Tax havens offer US multinationals a fantastic deal, and so will tax reform

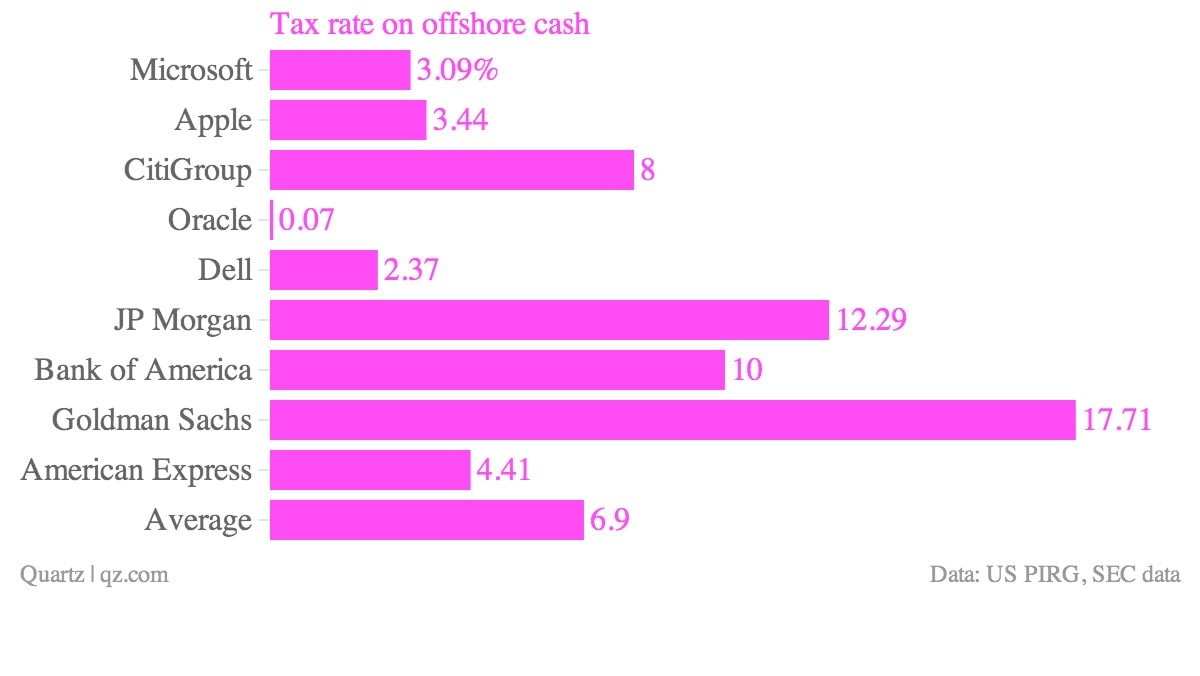

Attempts to reform the US corporate tax rate have been falling flat for many reasons, but chief among them is that multinationals enjoy such a good deal from tax havens: a 6.9% average tax rate on billions of overseas cash.

Attempts to reform the US corporate tax rate have been falling flat for many reasons, but chief among them is that multinationals enjoy such a good deal from tax havens: a 6.9% average tax rate on billions of overseas cash.

Eighty-two of the the one hundred largest US companies take advantage of tax havens, according to a new analysis from a the US Public Interest Research Group. Those companies are holding $1.17 trillion in cash overseas.

It’s easy to see why: Offshore money comes at a big savings to the effective rate of 12.6% paid by the average large US corporation. (The statutory rate is 35%.) US president Obama is currently seeking to lower the statutory rate to 28%, while the plan offered by Republicans would bring it down to 25%.

So how do you get that overseas corporate cash out of limbo? In Washington, they’re trying to figure it out, but the tax havens give multinational corporations all the leverage. The leading proposal among Republicans tempts corporations with a 5.25% tax rate on money they bring back while other reforms go into effect, a figure chosen to undercut what tax havens offer. After that, both Republicans and Democrats lean toward a global minimum tax, but it could be as high as 15%.

In short: Even if tax reform goes through, there’ll be plenty of incentive for companies to shift intellectual property and earnings overseas.

That’s why the question about rates is second to how the US should try to close the loopholes companies exploit. It’s also worth considering whether the corporate income tax is becoming archaic, and it’d be better to toss the whole thing out and raise revenue through a method with more positive externalities, maybe one of those newfangled carbon taxes or an old-fashioned hike in levies on capital gains and dividends.