Why a deal for MoPub was the finishing touch Twitter needed to prepare for its IPO

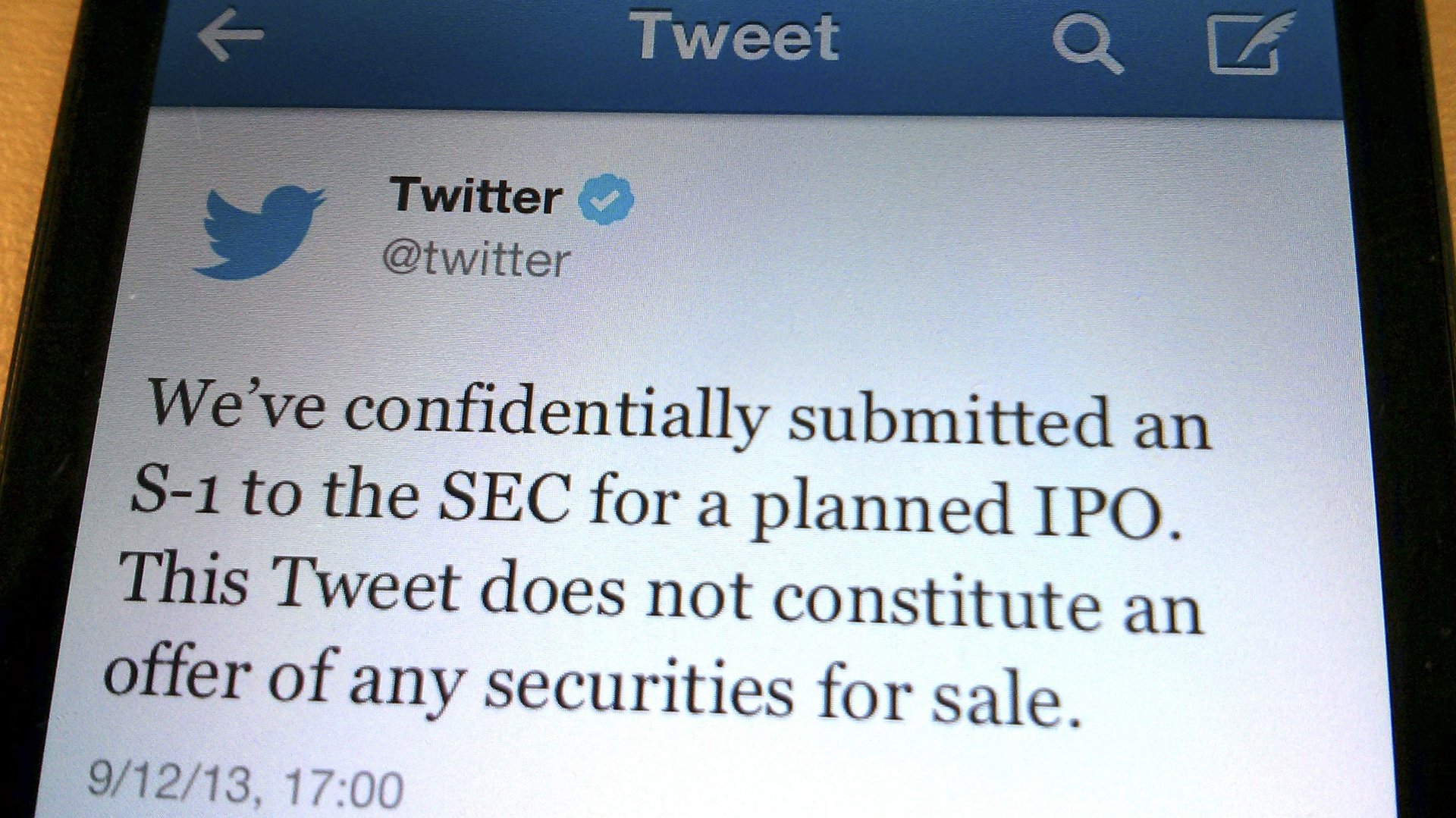

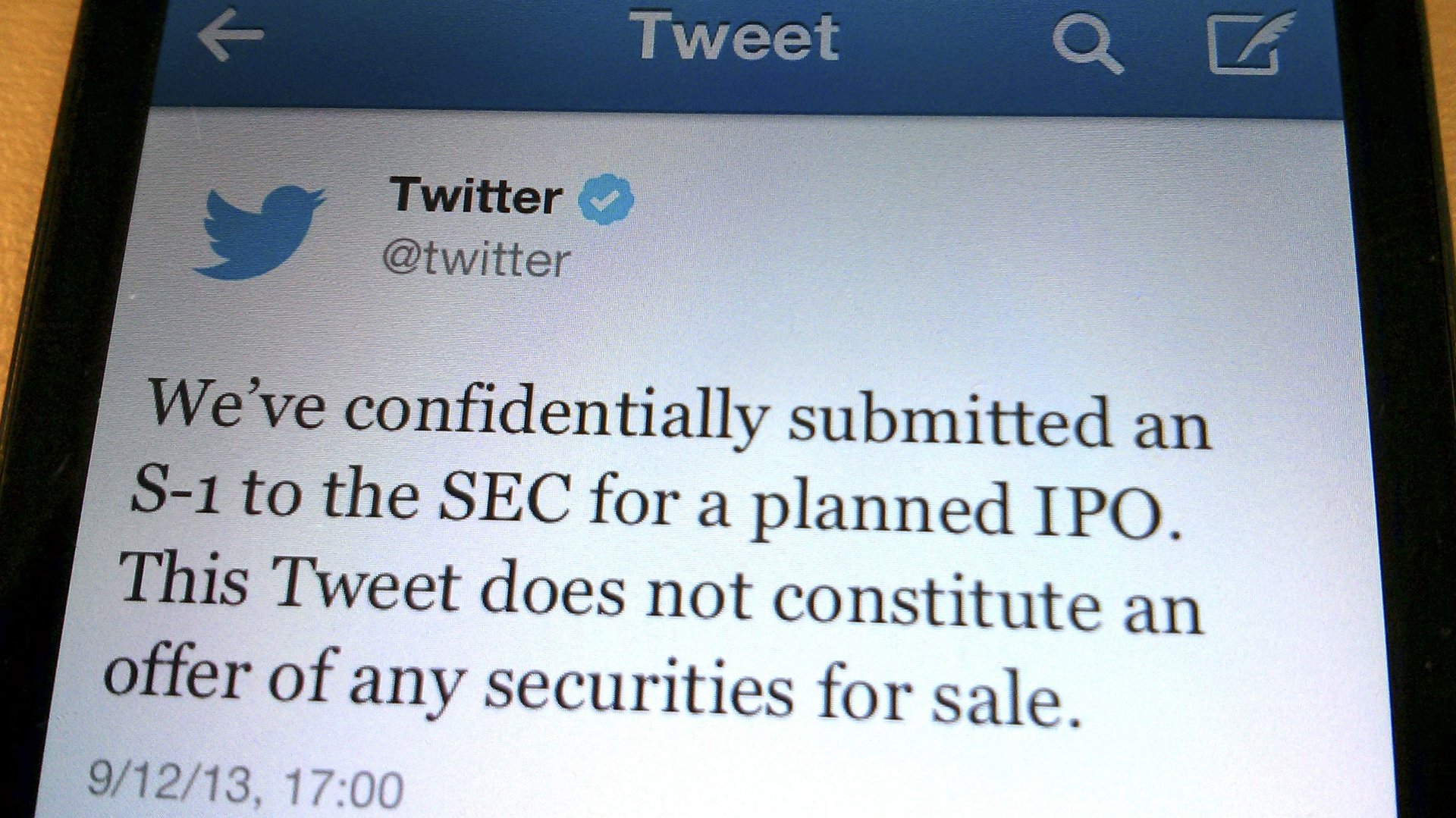

Twitter just announced its long-awaited and much-hyped initial public offering (IPO) on, predictably, Twitter. But just four days before, it was doing something else: acquiring MoPub, a mobile ad serving platform and marketplace, for $350 million in Twitter shares.

Twitter just announced its long-awaited and much-hyped initial public offering (IPO) on, predictably, Twitter. But just four days before, it was doing something else: acquiring MoPub, a mobile ad serving platform and marketplace, for $350 million in Twitter shares.

The timing of the deal is no coincidence—MoPub may be a crucial, last ingredient to a successful IPO. The two year-old company allows mobile applications to manage the kinds of ads that appear on their platform, so that users see the ads most attractive to them and the mobile application makes the most money from user click-throughs. It does this via an ad exchange, which matches these mobile applications with companies who want to buy ad space, often in real-time. It’s not unlike Google’s acquisition, DoubleClick, which serves pages across the web with Google Ads.

The MoPub deals comes on the heels of other deals seemingly designed to get Twittter IPO-ready in recent months, including the purchase of social media data cruncher Trendrr and tech training company Marakana for undisclosed amounts in August, coding firm Ubalo in May, music-search platform We Are Hunted in April, and an approximately $90 million buyout of TV social analytics company Bluefin Labs in February.

It might not be immediately apparent why MoPub is such a great acquisition for Twitter. Twitter is, of course, much larger and, more importantly, already has a strong presence in mobile advertising all by itself. Its 2012 revenues totaled $288 million, and these are expected to more than double this year, according to eMarketer. Of that, $138 million came from mobile ad sales. MoPub, meanwhile, just hit an annualized revenue rate of $100 million in May.

