Bankers take the lion’s share at safer but less profitable banks

Financial crisis retrospectives have flourished over the past week, tied to the five-year anniversary of Lehman Brothers’ collapse. In this regard, the latest quarterly review of the global banking system by the Bank for International Settlements (BIS), published yesterday, is well-timed.

Financial crisis retrospectives have flourished over the past week, tied to the five-year anniversary of Lehman Brothers’ collapse. In this regard, the latest quarterly review of the global banking system by the Bank for International Settlements (BIS), published yesterday, is well-timed.

Of particular interest is a special feature examining how big global banks have built up their capital cushions since the crash. Data from this research can be used to paint a pleasingly concise portrait of the post-Lehman banking industry.

The first chart shows leverage at large, internationally active banks, as measured by the ratio of equity to total assets. The higher the ratio, the less borrowed money a bank needs to back up its assets.

By this measure, banks are more secure than they were four years ago. But as we point out in our own contribution to the slew of Lehman retrospectives, safer doesn’t necessarily mean safe. Proposals to impose even stricter rules on leverage would boost these ratios much higher.

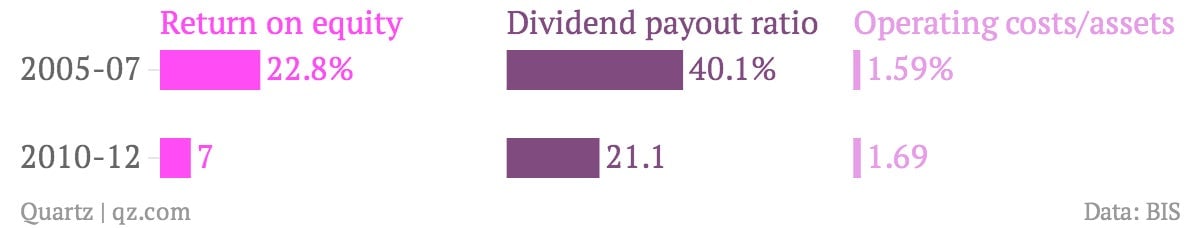

At the same time, the banking business is hardly booming. Unable to goose returns with mountains of debt, return on equity has plunged by more than two-thirds compared with its pre-Lehman average. To conserve capital, dividends as a share of earnings have been slashed in half.

Another way to preserve capital is to cut costs, the biggest chunk of which comes from bankers’ pay. Predictably, banks have been reluctant to pull this lever; in fact, operating expenses as a percentage of assets are higher than they were before Lehman’s demise. Although the overall pie may be shrinking, bankers have made sure that their slice is larger than ever.