Jaguar deigns to offer cheaper cars and SUVs that rival BMW and Mercedes

With its C-X17 sport utility vehicle prototype unveiled at the Frankfurt Auto Show, luxury carmaker Jaguar is breaking with its uppity past to enter the entry-level luxury market.

With its C-X17 sport utility vehicle prototype unveiled at the Frankfurt Auto Show, luxury carmaker Jaguar is breaking with its uppity past to enter the entry-level luxury market.

In recent years, middling luxury car brands have migrated down market, as new wealthy classes in emerging markets have exploded and weak Western economies have squeezed their aspiring high-end consumers. Unlike its German luxury competitors, Jaguar has long resisted modifying its prestige brand to cater to lower-end consumers for fear of alienating loyal elite drivers. That has taken a toll on the carmaker’s sales: Last year, Jaguar sold around 53,000 cars (paywall), while BMW and Mercedes, which boast a much wider price range of models, sold 1.5 million and 1.3 million cars respectively. Lower-end German luxury vehicles have fared especially well in emerging markets.

If Jaguar’s C-X17 concept makes it to production, it will be the carmaker’s first attempt to break into the growing “crossover” market, in which vehicles combine the functionality of SUVs with the comfort and performance of luxury cars. But more importantly, the new aluminum architecture that underpins the C-X17 will be the platform for a series of vehicles that Jaguar hopes will bring its cars into the “accessible price segment.” Owned by India’s Tata Motors since 2008, Jaguar plans to spend $2.4 billion on the new range of mass market vehicles.

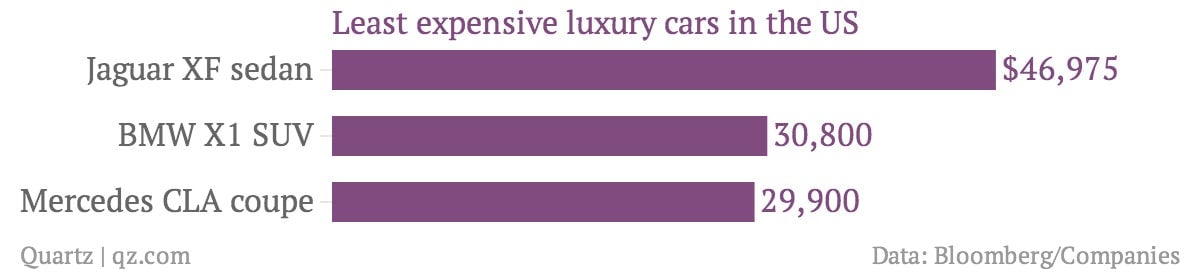

The first production vehicle to use the new aluminum frame will be a mid-size sedan that will go on sale in Europe in 2015 and arrive in the US in 2016 and be priced below existing Jaguar models to be competitive with BMW and Mercedes. Currently, Jaguar’s least expensive vehicle in the US, the XF sedan, has a price tag that is least $16,000 more than the cheapest offering from its German rivals.

Jaguar is the last major carmaker to consider entering the fast-growing SUV market. Last year, crossovers and SUVs accounted for nearly 25% of the premium vehicles sold in Europe, according to LMC Automotive. Jaguar expects the global market for higher-end SUVs to grow from two million vehicles presently to about three million by 2020 (paywall).

Jaguar will be looking to replicate the success of sister SUV brand Land Rover in making affordable models. Land Rover’s sales have surged 67% since 2008, driven by the popularity of its SUVs like the Evoque, while Jaguar’s deliveries are down 18% from four years ago.

Here’s a look at the key features that the C-X17 concept boasts of: