China’s opening-up to foreign hedge funds is largely symbolic, at least for now

China will allow its citizens to invest some $300 million worth in yuan in six foreign hedge funds, reports the 21st Century Business Herald (link in Chinese), a leading financial newspaper. The six funds—Man Group, Winton Capital Management, Oak Tree, Citadel, Och-Ziff and Canyon Partners—have received quotas of $50 million apiece to set up shop in Shanghai on a “trial basis,” though the pilot hasn’t had the final green light, a source told the Financial Times (paywall).

China will allow its citizens to invest some $300 million worth in yuan in six foreign hedge funds, reports the 21st Century Business Herald (link in Chinese), a leading financial newspaper. The six funds—Man Group, Winton Capital Management, Oak Tree, Citadel, Och-Ziff and Canyon Partners—have received quotas of $50 million apiece to set up shop in Shanghai on a “trial basis,” though the pilot hasn’t had the final green light, a source told the Financial Times (paywall).

Some might hail this as a sign that China’s opening up its closed capital account. Specifically, by allowing foreign funds to gather money from certain Chinese money managers and (probably) wealthy individuals, the government is taking a bold new step in letting money flow freely in and out of China. The current rigid limits on capital flows leave most Chinese households with few and generally crummy savings options.

But the pilot will be too tightly controlled and too small to have much of an impact for most Chinese people, says Patrick Chovanec of Silvercrest Asset Management, an expert on China’s financial system. ”The government will select the hedge funds, rather than letting anyone in China take on the risk and reward of making their own investment decisions,” Chovanec tells Quartz. And, he notes, $300 million is only about 0.01% of China’s $3.3 trillion foreign-exchange reserves. “In terms of capital outflows, it’s a drop in the ocean.”

Could it just be the first small step of many? Perhaps; but to Chovanec, the timid scale of the pilot exemplifies the creeping pace of progress on capital account reform so far. It “offers the appearance of openness without any real openness or loss of control,” Chovanec says. ”This is what passes for reform in China for the past decade or so, which is why China’s reform process has stalled.”

This means the hedge funds might have to accept operating at a loss for quite some time, says a source close to China’s financial industry. ”These funds would need to make a return of roughly 20% a year to break even,” he tells Quartz. The quota means the funds will earn only around $1 million a year in management fees—hardly enough to cover the price of Shanghai office space and staff costs.

But the tradeoff is the usual one facing foreign companies trying to enter China: You have to get a foot in the door first, but it’s impossible to tell how long it will take to be truly let inside.

In this case, obstacles are not merely bureaucratic. The government’s rigid control of money flows reflects very real anxiety over what might happen if Chinese people could invest anywhere they wanted. A big chunk of China’s $9.8 trillion in savings might leave China. Those savings form much of the loan base for China’s banks, which are already struggling to satisfy the demand for credit. Capital flight could cause China’s stock market to plummet and force the central bank to use up its reserves trying to defend the yuan, among other things.

