The three charts showing why Nvidia is booming

Shares of Nvidia, the computer graphics chipmaker, rose nearly 100% last year, making it one of the biggest gainers on the Nasdaq in 2017. The reason isn’t a mystery: Nvidia is a first-mover in technology that’s fundamental to three thriving industries.

Shares of Nvidia, the computer graphics chipmaker, rose nearly 100% last year, making it one of the biggest gainers on the Nasdaq in 2017. The reason isn’t a mystery: Nvidia is a first-mover in technology that’s fundamental to three thriving industries.

Bitcoin’s ridiculous rise

If you haven’t heard already, bitcoin’s value skyrocketed from under $1,000 at the start of 2017 to almost $20,000 in December. To create bitcoin, a computer has to solve complex mathematical problems, and problems have become so dense that “miners” are running massive server farms for the promise of generating new valuable coins. Some of the most common chips miners use are made by Nvidia. Miners are even renting jumbo jets to ship the chips to them.

Nvidia said on its earnings call Feb. 8 that direct sales of bitcoin-mining chip setups accounted for a tiny portion of its quarterly revenue. But that ignores two things: First, Wall Street’s irrational focus on any company that’s part of a hot trend, and second, the fact that miners are buying chips meant for gaming computers. It’s entirely possible that much of Nvidia’s cryptocurrency-related revenue is hidden within the figure it reports for gaming-chip sales.

The artificial intelligence boom

Nvidia foresaw the artificial intelligence boom in 2005 and built software that allowed its GPUs to run the millions of tiny computations required by modern AI. That bet has paid off in the last four years, as illustrated by the company’s 524% increase in revenue for data center-optimized chips. Companies like Amazon, Microsoft, Google, and to some extent IBM, have expanded their data centers for AI services to serve their own customers as well as customers of their cloud services.

Analysts watch Nvidia’s database growth closely, trying to determine if it will continue as AI applications increase. Like cryptocurrency mining, many independent AI researchers and institutions may be buying graphics cards meant for gaming and using them to run AI algorithms. (Quartz uses two such GPUs for machine learning.)

