The Indian government is making state oil firms lose $77 million a day

India subsidizes diesel, cooking gas and kerosene. It’s a heavy burden on the government in the best of times, as it has to compensate state-run oil companies for the loss of revenue. But India imports more than 80% of the crude oil it requires, and with the rupee falling and crude prices rising, the cost of subsidized fuel is now threatening India’s efforts to rein in trade and budget deficits.

India subsidizes diesel, cooking gas and kerosene. It’s a heavy burden on the government in the best of times, as it has to compensate state-run oil companies for the loss of revenue. But India imports more than 80% of the crude oil it requires, and with the rupee falling and crude prices rising, the cost of subsidized fuel is now threatening India’s efforts to rein in trade and budget deficits.

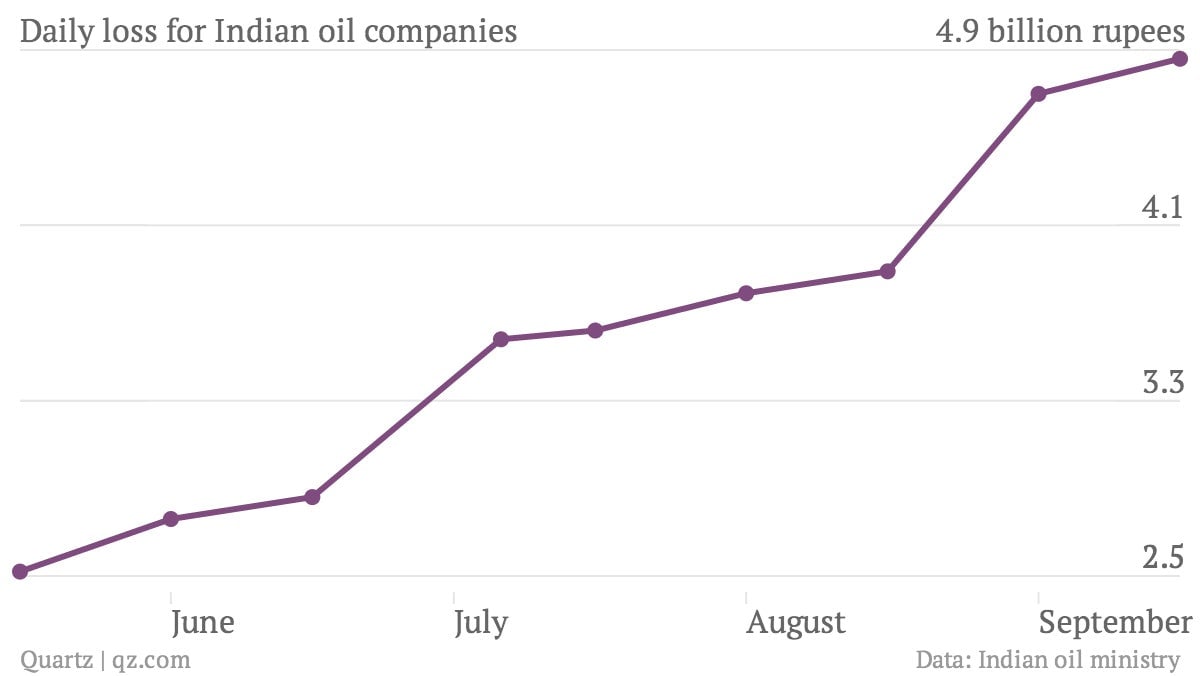

The three state oil-marketing companies that sell fuel to the public are now losing 4.86 billion rupees per day ($76.6 million) selling fuel below cost (pdf). The under-recovery—the difference between the import price and the retail price—has surged 93% since mid-May, when the rupee’s fall started.

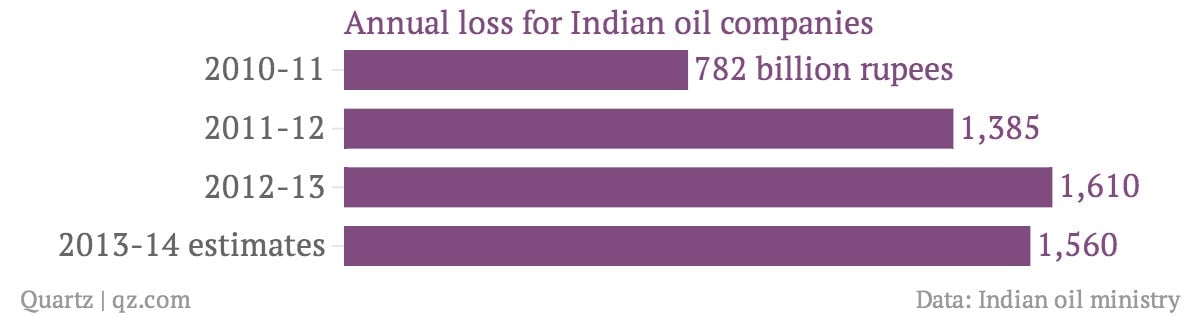

If the current trend continues, the oil retailers will lose 1,560 billion rupees in the current fiscal year. The government will have to shell out a record 975 billion rupees to compensate them, much above the 650 billion rupees it had budgeted for. Last year, the companies lost 1,600 billion in revenues, more than half of which was compensated by the government.

The government is considering raising fuel prices to bridge the growing revenue gap. Reuters estimates that a 10% increase in diesel prices alone could help the government save up to $4.3 billion, or 272 billion rupees, covering a good part of the budget shortfall.

Capping fuel subsidies is a crucial part of the government’s efforts to keep the fiscal deficit down to 4.8% of GDP. Higher prices could also translate into lower demand. That in turn could push imports lower, and help restrict the current account deficit to 3.7% of GDP, as promised by the finance minister.

But the big worry is that an increase in fuel prices would feed into inflation, which quickened to a six-month high of 6.1% in August. The fear of angering voters ahead of elections, which are due by next May, may also make the government reluctant to pass on all the cost increase to consumers. Fuel prices in India are already the highest in the world in terms of wages, according to Bloomberg: It takes 109% of an average daily wage to buy a gallon of gasoline. In the US it’s just 2.6%.