Why a slight revision to China’s 2012 growth is more than meets the eye

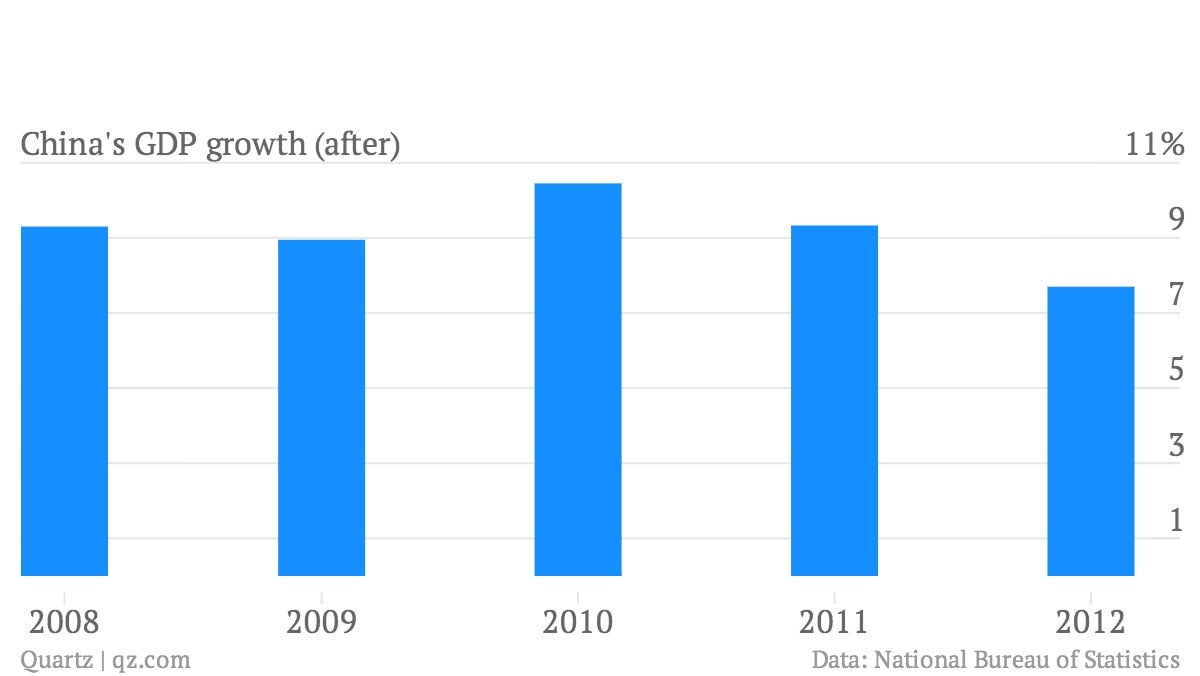

China’s National Bureau of Statistics just revised its 2012 GDP calculations, shaving 38 billion yuan ($6.2 billion)—an amount just about equal to Kyrgyzstan’s entire economy—off last year’s output. That means last year’s GDP grew only 7.7% from 2011, compared with the original calculation of 7.8%. (That still means China hit the government’s 7.5% 2012 GDP growth target, though.) Here’s how that looks:

China’s National Bureau of Statistics just revised its 2012 GDP calculations, shaving 38 billion yuan ($6.2 billion)—an amount just about equal to Kyrgyzstan’s entire economy—off last year’s output. That means last year’s GDP grew only 7.7% from 2011, compared with the original calculation of 7.8%. (That still means China hit the government’s 7.5% 2012 GDP growth target, though.) Here’s how that looks:

So what does it mean?

There are a couple of things worth noting. First, the NBS always revises its GDP. So this isn’t exactly surprising. Last September, it nudged 2011 GDP growth up to 9.3%, from 9.2%. And the year before that, 2010 GDP was bumped from 10.3% to 10.4% growth. (It also sometimes revises calculations in January, when the final official data is announced.)

A downward revision is unprecedented

Note that these are always upward revisions. The initial calculation tends to understate the final amount, and it usually understates the tertiary, or service, sector. This is often because it takes a while to calculate services, compared with goods.

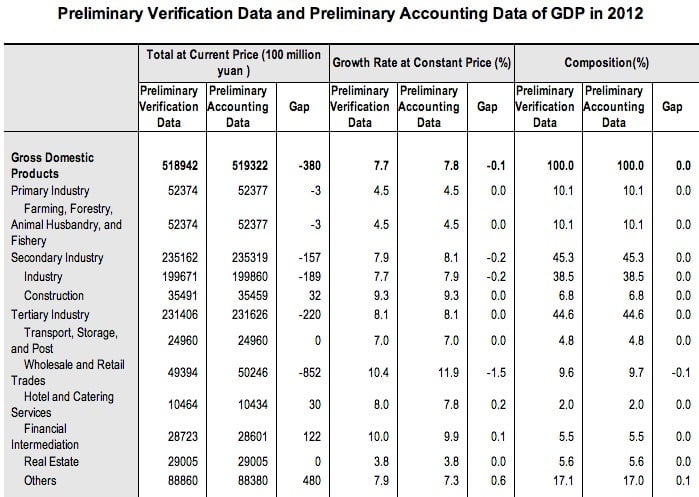

That makes 2012 the first year the NBS revised the year’s GDP downward. It also knocked 22 billion yuan ($3.6 billion) off the initial service sector estimate. Here’s a look:

The service sector is sliding

As you can see, wholesale and retail, which make up around 10% of the economy, came in at 85.2 billion yuan less than originally calculated. These comprise exactly the kind of consumer-focused, job-generating services that China is supposed to be shifting toward, as it weans itself off its addiction to investment-driven growth. That segment is still growing fast—10.4% more than in 2011—but the revision brings it down a lot from the much more heartening 11.9% growth originally calculated. Given that the calculation method usually grossly understates the services sector, this should be a disheartening sign for anyone hailing a “rebalancing” of China’s economy.

The NBS flubbed industrial output, too

Another thing worth noting is that industrial output fell 18.9 billion yuan. That’s a big blow, given that it generates nearly 40% of China’s GDP each year. That happened for the first time last year, with 2011’s GDP. And while it’s impossible to know why the government statisticians initially miscalculated it, the downward revision could indicate that actual output is less than investment in that sector would suggest.

What does this mean for 2013?

Of course, this announcement comes as China’s economic prospects appear to be brightening. Manufacturing activity in August hit a 16-month high. And while Credit Suisse upped its 2013 GDP projections from 7.4% to 7.6%, Deutsche Bank recently boosted its second-half forecast to 7.7%, from 7.6%.

Could a lower 2012 base help China’s 2013 performance look healthier still? Probably not; it’s unlikely that the NBS’s revisions are big enough to make a difference, in relative terms. That said, it’s possible China watchers will see a slowdown from 7.7% to, say, 7.6% as slightly less alarming than from the originally calculated 7.8%. Plus, the NBS can still change the calculation, when it issues its “final verification” in a few months. If the reversals outlined above for 2012 have continued into 2013, this year’s growth may be lower than the statistics now suggest.