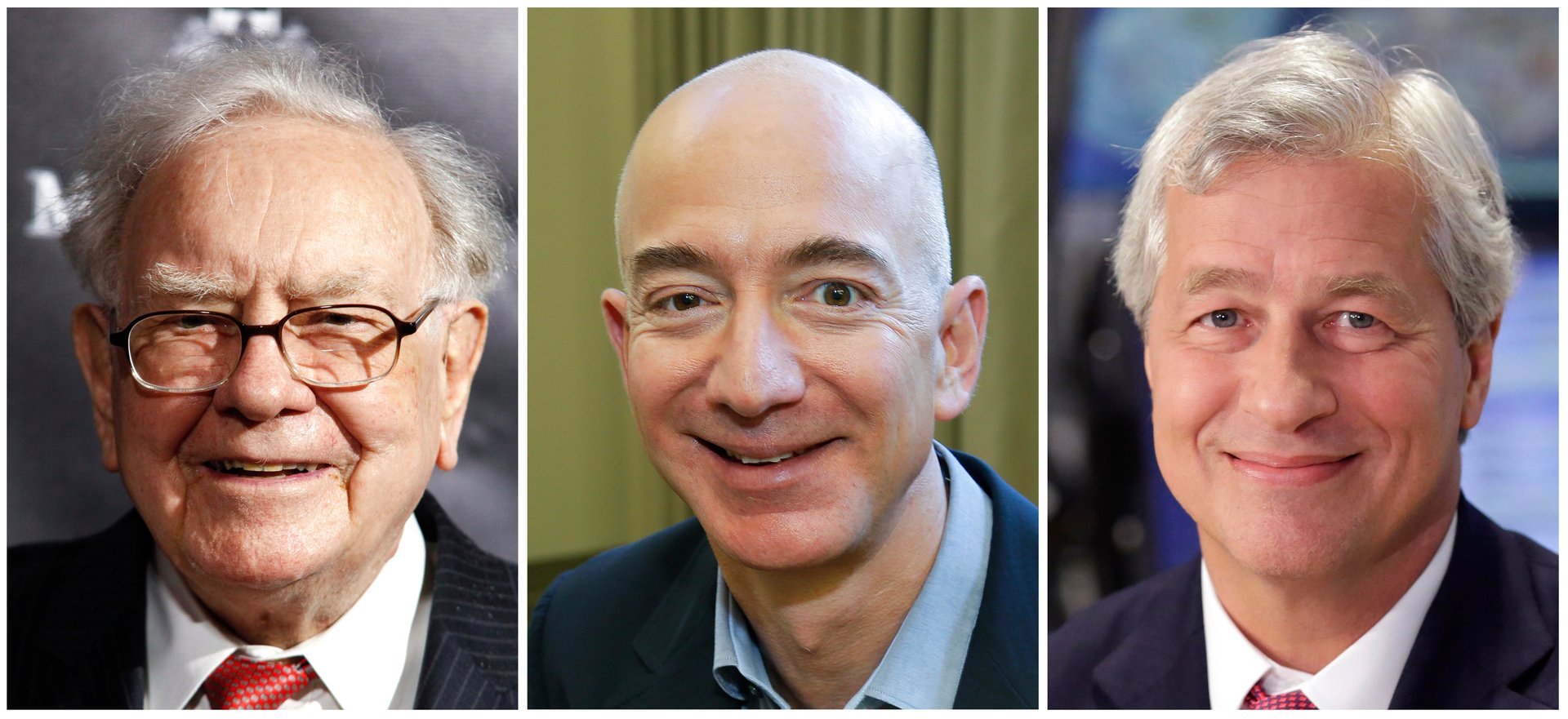

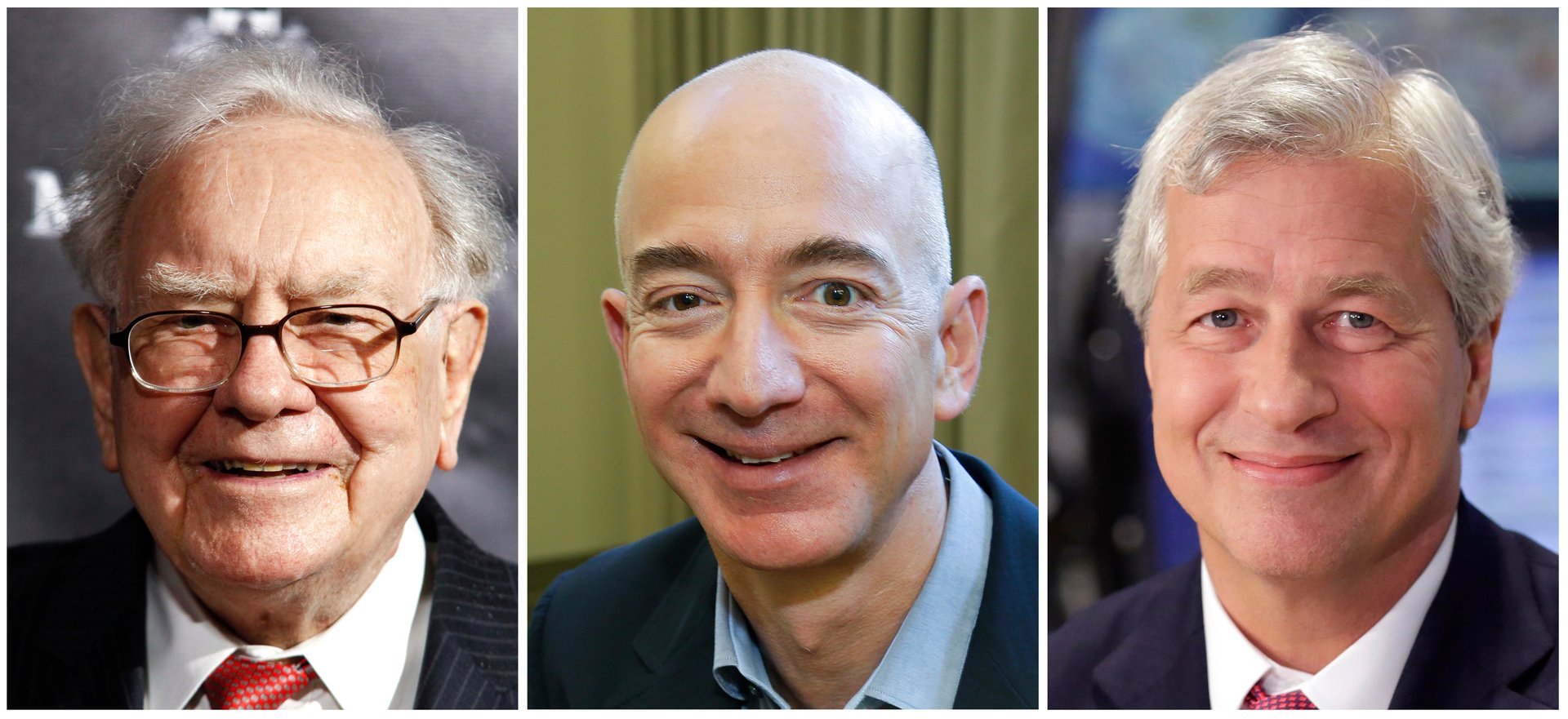

Amazon, JP Morgan, and Berkshire Hathaway are starting a health-care company

Three of the biggest corporations in the world don’t think health care should be a business. Amazon, JP Morgan, and Berkshire Hathaway are starting a health-care company that is “free from profit-making incentives and constraints,” sending US health insurance and pharmacy stocks plummeting.

Three of the biggest corporations in the world don’t think health care should be a business. Amazon, JP Morgan, and Berkshire Hathaway are starting a health-care company that is “free from profit-making incentives and constraints,” sending US health insurance and pharmacy stocks plummeting.

The venture, which doesn’t yet have a name and is still in the early planning stages, will initially be focused on “technology solutions” that will provide “simplified, high-quality and transparent healthcare at a reasonable cost” to the combined 1.2 million employees of the three participating companies.

Investors clearly see a big threat to the massive, bloated US healthcare sector, which spends much more per citizen than any other country in the world, for demonstrably worse health outcomes. Shares of health insurers Anthem, UnitedHealth, Cigna, and Aetna were each down at least 5% in premarket trading, along with pharmacy benefit managers like CVS and Express Scripts.

The boldface name effect is a big factor: Amazon is the biggest US retailer, JP Morgan is the biggest bank, and Berkshire Hathaway one of the most admired conglomerates. The vow to forsake profits is also striking when coming from three of corporate America’s best-known executives, overseeing companies with a combined market capitalization of $1.6 trillion.

Buffett called the “ballooning costs of health care” a “hungry tapeworm on the American economy.” Bezos said success would require “a beginner’s mind.”