Here’s a glimpse, from 2010, of SoftBank CEO Masayoshi Son’s vision of the future in 300 years

Many people in the tech industry struggle to understand SoftBank. The Japanese company baffled investors in Silicon Valley a year ago when it announced it would raise a whopping $100 billion (paywall) to launch its Vision Fund for venture capital investing in tech companies. Earlier this month, Recode reported that the company is raising another fund that could be even larger.

Many people in the tech industry struggle to understand SoftBank. The Japanese company baffled investors in Silicon Valley a year ago when it announced it would raise a whopping $100 billion (paywall) to launch its Vision Fund for venture capital investing in tech companies. Earlier this month, Recode reported that the company is raising another fund that could be even larger.

But the nature of the funds, the investment targets, and the company’s core revenue generators in Japan—an ordinary telco business and the aging Yahoo! Japan web portal—would seem to have little to do with one another.

As many search for patterns or a broad theme to better understand Softbank, one place to look is a seven-year-old slide presentation which resurfaced earlier this month on Hacker News, a popular forum for developers and VC investors. The 133-page deck accompanied a two-hour long presentation in Tokyo after the company’s annual shareholders meeting in June 2010. That’s two years before SoftBank first caught the attention of the global tech industry with its planned acquisition of US-based telco Sprint.

Speaking in Japanese amid a slideshow full of stock images and muddled English, Son lays out a vision for SoftBank that’s fitting for a madman, and perhaps equal to only Elon Musk in ambition.

The presentation opens with Son’s description of Softbank’s “philosophy,” which he initially summarizes as “Information Revolution – Happiness for Everyone.” After listing the leading causes of death around the world and showing Japan’s increasing suicide rates, Son states that the company will strive to increase people’s joy. “Making excellent products or competing on price and acquiring new customers, these are not our ultimate goals,” he says. “We want to increase the number of people being moved by something and increase people’s happiness.”

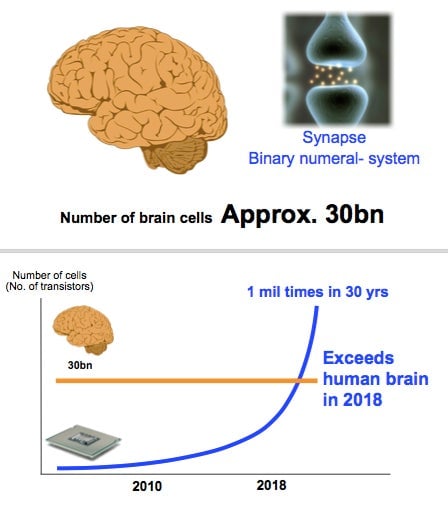

Son then notes the exponential increase in the number of transistors inside computer chips that has occurred over the past decades. Comparing chips to the human brain, he predicts that the number of transistors in a single chip will exceed the number of cells in a brain by 2018.

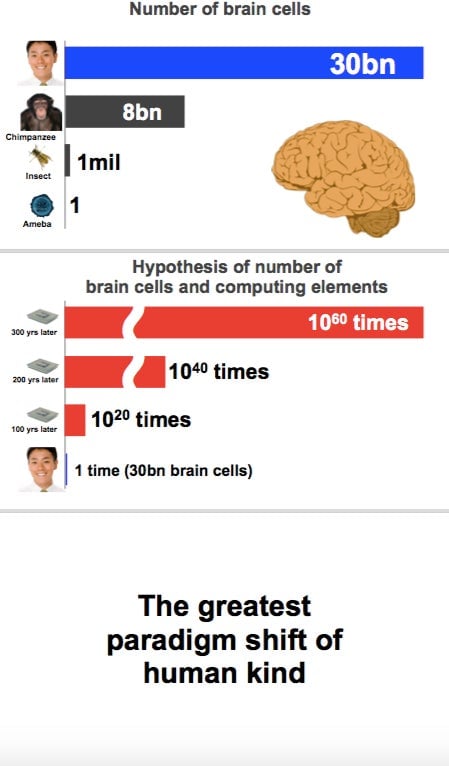

Taking the comparison further, Son predicts that in 100 years, human intelligence will be look like something on the order of the single-cell amoeba compared to computer intelligence. In his address, he says:

