Stocks soar and the dollar sinks as traders see happier days under a Yellen-led Fed

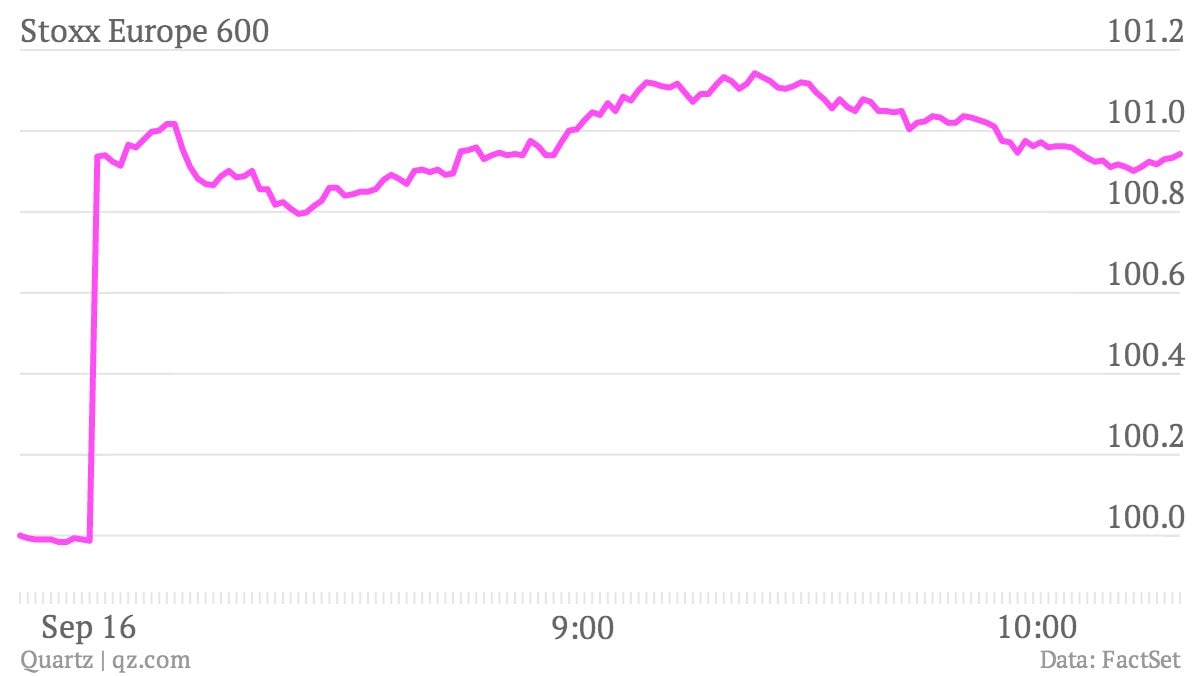

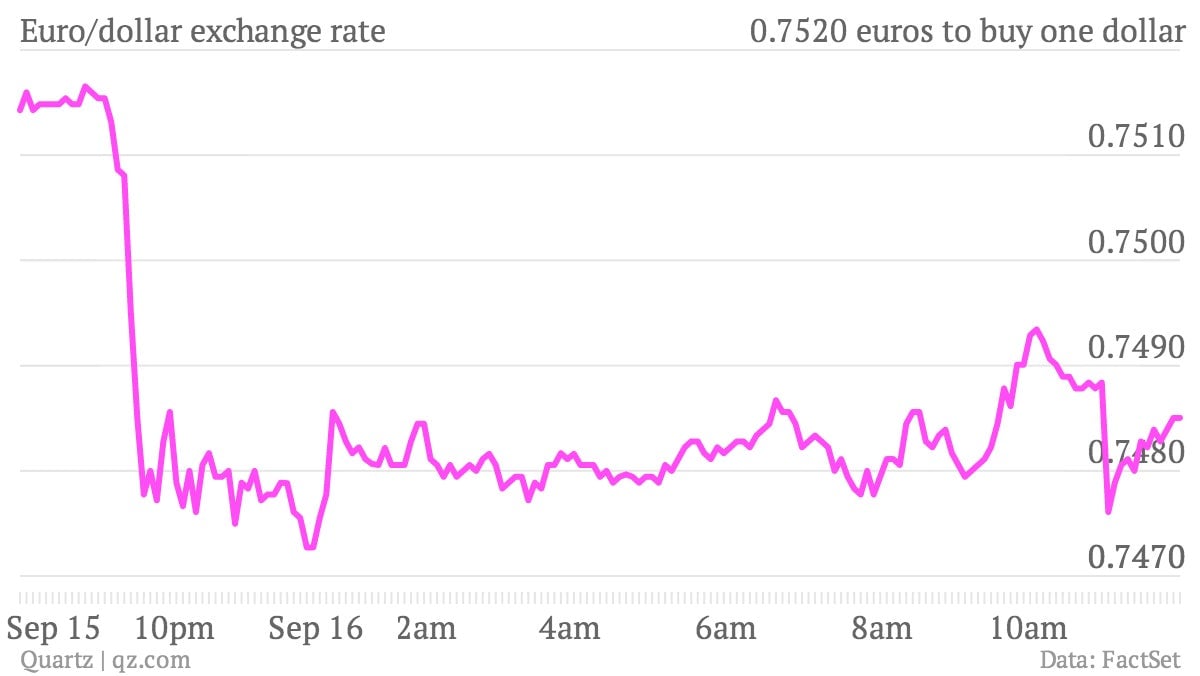

When traders in Asia and Europe woke up this morning, they read the news that Larry Summers dropped out of the running to be the next chairman of the US Federal Reserve. They promptly loaded up on equities and dumped the dollar, as the once-and-former frontrunner for the post, Janet Yellen, now seems close to a sure thing. The moves in the Stoxx Europe benchmark index are typical for other markets in both Europe and Asia.

When traders in Asia and Europe woke up this morning, they read the news that Larry Summers dropped out of the running to be the next chairman of the US Federal Reserve. They promptly loaded up on equities and dumped the dollar, as the once-and-former frontrunner for the post, Janet Yellen, now seems close to a sure thing. The moves in the Stoxx Europe benchmark index are typical for other markets in both Europe and Asia.

Yellen is widely perceived as more dovish than Summers, and thus more reluctant to withdraw the extraordinary monetary stimulus (to “taper,” in the current lingo) that has boosted a range of assets since the financial crisis.

Never mind that current chairman Ben Bernanke, who is expected to step down in January, will probably announce the first steps towards tapering after the Fed’s rate-setting committee meets later this week. If and when Yellen takes over, investors are betting that the pace of rate hikes and severity of the taper will be more modest than it would have been under Summers. That means lower rates and more liquidity, which is driving sharp movements in the markets today.

The open of US markets will be equally exciting, as Bill Gross of asset manager PIMCO predicts: