Ten billion reasons why the US government should make life easier for American homeowners

Fannie Mae, the nationalized US housing lender that US president Barack Obama would like to eliminate, will pay $10 billion back to the government this quarter—a boon to the deficit reduction project, but a problem for efforts to speed up the still-slow US economic recovery.

Fannie Mae, the nationalized US housing lender that US president Barack Obama would like to eliminate, will pay $10 billion back to the government this quarter—a boon to the deficit reduction project, but a problem for efforts to speed up the still-slow US economic recovery.

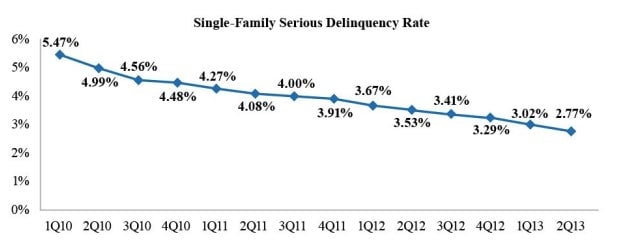

The news comes in today’s earning’s announcement, which notes that the nationalized home lender will return $105.3 billion to the US Treasury during the current quarter, compared to the $116.1 billion it withdrew to cover losses during the financial crisis. Fannie is returning the extra cash thanks to the strengthening housing market and its economic effects. More people are paying back their loans:

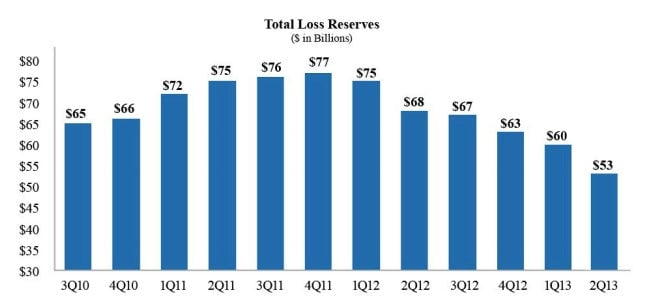

And with home prices going up even as interest rates remain low, the company doesn’t need to keep as much money on hand to cover potential losses:

While the returns are a boon for the budget (and push off an economically damaging showdown over the national borrowing limit), some analysts fear the success will make it harder for US lawmakers to pull back from government involvement in the mortgage markets. In other words, the more successful these government-sponsored entities are, the less likely we are to reform them. That dynamic has also blocked legislative efforts to provide relief to millions of still-struggling homeowners at a time of high unemployment.

The Obama administration has been pushing the Federal Housing Finance Agency, the regulatory body that supervises Fannie Mae and its equally profitable sibling Freddie Mac, to use these earnings to write-down the principal on home loans in foreclosure or, failing that, open the door for more borrowers to refinance while mortgage rates still remain below their pre-crisis highs. The regulator in charge, Ed DeMarco, has so far refused to endorse the measures, earning plaudits from critics of the president for focusing on the financial strength of the two companies. Like most of Obama’s efforts to aid homeowners, these programs remain still-born.