Why the Republican debt strategy in the US makes so little sense

In two weeks, the US government will shut down, and about a month from now, the US will run out of cash, unless a bipartisan deal can be struck.

In two weeks, the US government will shut down, and about a month from now, the US will run out of cash, unless a bipartisan deal can be struck.

It’s worth digging into what’s behind lawmakers’ insistence on gambling with the economy. Today’s new forecasts from the US’s Congressional Budget Office (CBO) pinpoint why the country is preparing for a misguided conversation about its debt problem.

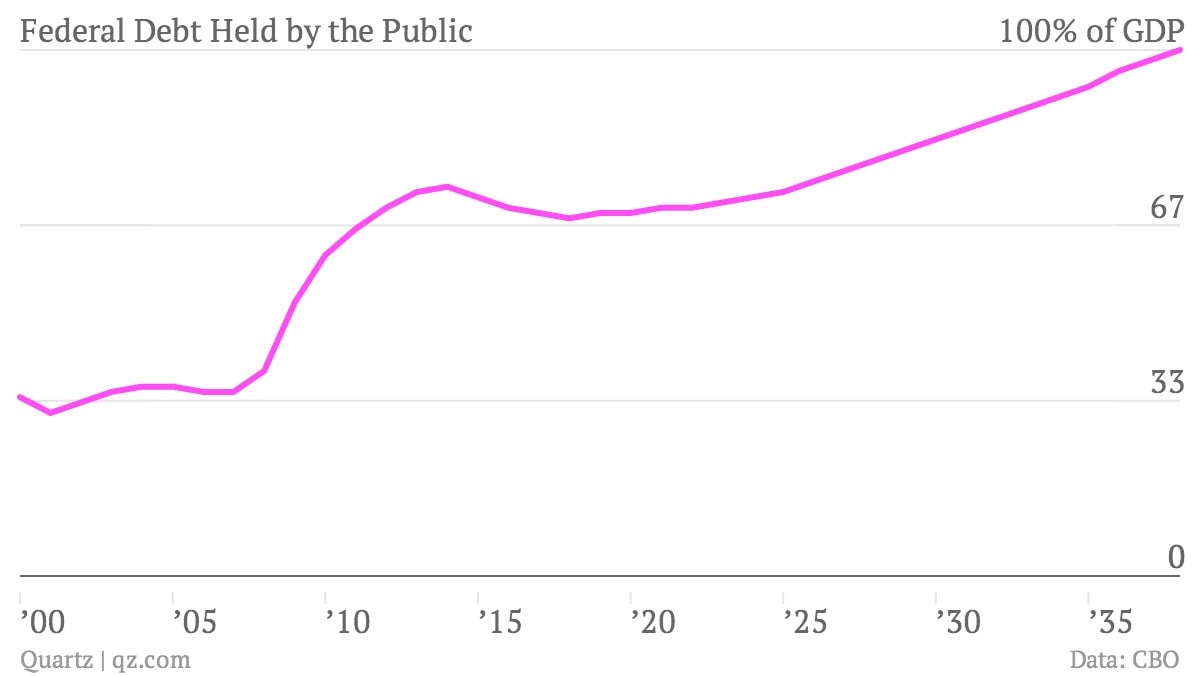

First, here’s a look at the debt. It skyrockets after the 2008 crisis thanks to lower tax revenues, higher safety-net spending, and fiscal stimulus:

The good news is that debt will shrink and stabilize over the next decade, largely due to the improved economy and spending cuts passed in 2011, but also thanks to tax increases on the wealthy at the end of 2012. Perhaps, then, it’s time to overcome the fear that there’s some kind of immediate debt crisis. In fact, the reality is quite the opposite.

The bad news? The debt will start increasing again in 2020. To get to the bottom of why, let’s look at where all that borrowed money is going:

