Onerous new rules on foreign banks in India should be good for them in the long run

Things are about to get tougher for foreign banks in India. The central bank is set to unveil new norms that will force new foreign banks entering the country to form separately capitalized local subsidiaries, instead of simply setting up branches of the parent bank. Existing foreign players will be encouraged to make the same switch.

Things are about to get tougher for foreign banks in India. The central bank is set to unveil new norms that will force new foreign banks entering the country to form separately capitalized local subsidiaries, instead of simply setting up branches of the parent bank. Existing foreign players will be encouraged to make the same switch.

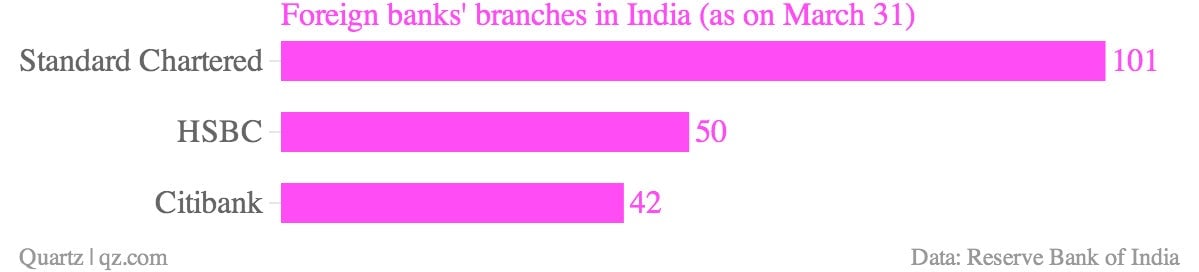

The move stems from the aftermath of the 2008 financial crisis, when international banks shrank their India operations. Over 40 foreign banks operate in India, and all of them, including Standard Chartered and Citigroup, operate as branches, leaving them exposed to the weaknesses of the parent company. In a 2011 discussion paper the central bank laid out its rationale for favoring subsidiaries over branches.

“It is generally understood that with a branch it may be difficult to determine the assets that would be available in the event of the bank’s failure to satisfy local creditors’ claims, and the local liabilities that can be attributed to the branch.”

The regulator also believes the move will level the playing field for foreign banks and make it easier to protect the interests of Indian depositors in a crisis. ”It is easier to define the jurisdiction whose laws would apply to the subsidiary, thereby affording more effective control to regulators in a crisis situation,” reasoned central bank governor D Subbarao. Under the proposed norms, wholly-owned subsidiaries would have a separate board of directors and an asset-liability book, thus ring-fencing their operations in India from the parent banks’ balance sheets.

However, the new rules also come at a time when foreign banks are soon to be forced to lend more to poorer Indians. All foreign banks with more than 20 branches will have to lend 40% to “priority sectors“—farmers, micro and small enterprises, and low-cost housing.

But Ashvin Parekh, senior advisor at Ernst and Young, believes the concerns about the new regulatory regime are overblown. “Subsidiary companies will be treated almost like domestic banks,” he says. Currently, India allows foreign banks to cumulatively open just 12 branches a year, while domestic banks are set to open over 8,000 branches this year. ”Any bank that looks at India from a long-term perspective, this route is a very welcome one,” says Parekh.