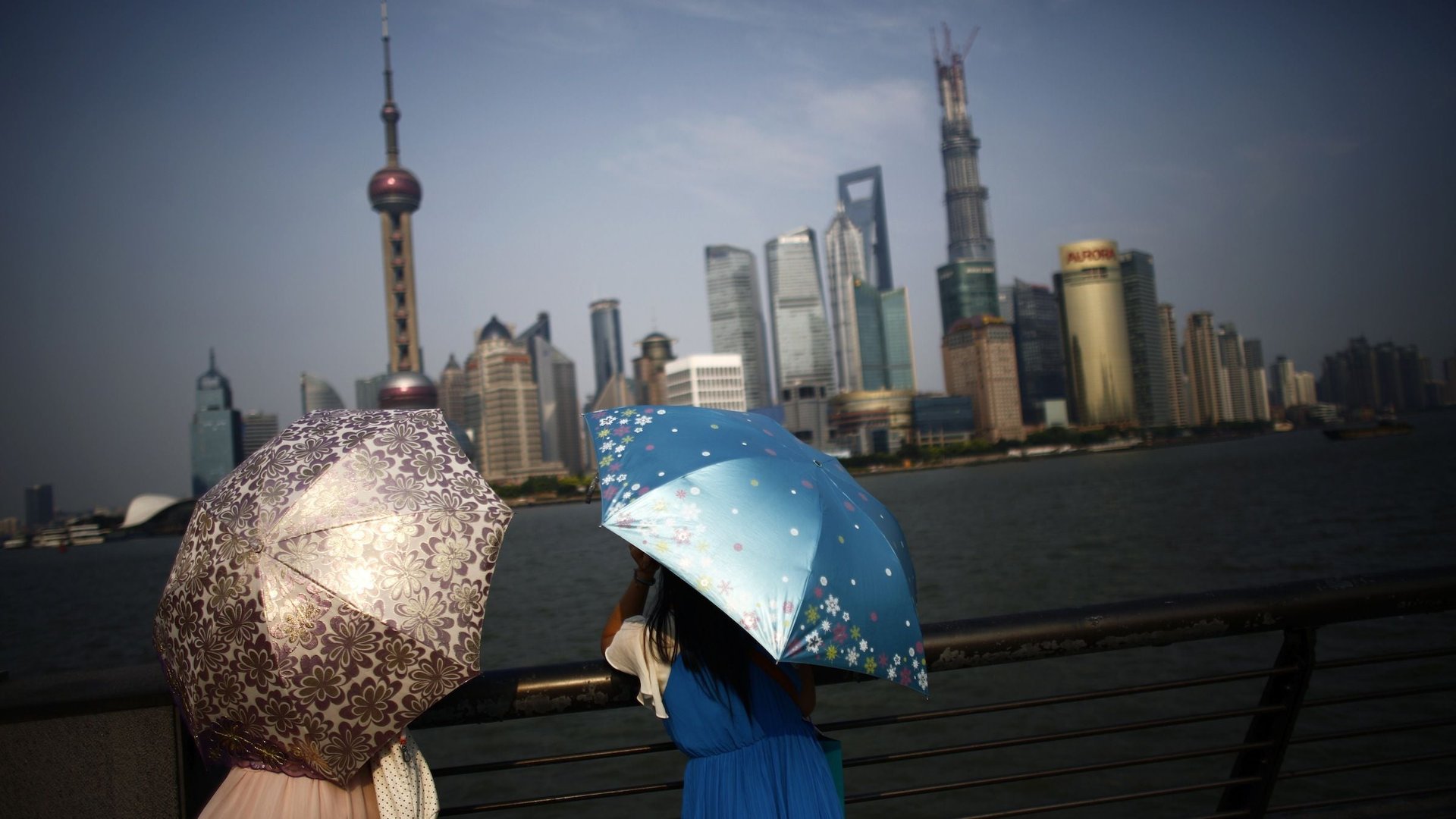

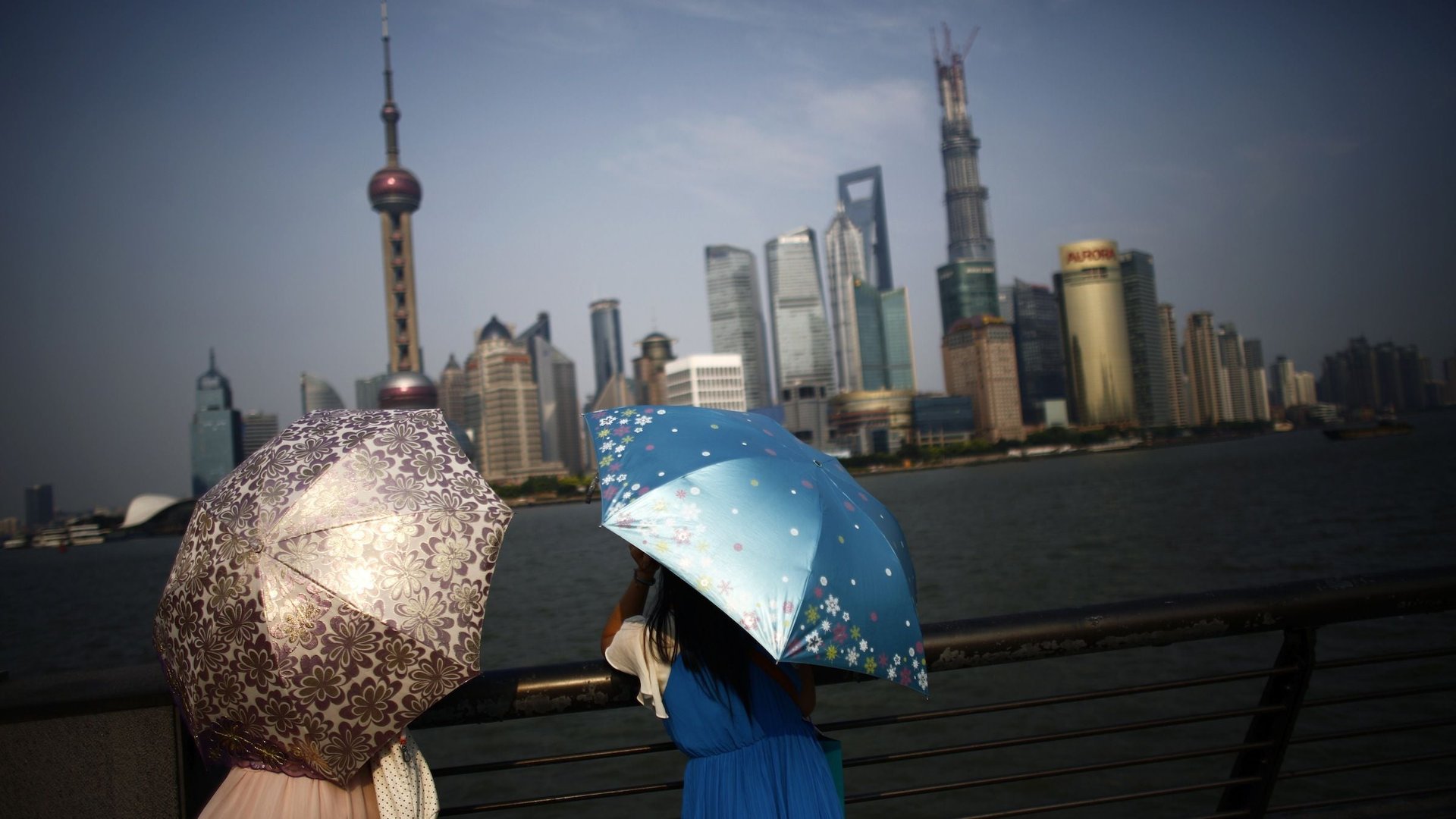

Perhaps more than it’s a concession to those in the Communist Party in favor of capital-account reform, the pilot seems to be a coup for the Shanghai city government. Becoming the hub for cross-border money flows is central to the city’s ambitions of rivaling Hong Kong as a global financial center. To date, Shanghai’s seen only sluggish progress on its proposed reforms, including the new pilot, which it put forward in 2011 (paywall). Landing six marquee hedge funds—as well as recent news of the imminent launch of Shanghai’s recently-announced free trade zone—suggests the local Shanghai government is regaining clout. But for the rest of China, and probably for those funds, it will likely be a long time before this means very much.