But MoPub’s real value to Twitter lies is the high-speed real-time ad-matching it provides. MoPub allows mobile applications like Twitter to choose which ads will go where, so that they can maximize the amount of revenue they’re earning. MoPub will allow Twitter’s mobile platform to, for instance, better distribute different ads to users following political tweets and those tweeting about the Real Housewives of New Jersey. And MoPub adds another benefit—the company already has a partnership with Placecast, which filters ads based on users’ location.

It’s also possible that Twitter is looking for technology that would allow it expand to different kinds of ads, beyond its current ones that look a lot like normal tweets. “Their entire strategy up to this point–up until the acquisition of MoPub has been native [ads within the newsfeed]. You don’t really even notice that they’re advertising,” MoPub CEO Jim Payne told Quartz. But there are many other was to advertise, and MoPub could help.

In the future, Twitter users might even see special ads promoting apps they can download to their smartphones, Payne speculated. Advertisers who built these apps will pay a higher rate each time a consumer downloads one than they will each time she clicks through a banner ad. MoPub can match users with apps they might want to download, he said.

To date, MoPub has grown quickly, but Payne says it lacks a “really sophisticated toolset for publishers” to crunch specific data about where they should advertise. “Obviously a deal like this can make a lot of stuff happen a lot faster,” he said, adding, “The Twitter team knows a lot about how to do that even better [than we do].”

And of course all that Twitter ad space will dramatically expand the inventory of MoPub can sell to advertisers through its exchange. In the short run, MoPub will also continue working with other mobile applications as well.

Payne said he and his team didn’t know beforehand about Twitter’s IPO plans, but they struck an IPO-friendly $350 million all-stock deal anyway. “We wanted to do an all-stock deal because we thought the deal offered a lot of upside,” Payne admits.

“The IPO news coming out today is exciting for the Twitter team,” Payne said. “It’s also pretty exciting for us.”