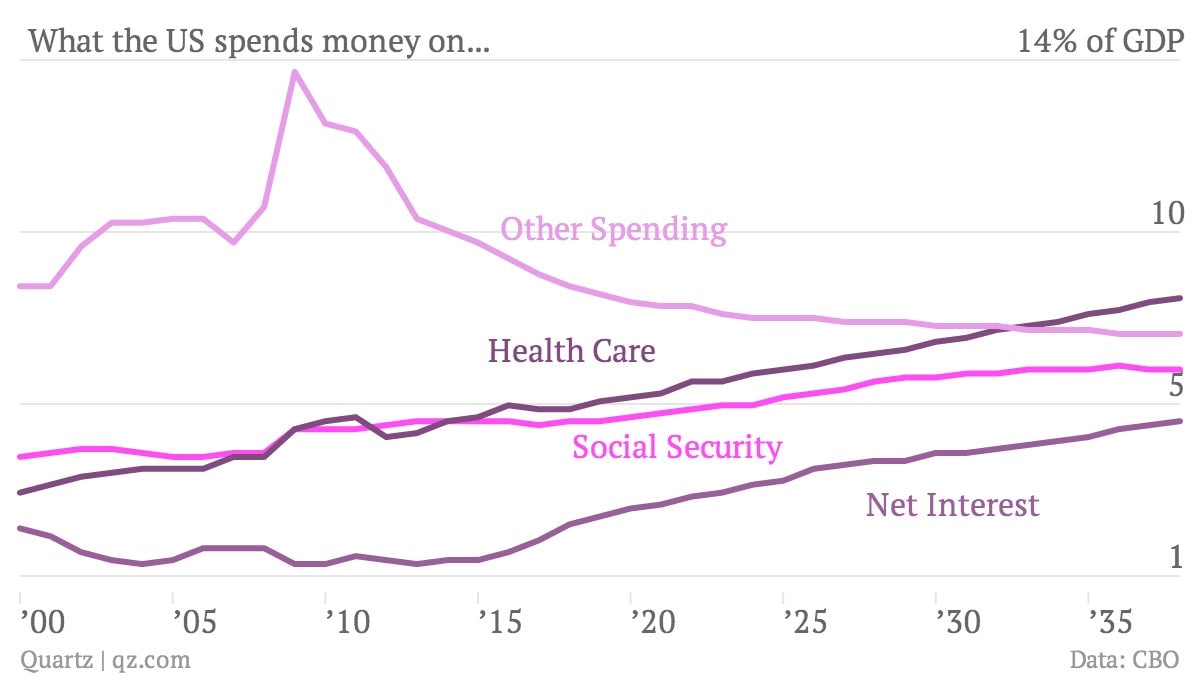

Notice that “other spending”—most of what we think of as government spending, from defense and law enforcement to building roads and doing research—peaked during the recession and is now plunging to below pre-crisis levels, thanks to all those spending cuts. That’s a problem, since that spending includes most investments in future capital and productivity. The cuts have been so deep that even advocates of lower spending can’t agree on how to divvy up the remaining money among programs.

That spending aside, the real problem is the dramatic increase in spending on health care and social security. That’s partly because America is getting older—51% of the increase for the two programs combined in 2038 is related to aging. America’s fast-growing health care costs make up 28% of the increase for the two programs combined. Costs of the universal health care law enacted in 2010 make up some 19%.

