China is missing out on the US economic recovery

August trade data offered another sign that the recovery in China is underway, as exports jumped 7% from August of last year, up from 5.1% this July. Imports also expanded by 7% compared with August 2012, down from solid growth of 10.9% in July. While China’s exports and imports seem to be in sync at the global level, its trade balance with the US tells a different story, says Société Générale’s Wei Yao. In fact, it “looks as if China missed out on the US recovery,” she wrote in a note today.

August trade data offered another sign that the recovery in China is underway, as exports jumped 7% from August of last year, up from 5.1% this July. Imports also expanded by 7% compared with August 2012, down from solid growth of 10.9% in July. While China’s exports and imports seem to be in sync at the global level, its trade balance with the US tells a different story, says Société Générale’s Wei Yao. In fact, it “looks as if China missed out on the US recovery,” she wrote in a note today.

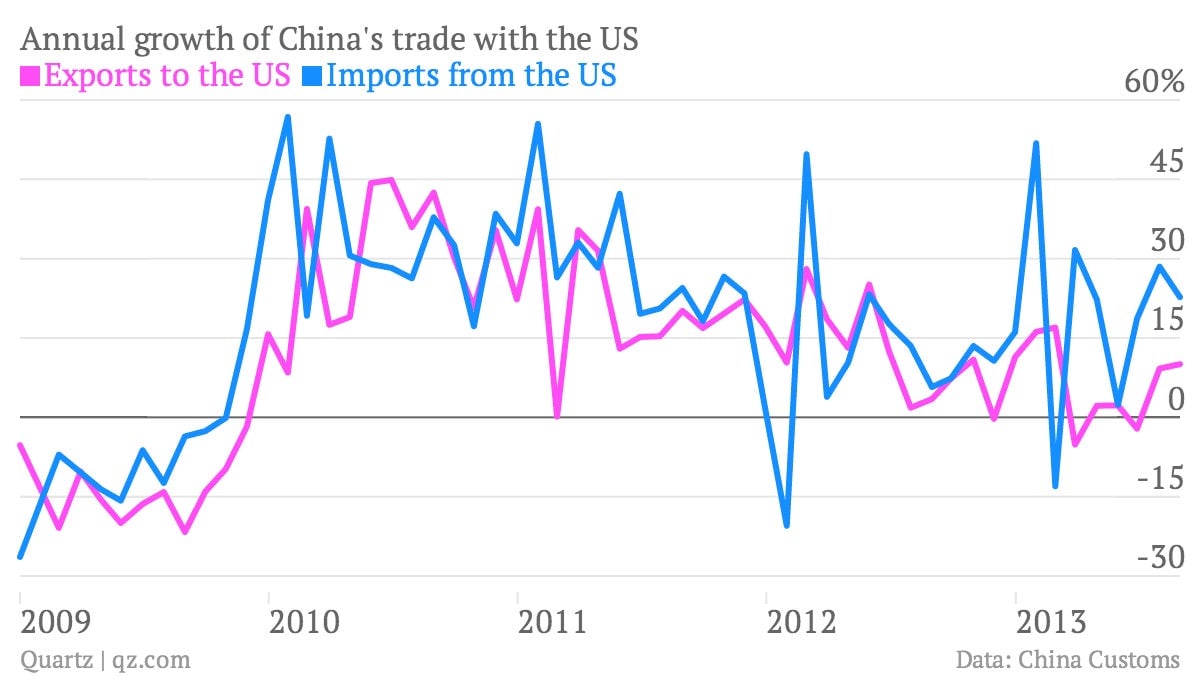

Growth of China’s imports from the US has outpaced that of its exports to the US for 15 months running—the longest streak since China joined the World Trade Organization back in 2002, Yao flagged in a note today. And with a few exceptions, that’s a longstanding trend:

By comparison, growth in China’s global export and import levels tends to be more in line, with exports outpacing imports for big chunks of 2012:

What’s causing China to import more US goods and services, while exporting at a slowing rate? SocGen’s Yao points to “the relocation of low-end manufacturing from China to neighboring emerging countries, as well as the regained competitiveness of the US itself” as two major possibilities.

In the grand scheme of things, this hints at a welcomed shift toward higher domestic consumption in China; growing demand for imports is one sign of China’s economic “rebalancing.” On the other hand, a return to a heavier reliance on exports is the opposite of rebalancing; it entrenches China’s habit of keeping its currency artificially weak, which suppresses consumption. One thing is for sure: China can’t count on the US rebound to buoy its recovery.