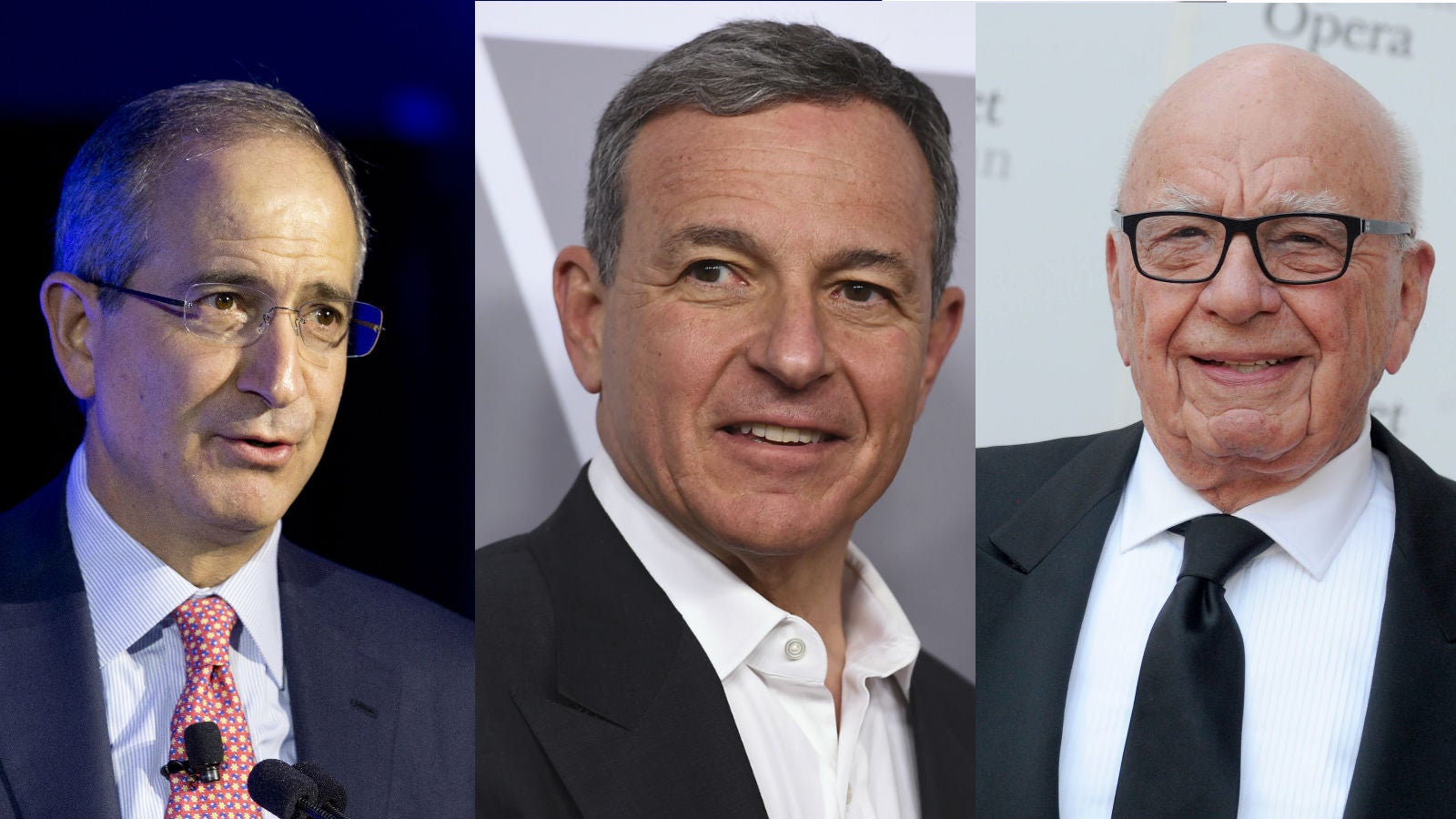

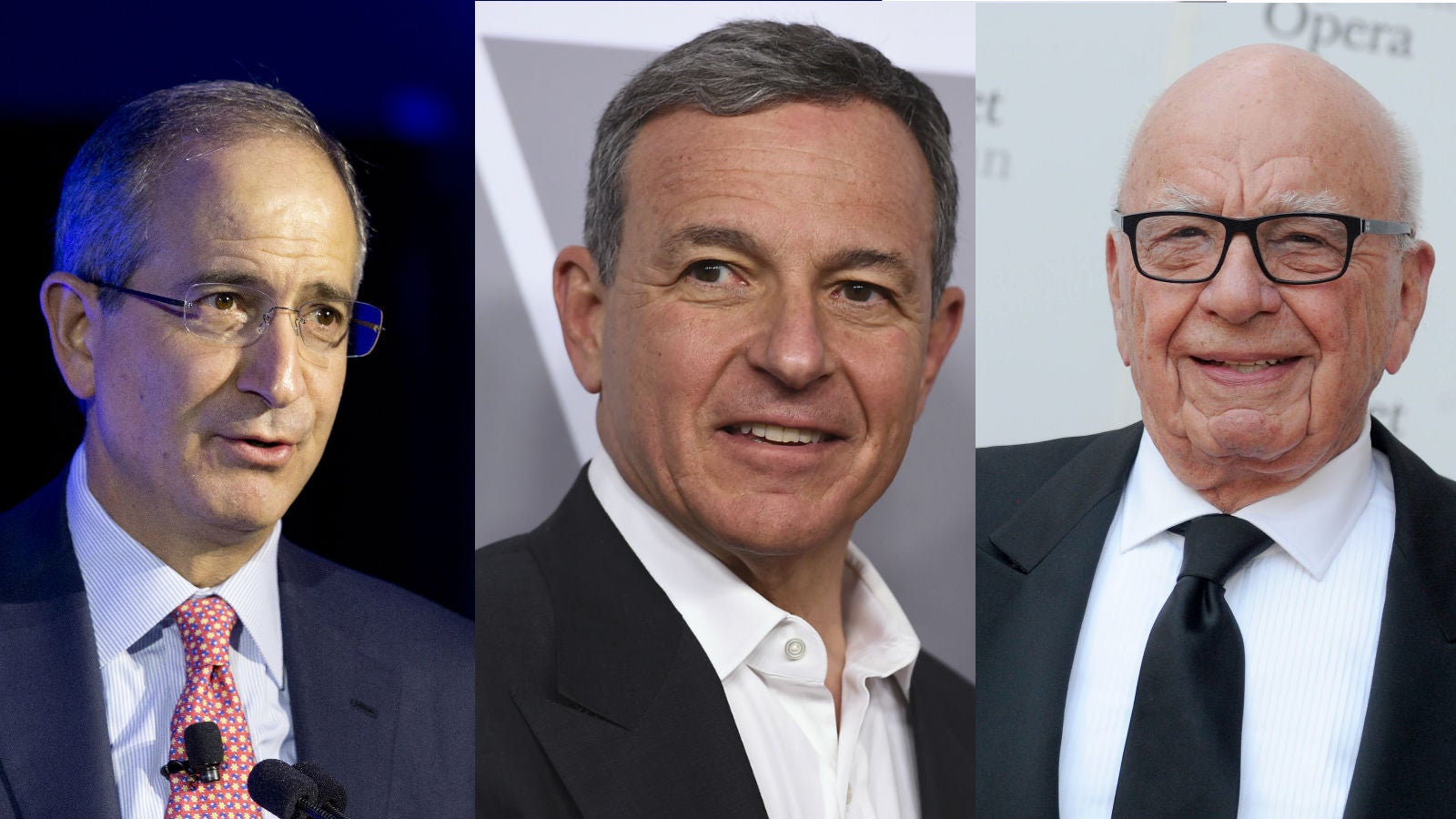

The future of global entertainment is in the hands of these three men

Media mogul Rupert Murdoch, 86, had the future of his empire all secured, agreeing last year to sell 21st Century Fox to Disney’s Bob Iger for $52 billion. Included in the deal was the 39% of European pay-TV giant Sky that Fox owns.

Media mogul Rupert Murdoch, 86, had the future of his empire all secured, agreeing last year to sell 21st Century Fox to Disney’s Bob Iger for $52 billion. Included in the deal was the 39% of European pay-TV giant Sky that Fox owns.

Then Comcast CEO Brian Roberts, 58, decided to stir the global media pot.

The US’s largest pay-TV provider said Feb. 27 that it plans to offer Sky $31 billion for the entire business—a 16% premium over what Fox previously agreed to pay for the remaining 61% of the company in 2016. The offer disrupts the carefully laid plans of Murdoch and Iger, 67, who are now forced to re-evaluate the value of Sky and, potentially, Fox.

