The “bull market in everything” should worry investors

All good things must come to an end and Goldman Sachs wants investors to remember that message. Right now, record-high stock markets, low interest rates, and high demand for credit are making it a pretty comfortable time to be an investor in almost anything. A balanced portfolio of US stocks and bonds—a 60:40 ratio—hasn’t had a 10% decline since the financial crisis in 2009, making it the longest bull market for a balanced portfolio since the 1920s, analysts at the bank wrote in a recent note.

All good things must come to an end and Goldman Sachs wants investors to remember that message. Right now, record-high stock markets, low interest rates, and high demand for credit are making it a pretty comfortable time to be an investor in almost anything. A balanced portfolio of US stocks and bonds—a 60:40 ratio—hasn’t had a 10% decline since the financial crisis in 2009, making it the longest bull market for a balanced portfolio since the 1920s, analysts at the bank wrote in a recent note.

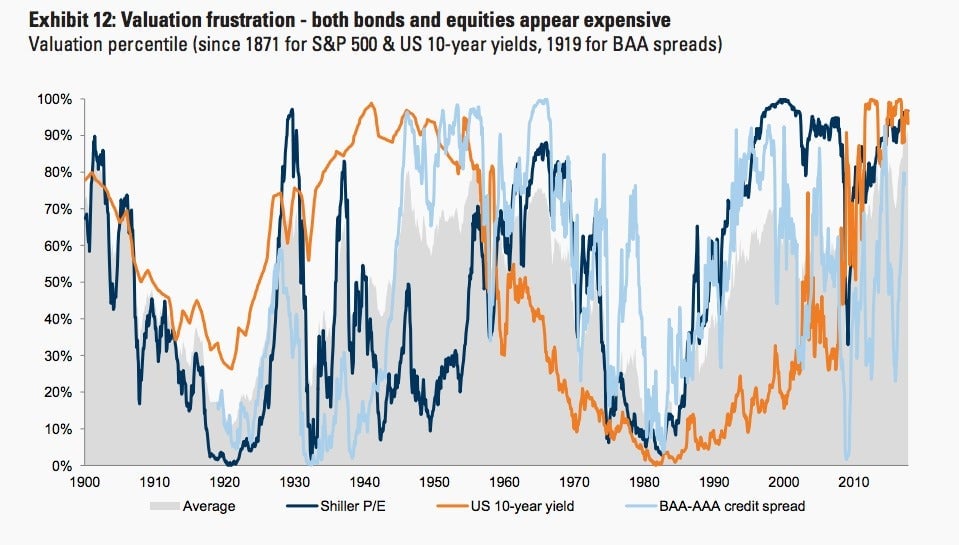

However, this “bull market in everything,” fueled by relatively strong economic growth and low inflation, has resulted in “valuation frustration,” in which assets are so historically expensive the potential for future returns is reduced, strategists at Goldman Sachs said. A measure of the average valuation across US stocks, bonds and credit is the highest since 1900. The only other times that all three asset classes have been similarly expensive at the same time is in the 1920s and 1950s.

And this presents a problem for investors. “After a balanced bull there will be a bear market, eventually,” the reports authors wrote. Firstly, because valuations this high mean there is less of a buffer to absorb any market shocks, increasing the risk of a downturn. Also, with asset classes acting in tandem, there are fewer opportunities to diversify and boost returns.

What’s likely to follow, according to the analysts at Goldman Sachs, is a period of low returns. However, if US growth slows and inflation rises quickly as the market has to adjust to the unwinding of the central bank’s massive bond-buying program, there could be a bear market.

For now though, there’s still the possibility that earnings and productivity growth accelerate, and returns on a balanced portfolio could get even stronger. Still, looking further into the future, Goldman warns that high valuations with be a “speed limit” on returns.