetary policy, now that he’s the leading candidate to be the next chairman of the US Federal Reserve. It’s not that his views aren’t known, but the way he puts them is often intentionally obfuscating.

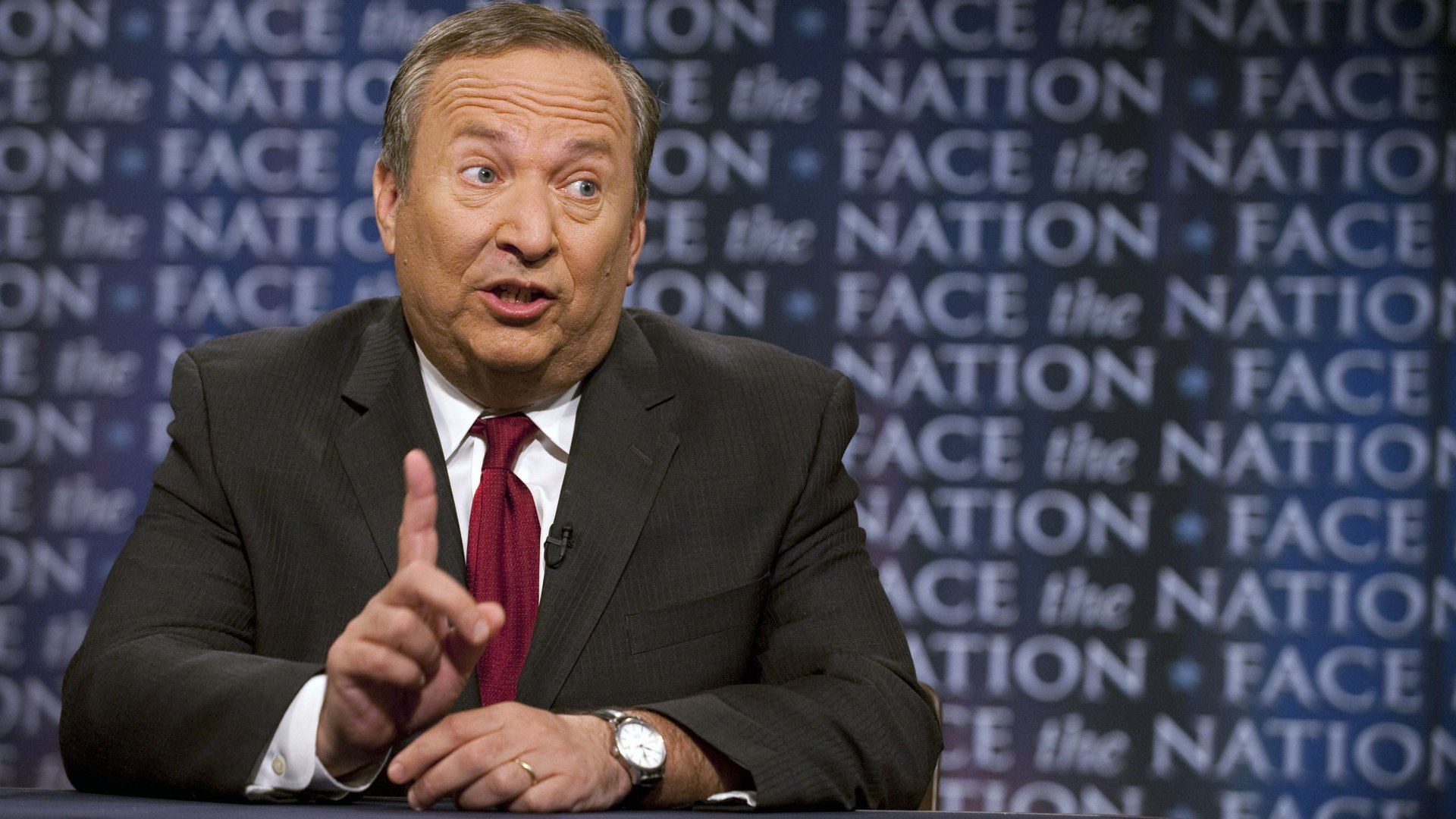

I have followed Summers and taken an interest in his rhetorical quirks for the past nine years, dating back to his now-infamous speech musing about why so few women become science professors at elite universities. Those unscripted remarks were hedged every which way, though it didn’t much temper the reaction, which was mostly critical.

In speeches and informal talks over the last few years, Summers has developed a new kind of disclaimer before commenting on controversial subjects. He often prefaces his remarks by saying something along the lines of, “If, at the end of this, you feel like you’ve understood me completely, then you have misunderstood me.” It’s a riff on what Alan Greenspan, who served as Fed chair for more than 18 years, famously told Congress in 1987.

The effect, or at least the intent, is to inoculate his comments from the pitfalls of certainty. A statement can be contentious, but an equivocation is harder to assail. And it steels the listener for a loquacious loop-the-loop.

“Summers Hedges Doubts on Bond Buys,” reads the headline on the cover of today’s Wall Street Journal (paywall). Of course he does. The article seems informed by Summers himself or his advocates, who want to make it clear that he wouldn’t make a hasty exit from the quantitative easing policies pursued by the current Fed chair, Ben Bernanke, however skeptical he may be of them.

It’s hardly surprising that Summers wouldn’t immediately reverse course, jolting markets that have come to depend on easy money. Whether that tells us anything about what kind of monetary policy Summers would pursue is less clear, but that’s not the point. He’s shifting the position slightly, like a subatomic particle, as to suggest that measuring it is futile.

A new piece from Politico, which also reads like it was informed by Summers’s closest allies, argues that while the specifics of his views on quantitative easing may be unknown to us, president Obama “knows exactly where Summers stands on monetary policy.” Perhaps, but that would be a departure for Summers, whose associates say can be just as circumspect about his views in private as in public.

That rhetorical style stands in contrast to the conventional view of Summers as a brilliant, if arrogant, academic with unwavering views. What’s in his head, I wouldn’t dare to guess, but what comes out of his mouth is actually quite far from absolutism. And that’s probably informed by his long history of lighting fires with his words.

It’s not as though Summers is a blank slate. His broad views on a variety of economic and fiscal issues are well known, many of them documented in columns he wrote for the Financial Times. What gets confused are the subtle nuances of Summers’s positions—because, of course, nuance is where controversy is generated.

All of that makes it extremely difficult to discern Summers’s views on the direction that the Fed should take to shore up the US economy. But if you think it’s tough now, it will be downright maddening if Summers is appointed to a position for which the chief task is sometimes described as saying as little as possible in as many words.

Which, come to think of it, might be his best qualification for the role.