IMF: Spain looks awful for the next 5 years

The IMF tries to put it nicely in its latest update (pdf) on the state of Spain’s financial health, but the truth is that the Spanish economy looks awful today.

The IMF tries to put it nicely in its latest update (pdf) on the state of Spain’s financial health, but the truth is that the Spanish economy looks awful today.

Executive Directors commended the authorities for strong progress on critical reforms amid challenging conditions, which is helping to stabilize the economy. External and fiscal imbalances are correcting rapidly. However the economy remains in recession, with unacceptably high unemployment, and the outlook remains difficult.

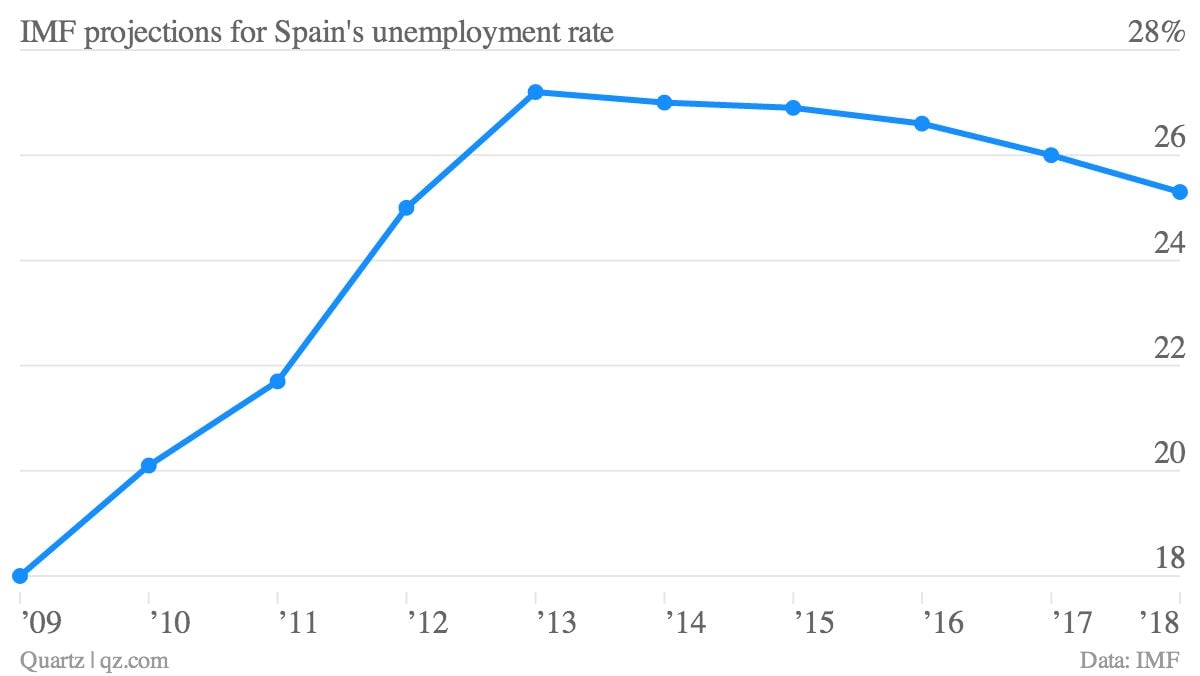

And it’s only going to get worse before it gets better. For starters, the IMF predicts that unemployment will remain above 25% through 2018. The IMF’s forecasts suggest that unemployment peaked in the first quarter of this year at 27.2%.