Gaming growth

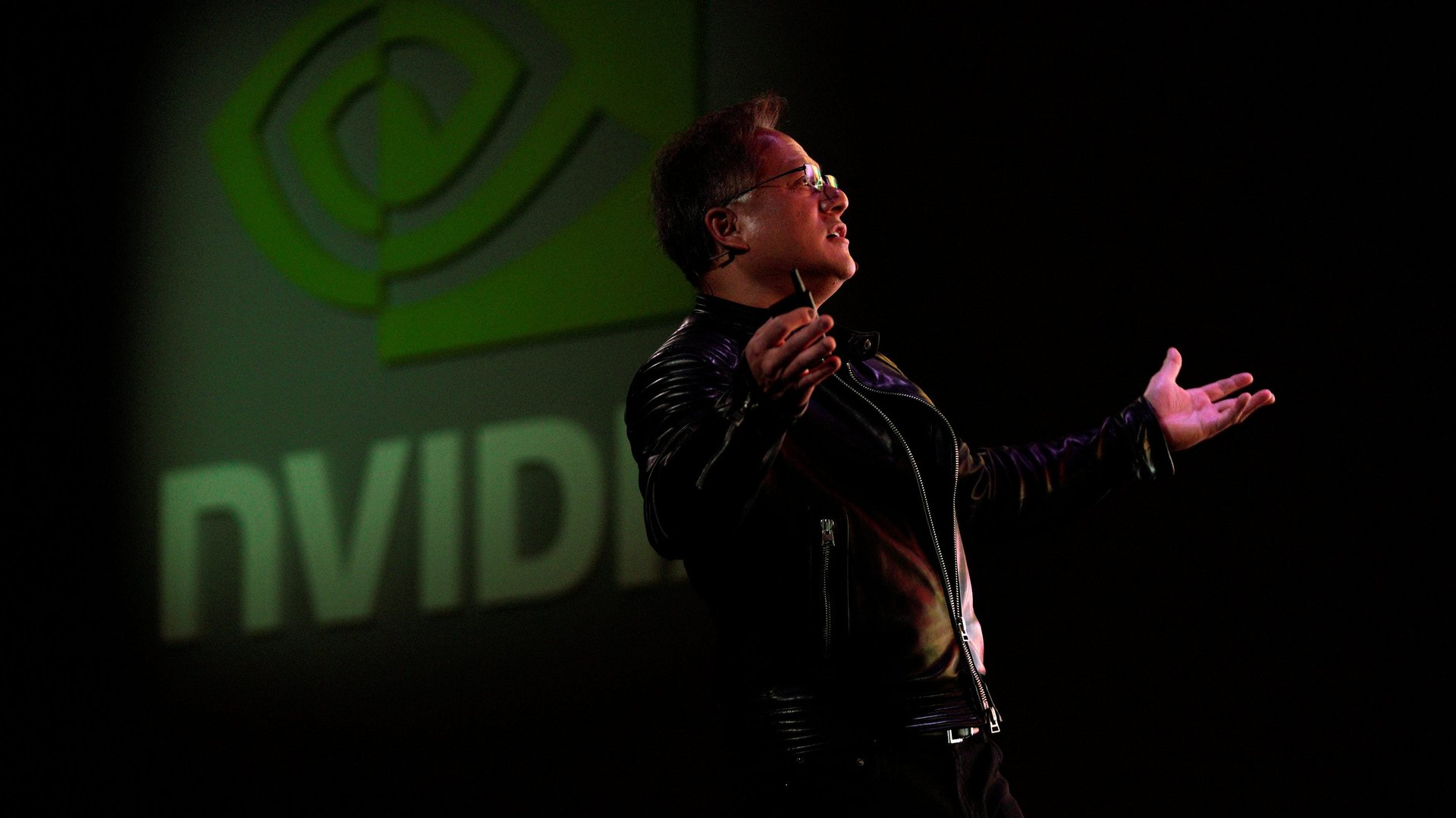

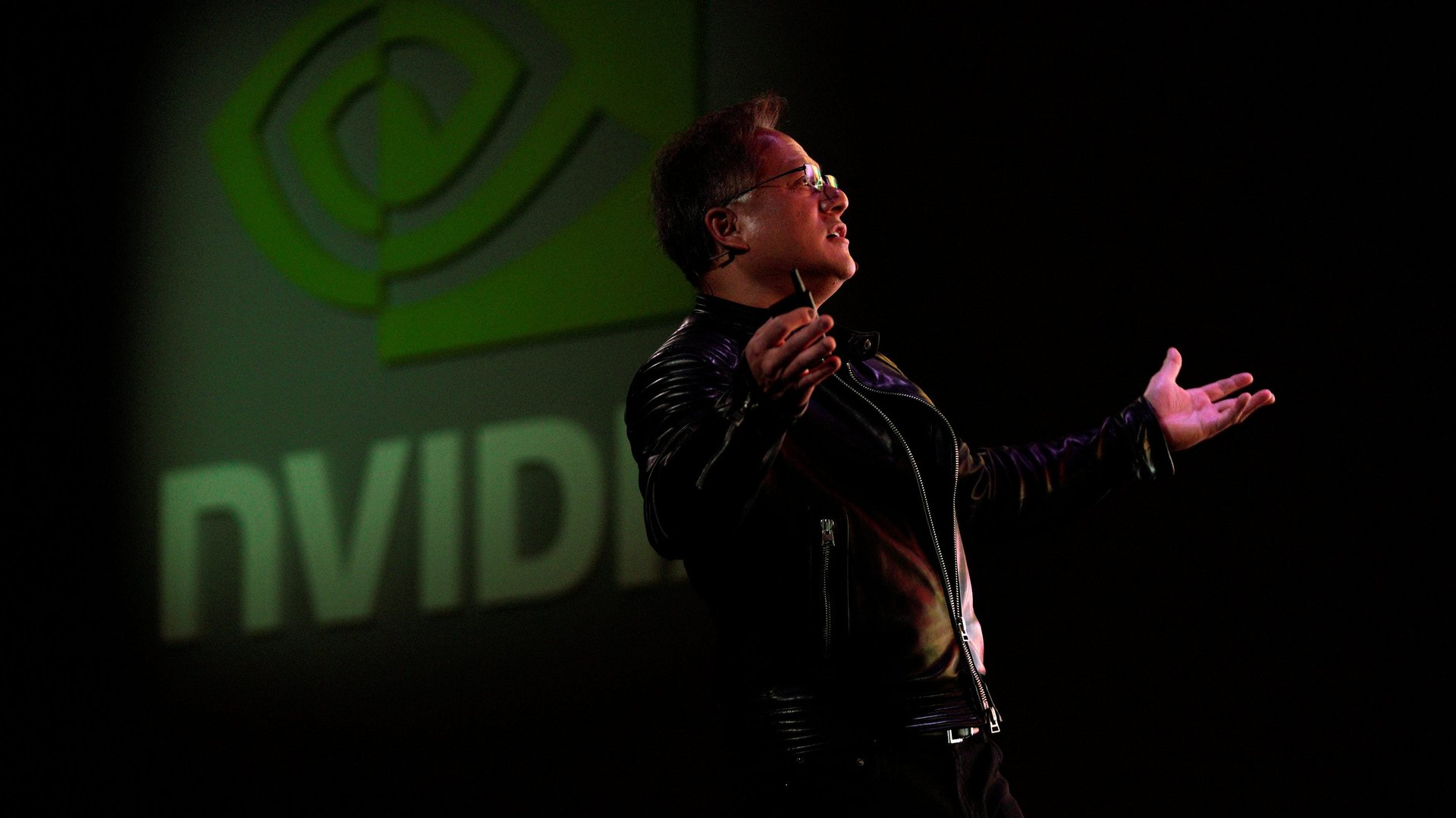

Gaming is cool again—or at least it’s making a lot of money. While Nvidia CEO Jensen Huang talks about the utopian GPU-powered future of self-driving cars and robots, it’s sometimes easy to forget that Nvidia makes most of its money selling computer parts for gaming.

As computer gaming becomes more mainstream, more people are buying graphics cards to make games run well. The top five most-streamed games were broadcast on the Twitch platform for more than 233 million hours in December 2017, according to NewZoo.

PwC projects that gaming will grow by 5% annually, generating some $90.1 billion in revenue by 2020. Even if bitcoin goes busts and we see another AI winter, at least Nvidia’s core business will remain intact.