Could the US grow as fast as China? Of course it could.

The US still has what founding father Alexander Hamilton called “the adventurous spirit, which distinguishes the commercial character of America.” Hamilton knew that British monopolists feared that spirit 250 years ago and China ought to be fearful of it today. Yet in 2017 we have a president who is cheerleader-in-chief for those who believe America can’t compete, and a Congress that makes it harder, rather than easier, to do so.

The US still has what founding father Alexander Hamilton called “the adventurous spirit, which distinguishes the commercial character of America.” Hamilton knew that British monopolists feared that spirit 250 years ago and China ought to be fearful of it today. Yet in 2017 we have a president who is cheerleader-in-chief for those who believe America can’t compete, and a Congress that makes it harder, rather than easier, to do so.

The question is why China, the world’s second largest economy since 2010, is gaining on us, and why Trumpers are circling the wagons instead of going for first place, the way Hamilton did. Trade, Trump’s culprit-of-record, is just a 10% sliver of the US economy. So, it is not trade policy that is holding America back. No, it’s the country’s austere macro-economic policies that suffocate the whole 100% of our economy. It’s our austere unwillingness to let government spend on things that businesses and the ambitious, job-seeking public need to prosper.

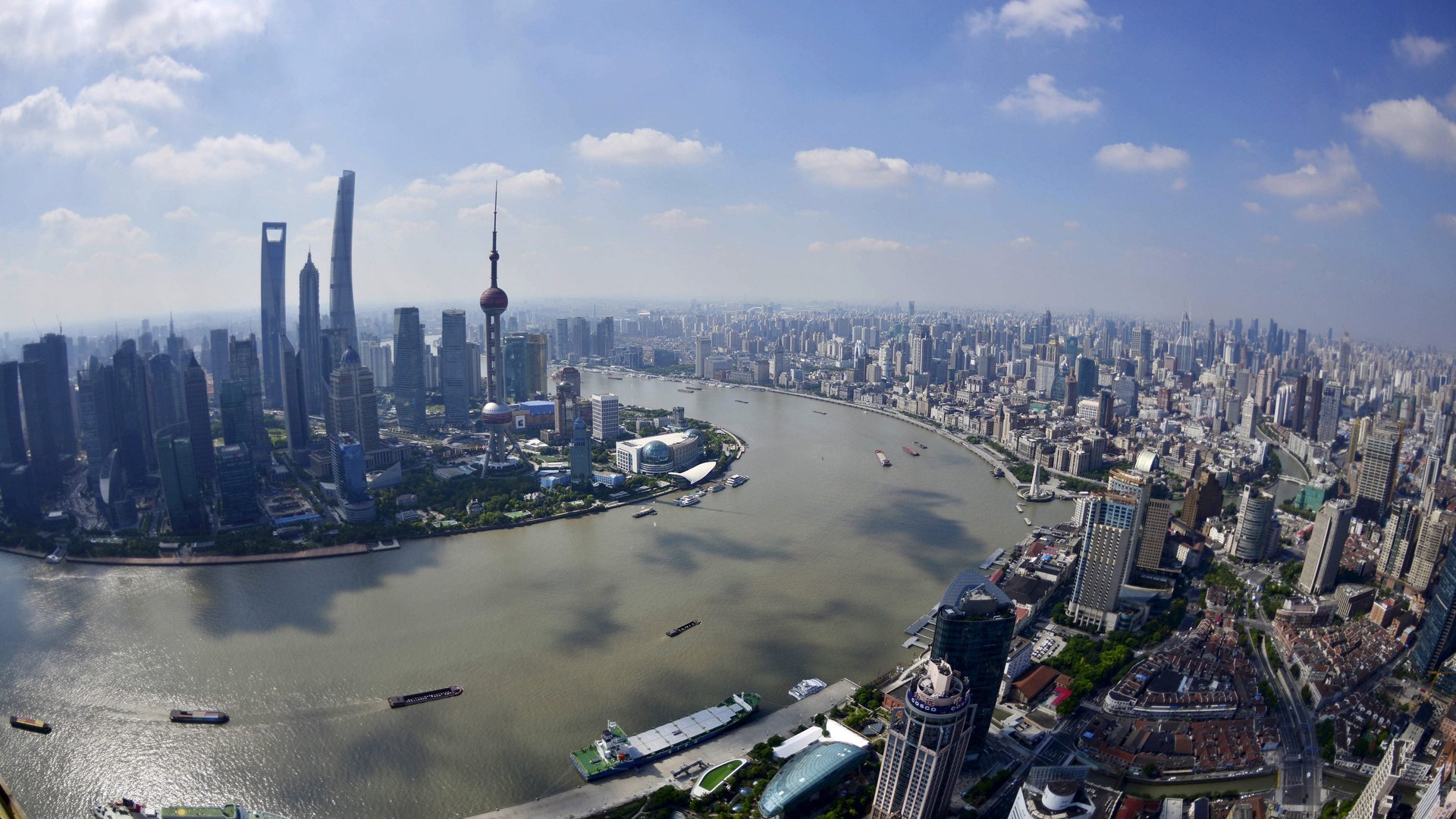

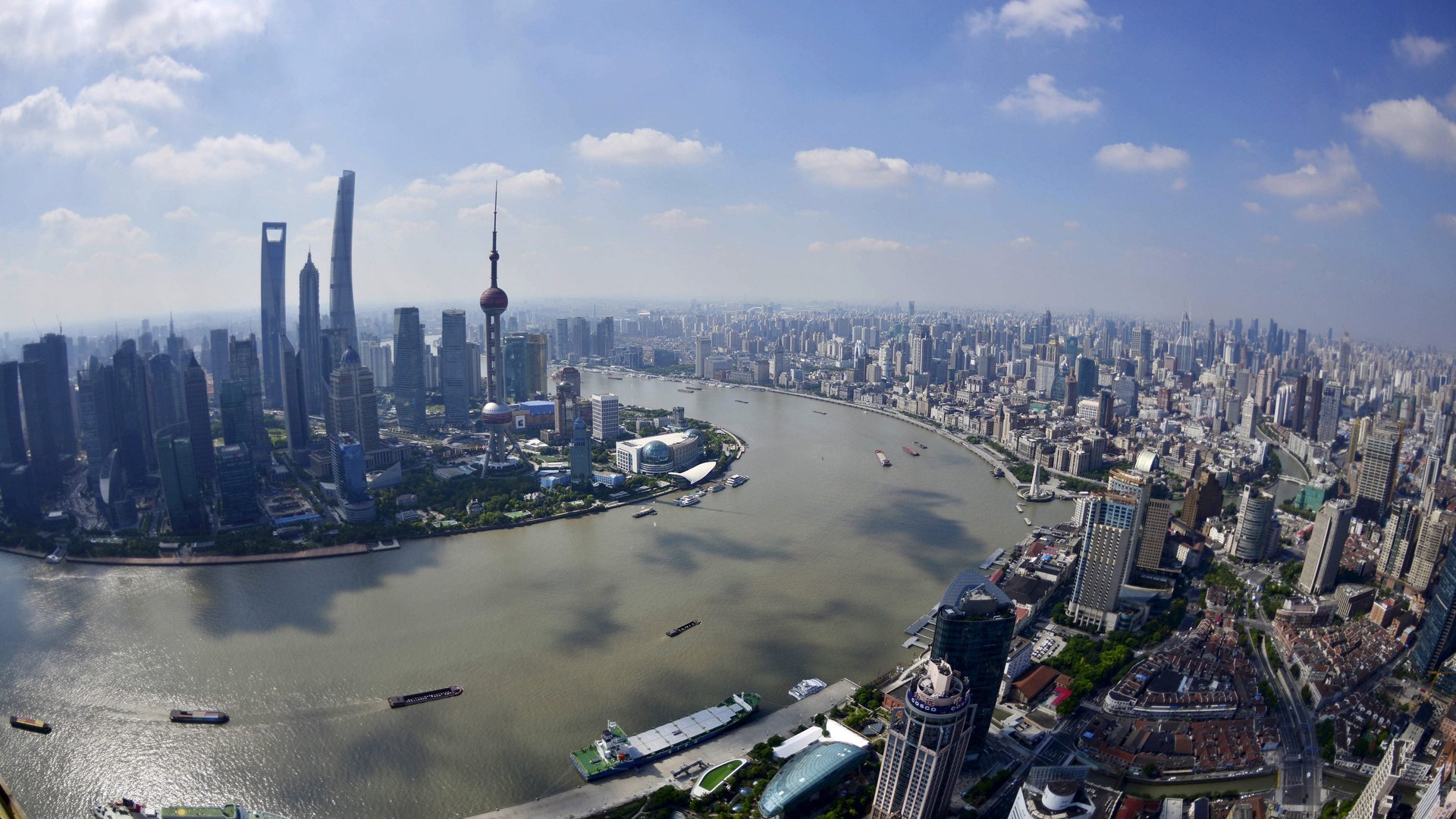

China is gaining on America because its government is not prevented by the astounding economic ignorance of its legislature from spending on modern infrastructure, renewed cities, education, and new scientific centers that produce state-of-the-art public assets. This spending creates jobs for the hundreds of millions of its people moving from rural occupations to its cities. The US’s congressionally imposed austerity policies deprive us of both the new facilities and the jobs.

The US is gripped by a fear of government spending, despite 250 years of history showing that such spending boosts growth and the private sector. If China had legislative know-nothings like America’s, committed to austerity and preventing its government from doing what governments have to do to be successful, that country would be lucky to grow at 2% a year, instead of today’s 6% or 7 percent.

