Disasters cost a mere $56 billion in the first half of 2013 but the worst may be yet to come

The good news: Global economic losses from climate-related disasters totaled only $56 billion in the first half of 2013, down 16% from the same time last year. The bad news: The North Atlantic hurricane season is just kicking into high gear.

The good news: Global economic losses from climate-related disasters totaled only $56 billion in the first half of 2013, down 16% from the same time last year. The bad news: The North Atlantic hurricane season is just kicking into high gear.

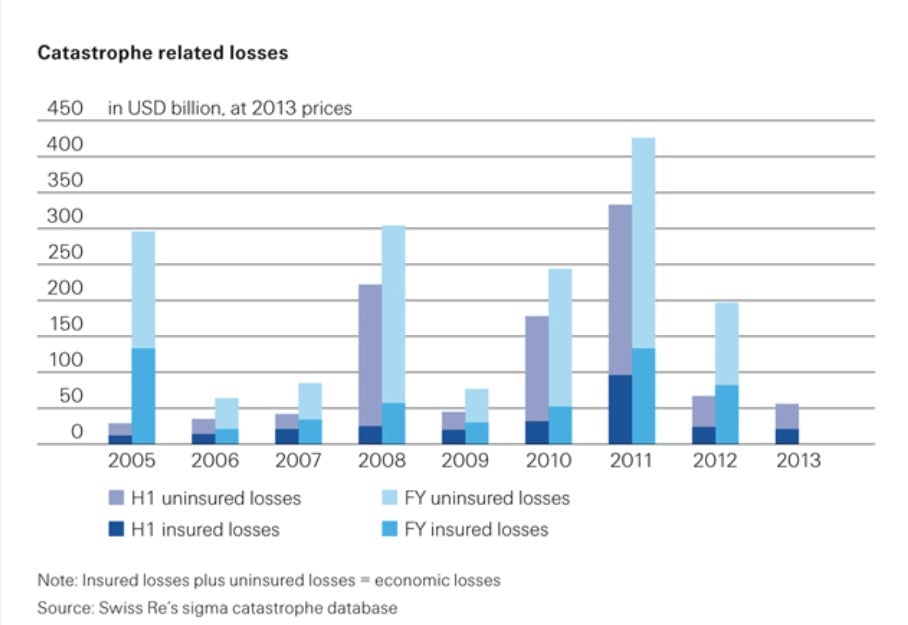

Worldwide, flooding caused the bulk of the insurance industry’s $20 billion in covered losses in the first half of this year, leaving individuals and companies on the hook for the remaining $36 billion, according to a report from insurer Swiss Re. “As a result, 2013 is already the second most expensive calendar year in terms of insured flood losses,” the report stated.

Few areas of the globe were spared from flooding that took 7,000 lives between January and June. Torrential rains led to $18 billion in economic losses in central and eastern Europe in June, while that same month flooding in Alberta, Canada cost $4 billion. Flooding in the wake of Cyclone Oswald, which hit Australia in January, racked up a $2 billion bill. Heavy rains and resulting floods also affected Africa, Argentina, Indonesia and India.

In the US, the massive tornado that swept through Moore, Oklahoma, caused $1.8 billion in insured losses. Between March and May, tornadoes and other severe storms led to a total economic loss of $6.7 billion in the US, according to Swiss Re. Insurance covered $4.5 billion of those losses, but the industry covered only $4.1 billion of the $18 billion in losses from European flooding.

Tornado season is over in the US, so the wild card for the remainder of 2013 is the severity of any hurricanes that develop over the remaining months of the year. Swiss Re’s chief economist, Kurt Karl, warned against becoming complacent. “Though 2013 has so far been a below-average loss year, the severity of the ongoing North Atlantic hurricane season, and other disasters such as winter storms in Europe, could still increase insured losses for 2013 substantially,” he said in a statement.