“Humans have only 30 billion times more brain cells than an ameba [sic]. But in 100 years, when we compare the number of brain cells humans have, with the number of transistors on a chip, we will be below what amebas are to us today. This difference between humans and insects is only about 30,000 times. A tiny difference. And we look down on amebas and insects. But in 100 years – compared to just one chip – we’ll be less than amebas. The brain power of computers compared to ours, will be like ours compared to amebas.”

Son then stresses the importance of ensuring that “computer brains” developed by humans will be used for benevolent purposes.

“Through the Information Revolution, we don’t want to create extra-intelligent computers that mechanically achieve their goals; we are aiming them to use them to make people happy. Just like people make each other happy now, and just like machines in a very small way started to make people happy now. We want extra-intelligent computers to co-exist with people, and make them happier.”

Son goes on to speculate that within 300 years, chips planted inside or on our bodies will allow humans to communicate with one another, in any language, via “telepathy.”

“In 300 years, maybe Softbank won’t be a mobile phone company anymore. Softbank could be a telepathy service provider. And then as chips are communicating with each other wirelessly, people speaking different languages from Chinese to English to French will be able to use them for automatic translation. Computers will automatically translate what a person is saying. I think that day will come. Maybe we’ll even be able to communicate telepathically with dogs.”

Son then says that when moving motors are combined with chips, you get robots—which he also expects will eventually become ubiquitous enough to replace firefighters.

“It’s possible that robots equipped with artificially intelligent brain-like computers will become commonplace within the next 300 years. Those artificially intelligent robots could be sent to dangerous places like disaster sites after earthquakes or fires. Now we rely on firefighters to risk their lives to save us, but artificially intelligent robots will be able to go into dangerous places, into rubble, without risking lives.”

It’s only later in the presentation where Son touches on the actual business of Softbank. In the final part, he repeatedly stresses how Softbank will not offer a single product or service, but partner with many different companies in different lines of business. Comparing the survival of a business to the survival of a species, he says that he hopes the tactic will help keep Softbank active for the next 300 years. He also says that he hopes SoftBank can be involved with as many as 5,000 companies within 30 years.

“If I were to choose only one thing, it wouldn’t be a chip, or software, or hardware. I would want it to be said that I have created an organizational structure that can potentially grow for 300 years. That I have created a company, a group, that will continue to evolve without stumbling. As a company, we have become a strategic synergy group.”

Seven years later, SoftBank is still a long ways off from bringing telepathic dogs to the masses.

But since Son made his pie-in-the-sky proclamations, at least some rudimentary groundwork for his vision has been laid. The company is close to closing a nearly $10 billion investment in Uber, which would round out its holdings in nearly every major ride-hailing company on the planet—Softbank also has stakes in Grab (Southeast Asia), Ola (India), Didi (China), and 99 (Latin America). It also invested in Nvidia, one of the leading graphics chipmakers; and it acquired ARM, a company which provides the designs for chips that power 95% of the world’s smartphones. Those are the sorts of important, data-sucking companies that seem well-placed to lead the tech industry in the future.

On top of those investments, the company has placed dozens of bets on other startups, including Slack, WeWork, and a bevvy of lesser-known companies. But not all of the company’s bets have been winners. Pepper, a humanoid robot which the company acquired from French robotics company Aldebaran, remains a curious novelty at most. And Son’s investment in Sprint has yet to help the telco make a turnaround—though a planned merger with T-Mobile could change that.

The SoftBank of 2017, in some ways, resembles a typical venture capital firm—with a few big winners, some losers, and many unknowns. But with hundreds of billions of dollars in cash to spend, perhaps it can plan for the next 300 years as it pleases.