Four reasons why even more pain is coming to emerging markets

The minutes of the US Federal Reserve’s July meeting confirmed the worst fears of emerging markets: Easy money in the US could start drying up as early as next month. That would make US debt more enticing to investors again after years of record-low interest rates. The ripple effects were felt across the globe. The Indian rupee and Turkish lira set fresh record lows; currencies of Malaysia and Thailand tested multi-year lows; and other markets across Asia fell, including Indonesia’s benchmark index, which is now officially in bear market territory. But there may be more pain in store for emerging markets. Here’s why:

The minutes of the US Federal Reserve’s July meeting confirmed the worst fears of emerging markets: Easy money in the US could start drying up as early as next month. That would make US debt more enticing to investors again after years of record-low interest rates. The ripple effects were felt across the globe. The Indian rupee and Turkish lira set fresh record lows; currencies of Malaysia and Thailand tested multi-year lows; and other markets across Asia fell, including Indonesia’s benchmark index, which is now officially in bear market territory. But there may be more pain in store for emerging markets. Here’s why:

1. Emerging-market debt isn’t selling

Emerging economies have been slowing down for a while, but foreign capital has been supporting them. The tide is now turning. June was the slowest month for emerging-market bond sales since December 2008. Companies and governments have issued just $42.4 billion of debt since the beginning of June, compared to $95.1 billion over a similar period last year, according to data cited by the FT (paywall).

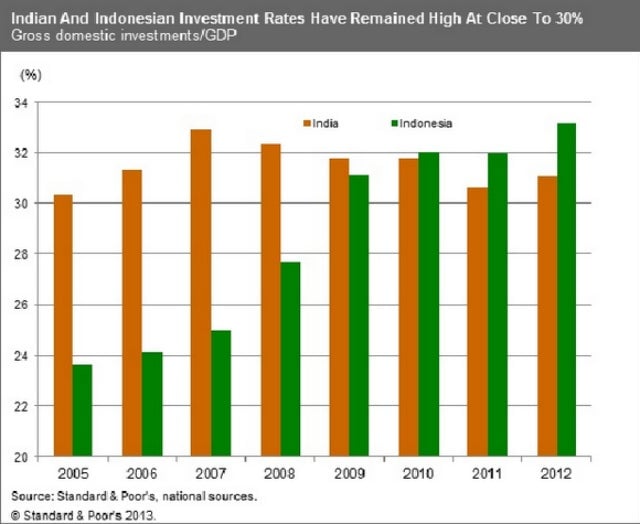

2. This puts a squeeze on investment

All that foreign money was helping finance projects in emerging economies. Now they face higher financing costs and bigger currency swings, warns Moody’s (pdf). The ratings agency warns that the slowdown will be especially tough in the medium term for countries like India and Indonesia, which rely heavily on cheap dollars to fund large current-account deficits.

3. A lot more money could still leave

Over the last decade, investors have pumped trillions of dollars into emerging markets. So far, they’ve pulled out only a fraction. In the three months that ended in July, funds that invest in emerging-market stocks saw outflows of $8 billion—less than 2% of the money they manage. Funds that buy dollar debt from emerging markets saw a similar picture, losing just $1 billion this year out of $124 billion. But as emerging markets keep slowing down and developed markets recover, more foreign investors could head for the exits.

4. Central bank reserves are shrinking

As foreign capital leaves emerging markets, their currencies lose value, and central banks have been forced to spend more foreign currency to prop them up. That’s putting their foreign-currency reserves under strain. In June, reserves began to shrink in all the world’s emerging-market regions for the first time in four years, according to Morgan Stanley (pdf):

In the last three months, emerging-market central banks have lost $81 billion of reserves (paywall), with Indonesia, Turkey, Ukraine, and India leading the way.