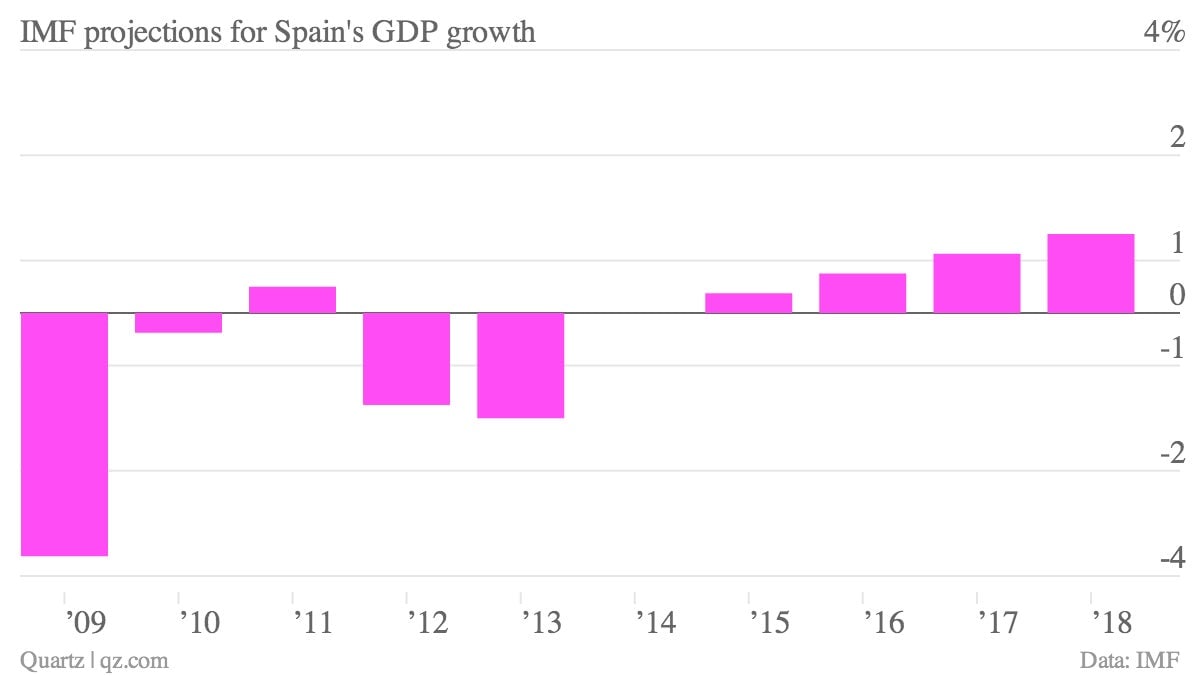

GDP isn’t expected to grow until 2015, though the Spanish economy could stop contracting as early as 2014. Even in 2018, however, growth will remain at a weak 1.2%.

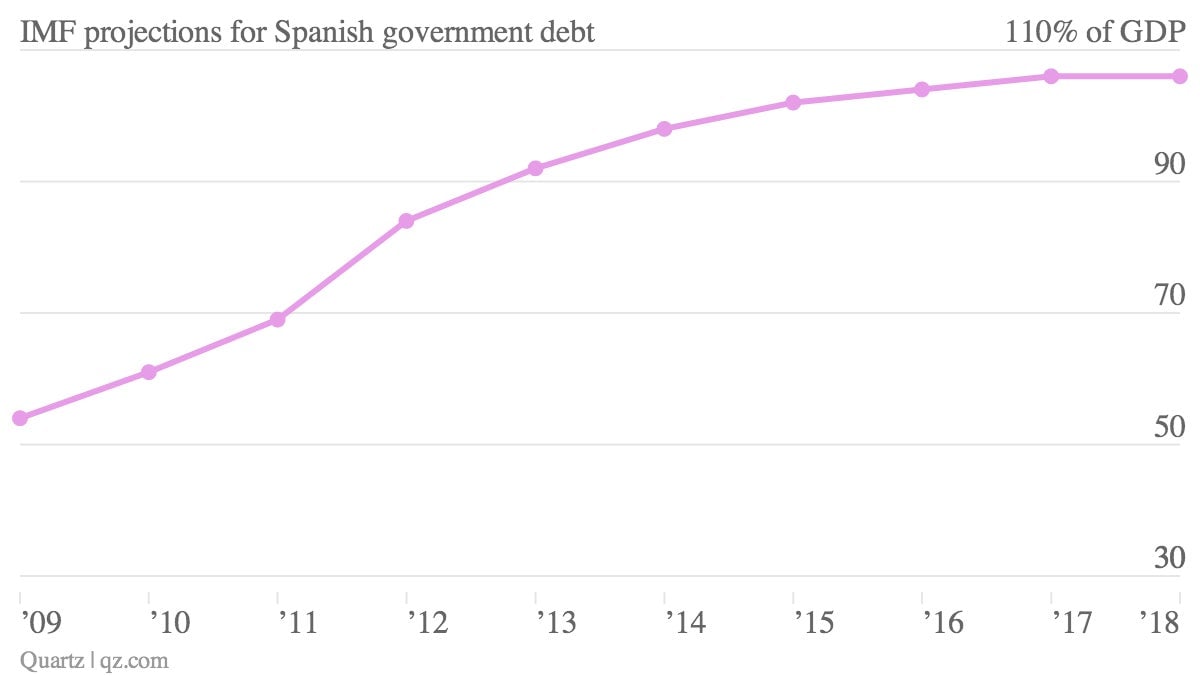

Finally, overall government debt will continue to rise throughout the IMF’s projections, only stabilizing in 2018 at 106%. Much of Europe’s sovereign debt crisis was caused by a loss of investor faith in euro zone governments’ ability to pay back their loans, but Spain’s problems have more to do with its overburdened banking sector. In fact, it benefited from the government’s lower debt level compared to Italy (124.3% in 2012) or Greece (156.9% in 2012, after defaulting). But with debt-to-GDP set to rise over 100% in the next few years, the country could face new and different problems.