This chart claims to show that higher hedge fund fees are a good thing—but actually proves the opposite

Is investing your money with hedge funds worth the expense? And should you pay more to invest with the ones that are? Those are the questions many money managers have been struggling with during the last few years, as hedge fund performance has soured.

Is investing your money with hedge funds worth the expense? And should you pay more to invest with the ones that are? Those are the questions many money managers have been struggling with during the last few years, as hedge fund performance has soured.

According to Goldman Sachs, the average hedge fund was up 4% year-to-date through mid-August, while the S&P 500 index was up 20%. Responding to disappointment, some funds have been cutting fees from the typical 2% in fixed management they charge on all the money an investor has invested and the 20% cut they take from the money’s performance.

But lest institutional investors rethink the hefty fees eating up client money, research firm Preqin is here to assure them that no, you really do get what you pay for. Seriously!

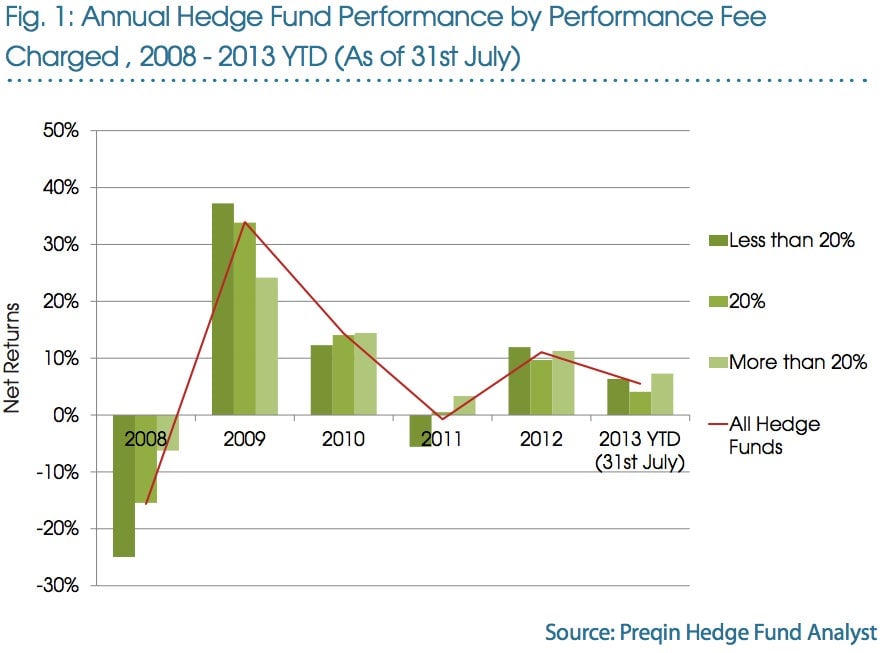

In a press release (pdf) published yesterday titled, “Hedge Funds With Highest Performance Fees Deliver Best Net Returns,” Preqin explains that funds charging more than the 20% performance fee typically offer the best returns for investors. Ergo, giving away a greater portion of the earnings on your money means that you must be better off!

Unfortunately for Preqin—whose clients include hedge funds—the actual data (pdf) from which it draws doesn’t totally support that conclusion.

In the last two years, funds charging less than 20% did better (2012) or very nearly as well (2013 YTD) as those charging even higher fees. In the chart above, “net returns” show performance net of fees. What’s more, the funds charging the typical 20% have underperformed in both years. Not to mention that the S&P 500 Index—the one you don’t have to pay performance fees to own—has outperformed funds with all levels of fees in those two years. While the most expensive hedge funds did somewhat better than the others in 2008, 2010, and 2011, the cheapest ones were far and away the best in 2009.

The report goes on to explain that hedge funds charging the highest fees are less volatile and post slightly higher returns when measured on an annualized basis over three or five years, even net of fees, which is a fair point—if you’re set on investing in a hedge fund at all.

And if the last three years are any indication, you shouldn’t be. The three-year annualized return on hedge funds with fees over 20% was 10.73% after fees are factored out. The annualized return on the SPDR S&P 500 Index—an exchange-traded fund that tracks the S&P 500 Index and charges a management fee of less than 0.1%—for the last three years was 17.83%. Indeed, the last year hedge funds of any sort beat the S&P 500 by any significant margin was in 2009. There are other drawbacks for investors: hedge funds often make it difficult for them to get their money out when they want. ETFs—which trade like normal stocks on exchanges—don’t.

The long and the short of it is that reports like this can claim that higher fees “are justified for managers achieving consistent net returns over the longer term,” as Preqin analyst Selina Sy puts it in the full report [emphasis ours]. But the Preqin data don’t support that correlation. Some funds may be beating their hedge fund peers—but in aggregate, the industry’s performance is embarrassingly poor.