Carl Icahn’s tweets on Apple may just be the beginning of a long campaign

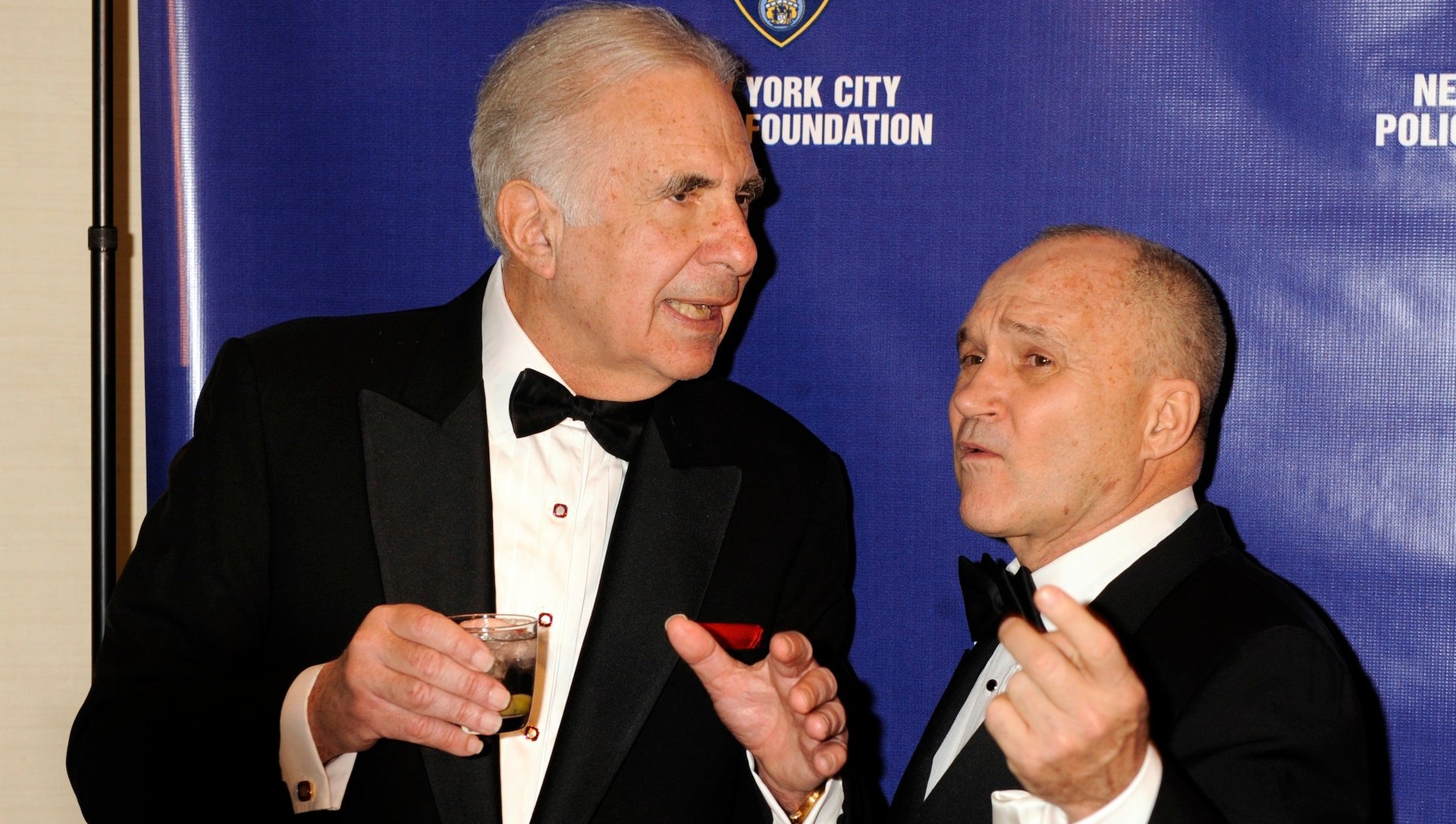

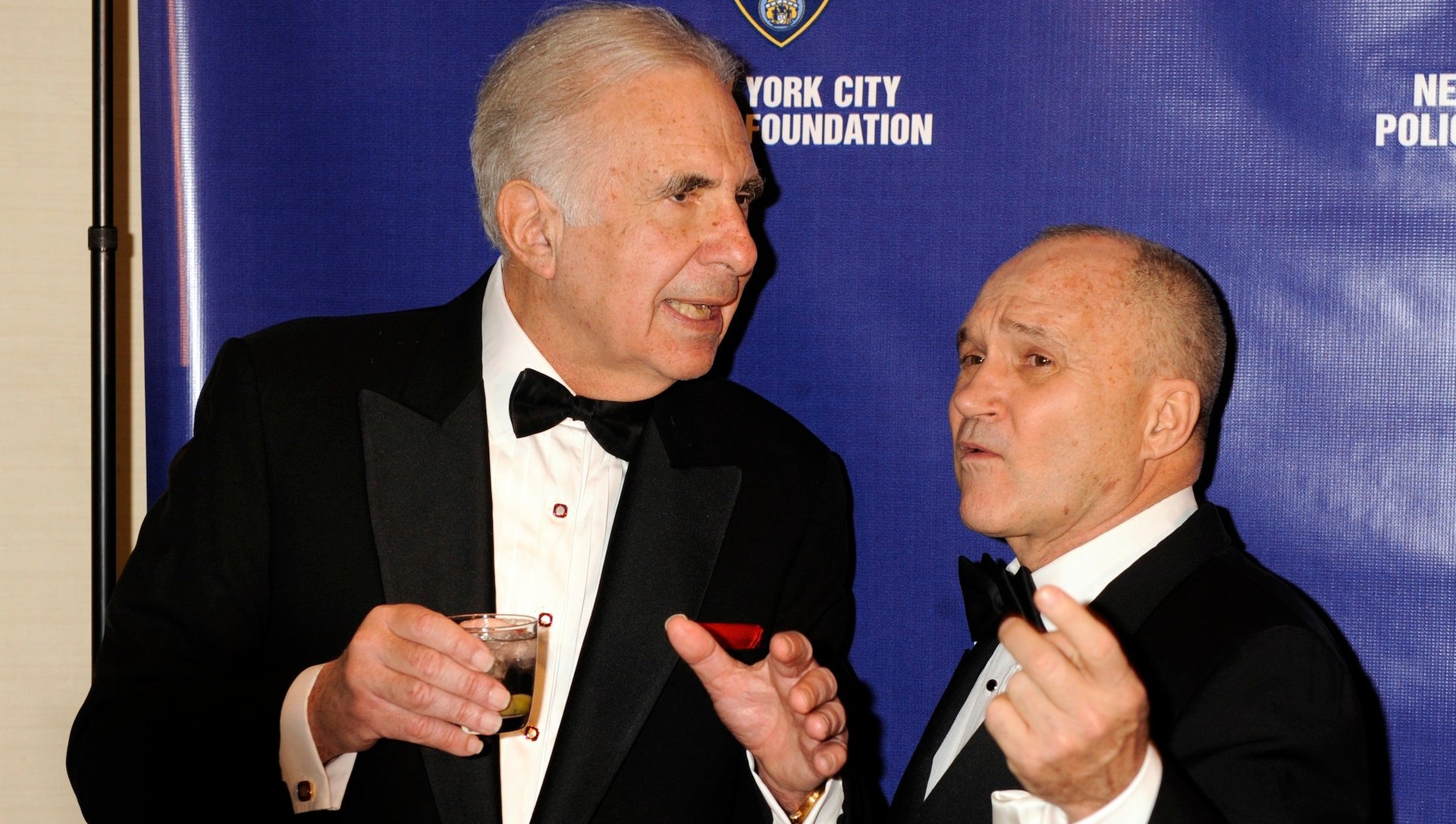

It didn’t take long for activist investor Carl Icahn to find his next target—and this time, it’s a big one. He announced today on Twitter that he had taken a “large position” in Apple, saying it was “extremely undervalued” and the company should implement a larger buyback of its shares. As of this writing, the news had pushed Apple’s shares up by some 5%.

It didn’t take long for activist investor Carl Icahn to find his next target—and this time, it’s a big one. He announced today on Twitter that he had taken a “large position” in Apple, saying it was “extremely undervalued” and the company should implement a larger buyback of its shares. As of this writing, the news had pushed Apple’s shares up by some 5%.

He also said he had a “nice conversation” with Apple CEO Tim Cook today and would be talking to him again shortly. Apple said in a statement that it appreciates “the interest and investment of all our shareholders. Tim had a very positive conversation with Mr. Icahn today.”

Apple already increased its share buyback program by $50 billion in April to a total of $60 billion. That move came after pressure from another activist investor, David Einhorn, who publicly pushed for Apple to give back some of its huge cash pile back to investors. Including a dividend increase, Apple planned to return about $100 billion to shareholders over three years.

When Einhorn was making his push, Apple’s cash pile totaled about $137 billion. In Apple’s last earnings release last month, the company reported that it had added $10 billion more to its coffers, a figure Icahn likely noticed. Apple consistently generates a large amount of cash and Icahn seems to think the company can afford to give even more of it to its investors. Doing that would make publicly traded shares more scarce and push up the share price—hence Icahn’s interest in buying some.

It’s unclear whether Apple will follow Icahn’s prompting, but it has shown that, unlike the days when the late Steve Jobs was running the company, it does now listen to investors. And Icahn has shown how annoyingly persistent he can be—take his opposition to the buyout of PC maker Dell by CEO Michael Dell, a situation about which Icahn has also tweeted.

Icahn’s tweets on Apple may seem friendly. But they are likely just the beginning of a very public, and, if the company wants to fight it, a very long campaign.