The three big media men are trying to secure their standings outside the US, where growth is more dynamic. “You either have to go big or go niche,” said Mary Ann Halford of OC&C Strategy Consultants. “And if you go big, you have to have a lot of assets and there are only so many TV assets in the world. Sky is one of the best.”

Sky, a satellite-TV and broadband provider, has 23 million subscribers in Europe, including the UK, Italy, and Germany. Its Sky Q video platform and behind-the-scenes advertising technology lead the industry. It owns a cable-news network, sports channels with coveted TV rights to English Premiere League soccer, and movie channels, with exclusive deals in Europe with HBO, Showtime, and other premium brands. It also operates streaming video in the UK with Now TV.

In the US, it’s almost impossible to turn on the TV, watch a movie, or even stream Netflix without encountering something created or distributed by Disney, Fox, or Comcast. Fox News, ESPN, Star Wars, Marvel, Jurassic World, The Simpsons, the Olympics and Oscar broadcasts—these companies touch them all. Heck, they distributed half of this year’s Best Picture nominees. Comcast owns the pipes that a third of the country uses to watch TV and surf the internet.

Together, they make up three of the US’s five largest media companies by revenue, generating a combined $168 billion in their last fiscal years.

Movies made by the three companies comprise half of the US box-office—the world’s biggest movie market, with a gross of more than $11 billion last year.

And they own stakes in more than 35 US TV networks, including 12 of the 25 most-watched, such as broadcasters ABC, Fox, and NBC, and cable-TV networks ESPN, Fox News, History, FX, and A&E. Each also has robust TV production capabilities that give them even more reach. NBC’s flagship drama This Is Us, for example, is a Fox production, and the Fox comedy Brooklyn Nine Nine is co-produced by NBCUniversal’s TV studio.

How the Disney-Fox-Comcast game plays out thus has major implications for what consumers watch, as well as the legacy of each man.

Roberts became Comcast CEO in 2002 after his father, the company’s founder, stepped down. He transformed the Pennsylvania-based pay-TV company into a media empire in 2011 with the acquisition of NBCUniversal, and its TV, movie, and theme-park businesses. The company has tried to buy other US pay-TV competitors, such as Time Warner Cable, and been shot down due to anti-trust concerns. Now, Roberts wants Sky.

Meanwhile, Iger, who delayed his retirement for a fourth time to see the Disney-Fox deal through, is trying to set up Disney for its digital future. It’s launching two streaming-videos services over the next two years, and will take control of a third, Hulu, if the merger with Fox goes through (we’ll get back to this). Yet, it’s not a pay-TV business. Sky is, and it’s doing well with its early efforts in the streaming space. There’s a lot Disney could learn from it, while also gaining a foothold in Europe.

Sky was formed by a 1990 merger of Murdoch’s Sky TV and British Satellite Broadcasting, and Murdoch has been trying to acquire full ownership for years. European regulators have been wary of giving Murdoch too much control over local news after the News of the World phone-hacking scandal destroyed any goodwill he had there. Britain’s Competition and Markets Authority said in January that it did not think the Fox takeover of Sky was in the public interest. The regulator’s final decision is due in May.

The calculation of each man gets more complicated when taking into account another asset, Hulu, which has 17 million subscribers and about $1 billion in annual advertising revenue. Formed as a joint venture, Disney, Fox, and Comcast each own 30%. Time Warner’s Turner owns the other 10%. If the Disney-Fox deal goes through, Disney will have a 60% controlling stake.

Comcast has been a silent partner until now because of a condition of its 2011 acquisition of NBCUniversal, but those deal restrictions end in September 2018. It may have its own opinions on what should happen to the service. It could try to force a sale of Hulu, Recode previously reported, or stop selling its content to the service, leaving Disney to fill the void.

Comcast could also use Hulu as a bargaining chip for Sky. Disney has repeatedly said that Hulu is important to its three-prong approached to streaming, which includes separate video services for sports, family programming, and general-audience content. The latter will be on Hulu. Comcast could cut a side deal to let Disney and Fox take control of Hulu, experts say, if it can take control of Sky. Comcast said on a conference call yesterday that it would settle for a 50% plus one share controlling stake in Sky.

In the end, it will come down to who wants what most.