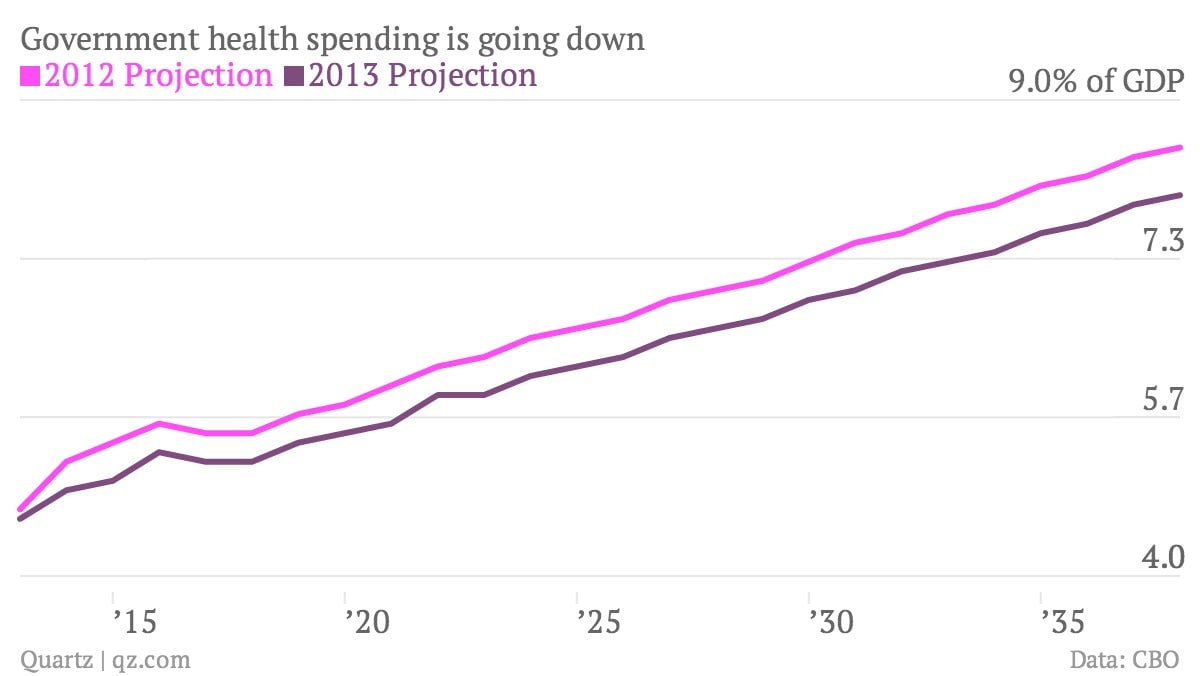

The increase in costs due to universal health care might make Republican demands—to repeal of the healthcare law in exchange for avoiding a government shutdown or a disastrous default—seem sensible. But those demands ignore the fact that Obamacare is actually reducing health care spending over time. In the chart below, the CBO projects less future health care spending than it did last year, and it attributes a significant part of that change to cost controls in the bill:

That suggests that the smarter path to reducing the long-term debt might be to build on the new health care law’s cost controls rather than blocking its implementation. Kicking people off public insurance programs doesn’t address the problems of aging and cost inflation.

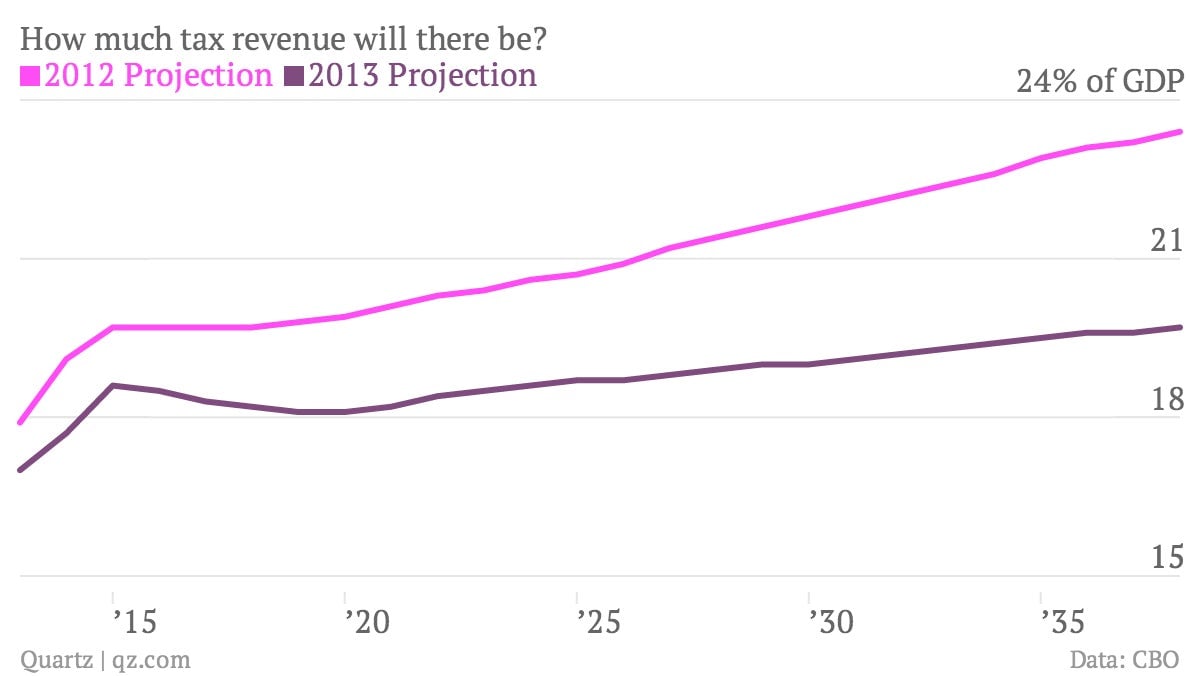

There’s one other component to the budget debate, and that’s taxes. The deal at the end of 2012 that permanently extended the Bush-era tax cuts for most Americans drastically reduced expected government revenues:

The Obama administration wants a grand bargain on the debt problem that includes bumping up investment, trimming health care costs further—even by cutting Social Security—and boosting tax revenues. Republicans in Congress aren’t interested in higher taxes; they prefer to focus solely on reducing spending, either by axing food for the poor or ending Obamacare.

At this point, the two sides are more concerned about playing politics than creating apt policies. Obama doesn’t want to repeat of the disastrous 2011 negotiations, which resulted in a fight over whether the US government would continue paying its bills. Republicans are struggling to coalesce around a strategy that will defeat Obamacare while avoiding blame for brinkmanship. Meanwhile, the deadlines approach.