The Chinese government is supporting investment in all kinds of modern assets, while our government’s stinginess holds back our entrepreneurial private sector. Today, for example, Chinese leadership is telling financial institutions to lend money to investors in its hugely ambitious Great Belt and Road Initiative (BRI), a cross-border, multi-country, regional infrastructure program. It seems not to care at all that many of the investments are certain to be unprofitable.

The Chinese government understands as the US Congress does not that high speed intercity and commuter rail, new airports, highways, internet capacity, and even empty high-rises are the foundations of growth, even if they are not profitable. Once, Americans built canals and railroads that were not money makers, but that nevertheless made it a great nation. No more.

The Chinese government is playing to win the future, not to maintain the value of outmoded assets like 50 year old power plants, and steel mills and coal mines opened in the 1960s. China’s aim is to create the world-beating facilities great countries need, the way far-sighted American governments did when Hamilton encouraged the building of light houses to aid commerce and water supply systems for growing cities.

The US economy today is being strangled by small-government ideologues preoccupied by the fear of deficits, taxes, unprofitability, and “waste.” These groundless fears have been hobbling us since the Clinton era of the late 1990s. Those were years of 4% annual GDP growth and 10% annual increases in plant and equipment investment. The failure of the Congress to empower the federal government to help drive the economy since then has been a disaster for businesses and workers.

Unemployment dipped below 4% during Clinton’s last four years. It was still falling in 2000 and there was virtually no inflation. Low unemployment was raising wages and pulling people out of low-wage jobs. Ex-convicts were getting work laying fiber optic cable.

Those eight Clinton years show what the American economy can do. Americans should be watching poor China in the rear-view mirror, but we can’t beat them if anti-government ideologues continue to hang anchors on the US economy.