The most cited, least important stock market index has been tweaked by its kingmakers

Alcoa, Bank of America and HP will be dropped from the Dow Jones Industrial Average. Nike, Visa and Goldman Sachs will be added. The Dow Jones Company will make the changes at the end of trading on September 20.

Alcoa, Bank of America and HP will be dropped from the Dow Jones Industrial Average. Nike, Visa and Goldman Sachs will be added. The Dow Jones Company will make the changes at the end of trading on September 20.

Changes to the Dow certainly feel important. Even though the index includes a mere 30 companies, it is cited during nightly news broadcasts, printed prominently in newspapers daily, and updated instantaneously at the top of websites. However, according to investors’ allocations, the S&P 500 index, which culls the leading 500 American companies based on more evenly-weighted criteria, is significantly more influential.

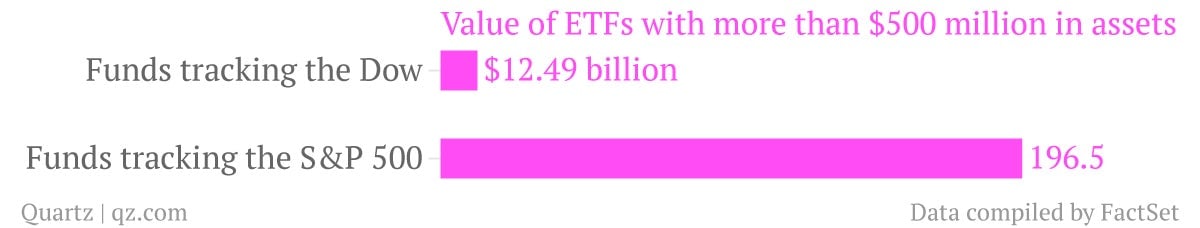

There are only two exchange traded funds that track the Dow with more than $500 million in assets. They have a combined value of $12.49 billion. There are eight funds with more than $500 million in assets that track the S&P 500. Those funds, which include leveraged and short offerings, are worth a combined $196.5 billion—15 times more.

Whereas the value of the S&P 500 is calculated using the market value of the component companies, the Dow is calculated using the share price of its component companies. For this reason, a company with fewer shares traded in the markets has more influence over the level of the Dow.

S&P Dow Jones Indices, the McGraw Hill subsidiary that manages the index, is not removing these companies from the Dow because their businesses are unworthy of inclusion, but rather because their share prices were too low. David Blitzer, chairman of the index committee at S&P Dow Jones Indices, told reporters on a conference call today, “by making this change we are removing three lowest-priced stocks already in the Dow and replacing them with stocks with higher prices.”